60-Second Summary

As organizations reevaluate their tech stack in 2026, many are questioning whether 6sense still delivers enough value to justify its cost and complexity. With evolving needs and regional challenges, exploring leaner, smarter, or more integrated alternatives has never been more relevant.

6sense’s strengths—like AI-driven intent data and robust ABM tools—make it ideal for enterprise teams, but too costly or complex for many mid-market or scaling organizations.

Dealfront stands out as a nimble, GDPR-compliant alternative especially effective in Europe, offering real-time buyer signals and precise account identification without overwhelming setup.

Different tools meet different needs: ZoomInfo excels at contact discovery, Bombora offers best-in-class third-party intent, and Apollo.io serves as a budget-friendly all-in-one for outbound teams.

Choosing the right fit means balancing price, integrations, usability, and whether your team prioritizes ABM campaigns, outbound prospecting, or real-time buyer visibility.

For years, 6sense has been trying to do just that, predict which businesses are in-market and prioritize them for sales outreach. It’s a powerful tool, no doubt, but in 2026, many teams will be re-evaluating their tech stack and asking: Is 6sense still the right fit for us?

Maybe your team is scaling back and needs something a little leaner, maybe you’re growing fast and need a tool that plays nicer with your CRM, or maybe you’ve just had one too many demo calls that ended with the phrase “Let’s talk about pricing.”

Whatever the reason, you're not alone. Plenty of companies are actively looking for smarter, more flexible, or more budget-friendly 6sense alternatives, and this article will help you explore them. But first, let’s make sure we’re clear on what 6sense does (and why people use it in the first place).

What is 6sense?

At its core, 6sense is a sales intelligence and intent data platform. It’s a software platform that helps B2B (business-to-business) sales and marketing teams identify which companies are actively researching their products or services. It uses artificial intelligence (AI) to analyze large amounts of data and detect buying signals.

The platform gathers billions of data points, from search engine queries, website visits, ad engagement, etc, and uses AI to spot buying patterns. Some standout features of 6sense include:

Intent data: Tracks what companies are researching online so you know who’s “in-market” and who’s just browsing.

Account-based marketing (ABM) support: Allows you to personalize campaigns for high-value accounts instead of casting a wide net.

Predictive analytics: Uses historical and real-time data to estimate which accounts are closest to making a purchase decision.

Sales orchestration: Helps align marketing and sales efforts so both teams are reaching out to the right accounts at the right time.

For many enterprise-level teams, these capabilities are game-changing. But as with any tool, 6sense isn’t the perfect fit for everyone. The price tag, complexity, or specific data coverage can all be reasons why teams begin looking for other options.

So if you’re wondering what else is out there, and how to compare, read on. We’ll walk you through the best 6sense alternatives available to you in 2026, and help you find the one that fits your goals, your tech stack, and your budget.

Why look for a 6sense alternative?

While 6sense has earned a strong reputation in the B2B sales and marketing world, it’s not always the perfect fit for every team. In fact, more and more companies, especially small to mid-sized ones, are actively exploring alternatives. Here are the most common reasons:

- 1.

The cost can be a dealbreaker. Let’s be real, 6sense is built for the enterprise, and its pricing reflects that. We’re talking multi-year contracts, five-figure annual commitments, and sometimes limited flexibility when it comes to scaling up or down. If you’re a growing company watching your budget like a hawk, or a marketing team that just got a stern email from finance, the price tag alone might prompt you to start shopping around.

- 2.

You might need features 6sense doesn’t offer. Despite its sophistication, 6sense doesn’t cover every use case. Some teams need built-in chat tools or more granular contact enrichment features. Others want lighter, faster tools that are easier to set up and train a team on. 6sense is powerful, but that power can also mean complex onboarding and a steeper learning curve. If your team just wants a plug-and-play solution that shows you who’s interested, what they clicked on, and how to reach them, without 20 hours of training, some alternatives might fit better.

