60-Second Summary

Cognism may lead the field in EU-focused B2B data intelligence, but it’s not a one-size-fits-all solution. If your team is scaling, selling outside Europe, or watching spend closely, there are several competitive alternatives worth considering.

Data coverage is the top reason teams explore beyond Cognism—especially for US, APAC, or niche verticals where gaps in data depth and breadth matter most.

Platforms like Dealfront and 6sense stand out by layering buyer intent and engagement signals on top of raw contact data, enabling smarter and better-timed outreach.

Many growing businesses opt for Apollo.io, UpLead, or Lusha for their affordability, integrated outreach features, and more flexible contracts compared to enterprise-first tools like ZoomInfo.

Real-world lesson: The best fit isn’t always the biggest database—it's the tool that syncs cleanly with your CRM, matches your ICP, and supports how your team actually sells.

That’s why platforms like Cognism have carved out such a strong name in B2B sales intelligence. Known for its GDPR-compliant contact data and accurate mobile numbers, it’s become a go-to for outbound sales teams, especially those selling into Europe.

But, and there’s always a but, even great tools have their blind spots. Maybe your team needs deeper data in the US market, maybe you're after a lighter price tag, or maybe you're just not vibing with the platform’s UX. Whatever the reason, you’re not alone in looking around.

This guide compares the top 10 Cognism competitors that sales and marketing teams are actively evaluating right now; tools that match (or exceed) Cognism in different areas like coverage, pricing, integrations, and automation.

Why consider alternatives to Cognism?

Cognism helps B2B teams connect the dots between target accounts and the right contacts. With features like intent signals, compliance safeguards, and firmographic data, it supports everything from cold outbound to account-based marketing.

But while it’s a solid fit for many, others find themselves asking: is there something better suited to our specific goals?

Here are the most common reasons teams look for Cognism alternatives:

- 1.

Data coverage gaps: Cognism is strong in EMEA, especially the UK and DACH regions, but coverage can be thinner in APAC or parts of North America. If you’re selling into underrepresented territories or niche verticals, you might notice some leads are MIA.

- 2.

Pricing for smaller teams: While Cognism’s data quality is pretty high, that quality often comes at a hefty cost. For small to mid-sized teams