- 3.

Regional and industry coverage may be limited. While 6sense excels in many North American markets, its global coverage can be patchy, especially when it comes to niche industries or European geographies. If your ICP is based in Germany, for example, or if you're selling into a very specific vertical, you may find gaps in the data that limit 6sense’s effectiveness. Some competitors are designed with these challenges in mind, offering region-specific data sets, GDPR-first compliance, or specialized firmographic filters that help you get more relevant leads.

- 4.

Integration isn’t always smooth sailing. 6sense plays nicely with major platforms like Salesforce and Marketo, but that doesn’t mean the integration process is always straightforward. If your tech stack includes more niche or modern tools, or if you rely heavily on automation, you might run into compatibility issues or a need for custom development. Some alternatives offer native integrations, open APIs, or Zapier support, making it easier to sync data across your systems without constant involvement from IT.

In short, while 6sense has plenty of strengths, it’s not a one-size-fits-all solution. Whether you're scaling back, scaling up, or just tired of feeling locked into long-term contracts, there are plenty of reasons to consider switching to something more tailored to your team.

Key features to compare in 6sense competitors

When comparing alternatives to 6sense, look at these important features:

Feature | Why it matters | What to look for |

Intent data quality | Shows which companies are researching topics related to your products | Data sources, how recent the information is, and topic coverage |

Account identification | Helps you know which companies visit your website | Accuracy of company matching and additional information provided |

Data compliance | Ensures you follow privacy laws like GDPR and CCPA | Privacy controls and documentation |

Integrations | Connects with your existing tools | Native connections to your CRM and marketing platforms |

Global coverage | Supports international sales | Data quality across different regions |

Pricing structure | Affects your budget | Transparent pricing and flexibility |

Intent data helps you see which companies are actively researching topics related to what you sell. Account identification connects anonymous website visitors to actual company names. Both features help sales teams focus on prospects that are more likely to buy.

The 10 best 6sense alternatives for 2026

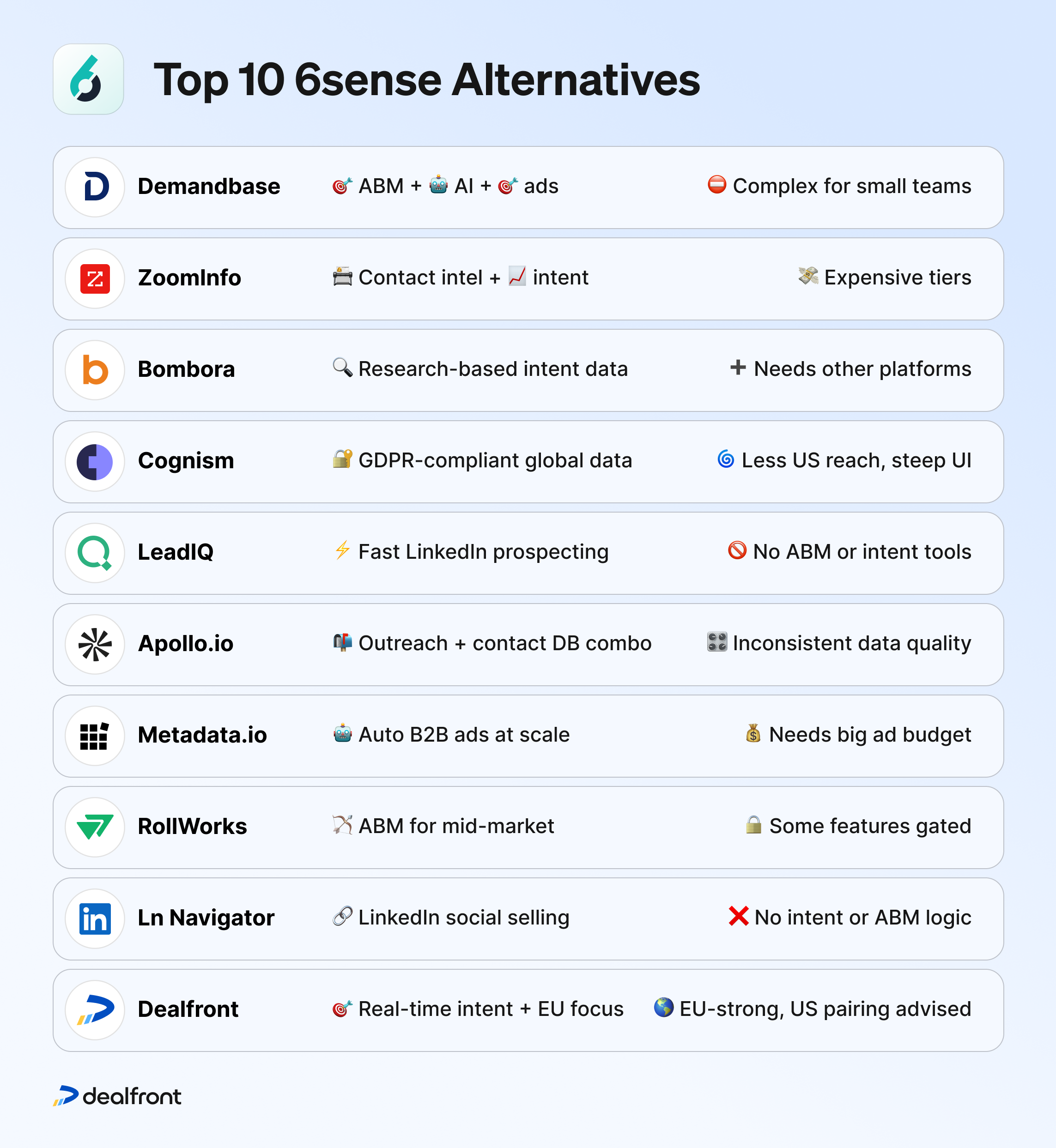

If you’re rethinking your relationship with 6sense, you're not alone. Whether you're seeking better value, simpler tools, or just a better fit for your team’s size and structure, here are ten platforms worth exploring. Each one brings something unique to the table, along with a few trade-offs.

1. Dealfront

Dealfront is a powerful 6sense alternative that blends real-time website visitor tracking, firmographic enrichment, and buyer intent into one platform. Built for B2B go-to-market teams, Dealfront helps you spot in-market companies the moment they show interest, so you can reach out with relevance and speed.

Where 6sense often feels like an enterprise aircraft carrier, Dealfront acts more like a high-speed radar-equipped speedboat: agile, fast to deploy, and focused on helping you convert interest into pipeline, particularly in the European market.

Key strengths:

Real-time website visitor identification (even for anonymous traffic)

Built-in ICP filtering and smart lead scoring

GDPR-first data collection for peace of mind in regulated markets

Buying intent signals from multiple sources (search, web behaviour, and engagement)

Automated workflows and alerts to keep your sales team in the loop

Native integrations with Salesforce, HubSpot, Pipedrive etc.

Dealfront is ideal for teams who want to move fast on buyer interest without needing a huge ops team or months of onboarding. Whether you’re inbound-heavy or running ABM plays, Dealfront provides the intelligence and speed modern GTM teams need.

Dealfront’s biggest strength, its precision in identifying and qualifying account-level interest, is also tied to regional strengths, particularly in Europe and the DACH region. While it does support international prospecting, US-based companies looking for a deep domestic database may still want to pair it with an additional contact provider for an even broader reach.

Dealfront’s unified platform means your sales, marketing, and RevOps teams can all work from the same data, meaning no more silos, and no more guessing.

2. Demandbase

Demandbase is one of the most well-known names in the account-based marketing (ABM) space, and for good reason. It combines intent data, firmographic targeting, advertising tools, and analytics into a unified platform that helps large B2B organizations zero in on the accounts that matter most.

Key strengths:

AI-powered account identification

Advertising tools for targeting accounts

Sales intelligence features

Marketing campaign analytics

If you’re running ABM at scale, with multiple stakeholders, channels, and metrics, Demandbase can be a powerhouse. In fact, some teams find it a more mature alternative to 6sense when it comes to ad orchestration and analytics.

But Demandbase isn’t exactly plug-and-play and users report it can take a while to implement. It also requires a decent level of technical and strategic alignment across teams so, for smaller companies or teams with limited resources, it can often feel like overkill.

3. ZoomInfo

ZoomInfo is often considered something of a titan in the B2B data world. It’s especially strong on contact-level intelligence, making it handy for SDRs and BDRs who live in outbound mode. If 6sense is about knowing which companies to target, ZoomInfo often tells you who to speak to.

Key strengths:

Extensive database of business contacts

Intent signal tracking

Website visitor identification

CRM integration

Sales teams love ZoomInfo for its data accuracy and depth, especially in North America. It’s also great for teams that want fast results without too much configuration.

However, ZoomInfo isn’t as strong on predictive analytics or account scoring as 6sense. It also leans more toward outbound use cases than full ABM orchestration. On top of that, a lot of users report that pricing can climb quickly if you need access to more features or seats.

4. Bombora

Bombora takes a different angle from many competitors. Rather than offering an all-in-one sales or marketing platform, Bombora specializes in intent data collection, giving you insights into what your target accounts are researching online, and when their interest is spiking.

Key strengths:

Large network of business websites for tracking research

Company Surge® scores to show increased interest

Works with many CRM and marketing platforms

Focus on quality data collection

Bombora’s strength lies in enhancing what you already use. Plug its intent data into your CRM or ABM platform, and suddenly your sales and marketing plays become much more timely and relevant.

For many though, Bombora isn’t a standalone solution. Think of it as a data fuel source, not the engine; it works best when paired with tools like HubSpot, Salesforce, etc. Basically, if you’re looking for an all-in-one platform, this isn’t it.

5. Cognism

Cognism has built a reputation for its B2B contact data, with a particular emphasis on data privacy and compliance. If you're working in Europe, or anywhere with tight data regulations, Cognism is a strong player with its GDPR-first approach and global coverage.

Key strengths:

Verified phone numbers

GDPR and CCPA compliant data

Global database coverage

Intent data through partnership with Bombora

It’s a solid option for teams that care about both accuracy and legality; with Cognism you’d have no worries about your reps emailing contacts who didn’t consent or data that doesn’t pass compliance checks.

But, while Cognism shines in Europe, it’s considered less competitive in North America when compared to ZoomInfo or Apollo.io on sheer database volume. Some users also find the interface more data-focused than user-friendly, especially for newer teams, which can lead to uptake and onboarding challenges.

6. LeadIQ

LeadIQ simplifies the process of finding, capturing, and sequencing prospect data, especially for outbound sales teams. It focuses on helping reps quickly identify decision-makers and personalize outreach using contextual insights.

Key strengths:

Fast prospecting with verified contact data

LinkedIn integration with Chrome extension

Personalized email sequence tools

Real-time sync with Salesforce and HubSpot

If you’re looking to speed up outbound prospecting and streamline data capture, LeadIQ is a practical addition to your stack.

However, it’s more focused on sales execution than ABM strategy. Unlike 6sense or Dealfront, it doesn’t provide buyer intent signals or deep account-level insights, so it’s best paired with platforms that do.

7. Apollo.io

Apollo.io is often considered a favorite among startups and SMBs. It combines a searchable B2B contact database with built-in tools for email automation, task management, and CRM syncing. It’s like Outreach, LinkedIn Sales Navigator, and ZoomInfo had a budget-friendly baby.

Key strengths:

Contact database with filtering options

Email sequence automation

Chrome extension for LinkedIn

CRM integration

For fast-moving sales teams that need to prospect, reach out, and follow up, all without switching tabs, Apollo.io offers an impressive bang for your buck.

But all that glitters is not gold. Apollo’s data coverage and accuracy can sometimes be hit-or-miss, especially outside the US. And while it packs a lot in one platform, some features (like enrichment and deliverability tools) feel less polished compared to other dedicated solutions.

8. Metadata.io

Metadata.io is built for demand gen teams that want to automate paid campaign execution and drive pipeline from targeted accounts. It uses AI to test different ad creatives, channels, and audiences, freeing marketers from manual campaign setup. Its focus is on speed, scale, and efficiency in B2B advertising.

Key strengths:

AI-powered ad campaign automation

Multi-channel targeting (LinkedIn, Facebook, Google)

Pipeline attribution and reporting

Integration with CRM and MAP tools

Metadata.io is a strong fit for growth-focused marketing teams that need to scale account-based advertising and prove ROI fast.

It’s less suitable for teams looking for deep sales engagement tools or unified intent data across marketing and sales. It also requires a certain volume of ad spend to unlock its full value, so it’s better suited to teams with a decent paid budget and mature ABM strategy.

9. RollWorks

RollWorks is an account-based platform designed to bring ABM-style targeting, engagement, and measurement to mid-market companies. Think of it as a more accessible cousin to 6sense, offering similar core features like intent signals, account scoring, and ad targeting, but with faster onboarding and simpler pricing.

Key strengths:

Account targeting based on firmographics and behavior

Bombora-powered intent data

Programmatic ad campaigns to engage priority accounts

Integrates with HubSpot, Salesforce, and other major tools

RollWorks is great for companies who want to try account-based marketing at scale, without committing to the complexity and cost of an enterprise solution.

While RollWorks covers a lot of ground, it doesn’t always offer the depth of contact-level intelligence or native outbound tools that sales-led teams might need. It’s worth noting that some features (like advanced intent and orchestration) are locked behind higher-tier plans, so cost can creep up as your use case matures.

10. LinkedIn Sales Navigator

Sales Navigator remains a sales team staple for a reason: it gives reps direct access to LinkedIn’s vast professional network and lets them find, track, and engage prospects with more context and less cold calling.

Key strengths:

Advanced search filters for companies and people

Updates about saved leads

InMail messaging

CRM integration

LinkedIn Sales Navigator works well for teams that use social selling as part of their strategy and want to leverage professional network data.

It's great for finding and messaging prospects, but it doesn’t provide intent signals, firmographic enrichment, or campaign analytics like true ABM platforms. Also, success with Sales Navigator depends heavily on reps’ individual effort and consistency. An all-in-one solution this is not, but it does remain a heavily relied upon tool for many a sales team.

How to choose the right 6sense alternative

Finding the right 6sense alternative isn’t just about swapping one tool for another, it’s about matching the right platform to your team’s workflow, budget, and growth goals. Here’s how to narrow it down:

1. Start with your size and spend

Your company’s size and budget will shape what’s realistic, and what’s overkill.

Enterprise-level teams might get the most from robust platforms like Demandbase, which offer deep ABM features and multi-channel orchestration.

Mid-market teams often prefer something like Dealfront, which balances performance with usability and price.

Smaller teams or budget-conscious orgs can still win big with tools like Apollo.io or Dealfront, offering high impact without the enterprise price tag.

2.Think about your main goal

What are you wanting the tool to do?

If your priority is identifying in-market buyers, focus on intent data providers like Bombora or Dealfront, which specialise in surfacing timely buying signals.

If you’re all about contact discovery and outbound sales, tools like ZoomInfo, Cognism, or Apollo.io will give your SDRs the fuel they need.

If your team runs full-blown ABM campaigns, platforms like Demandbase or Dealfront give you targeting, ad orchestration, and reporting under one roof.

3. Check compatibility with your existing tools

No one wants a new tool that doesn’t play nicely with the rest of your setup.

Most alternatives offer out-of-the-box integrations with major CRMs like Salesforce, HubSpot, and Pipedrive

Look for tools that offer native connections to your marketing automation platform, especially if you're running nurture sequences

If you’re planning to build custom workflows, API access and webhooks can be essential, and not all platforms offer the same level of openness

Finding the best fit for your team

The right 6sense alternative depends on what your team values most, and how complex your sales and marketing motions are.

For large enterprise teams, platforms like Demandbase and ZoomInfo offer strong feature sets and advanced targeting, but they often come with steep pricing and longer onboarding times.

Mid-market companies may prefer solutions like Dealfront, Terminus, or Cognism, which strike a balance between functionality and usability without requiring an enterprise-level budget.

Smaller businesses or scaling teams typically benefit from more agile platforms like Dealfront or Apollo.io which offer more accessible pricing, faster implementation, and focused features that deliver value quickly.

If your top priority is understanding which companies are actively researching your solution space, Bombora is a strong option with third-party intent data. For finding and verifying contact details, ZoomInfo and Cognism offer some of the most accurate databases on the market.

But if you’re looking for a platform that covers multiple bases (think: real-time website visitor tracking, intent signals, ICP targeting, and European data strength) Dealfront stands out as the smart choice for most B2B teams. It gives sales and marketing teams the visibility they need to reach in-market buyers at the exact right time, without the complexity or cost of enterprise platforms.

To see how Dealfront works with your specific sales process, you can request a demo at https://www.dealfront.com/request-demo/.

FAQs about 6sense competitors

How does intent data quality vary between 6sense competitors?

How does intent data quality vary between 6sense competitors?

Intent data quality differs based on how each platform collects signals. Bombora uses a cooperative network of business websites, while others like ZoomInfo may rely on proprietary sources or behavioral data from specific platforms, which can impact accuracy and coverage. Dealfront combines third-party intent data with first-party website activity, giving you both external research signals and real-time insights into how prospects are engaging with your own content, offering a more complete picture of buyer interest.

What is the difference between 6sense and Dealfront?

What is the difference between 6sense and Dealfront?

6sense uses predictive analytics and third-party intent data to identify accounts that may be ready to buy. Dealfront, on the other hand, combines real-time website visitor tracking with buyer intent signals, giving your team direct visibility into which companies are actively engaging with your website and what they’re interested in. It’s a more transparent, actionable approach, especially effective for B2B teams looking to prioritize outreach based on live engagement.

Which 6sense alternatives work best for small to medium businesses?

Which 6sense alternatives work best for small to medium businesses?

Dealfront, and Apollo.io are more accessible for small to medium businesses due to their lower entry costs, simpler setup processes, and flexible pricing models that don't require large upfront commitments.

How do global data coverage and compliance features compare across alternatives?

How do global data coverage and compliance features compare across alternatives?

Global data coverage varies significantly. Dealfront and Cognism have strong European coverage with GDPR compliance focus. ZoomInfo has excellent North American data but is less comprehensive in other regions.

What if I want both website visitor tracking and intent data in one platform?

What if I want both website visitor tracking and intent data in one platform?

Many 6sense alternatives focus on either visitor identification or third-party intent signals, but not both. Dealfront combines real-time website visitor tracking with intent data, helping you identify which companies are engaging with your content and what they're interested in. This makes it easier to prioritize high-value accounts and reach out at the right moment.

Which 6sense alternative offers the best balance of features, usability, and value?

Which 6sense alternative offers the best balance of features, usability, and value?

While platforms like ZoomInfo or Demandbase offer extensive feature sets, they can be complex and costly. Dealfront stands out by offering a well-rounded solution that includes visitor intelligence, intent data, account prioritization, and integrations, all with transparent pricing and an intuitive interface. It's a strong choice for teams that want actionable insights without the heavy lift.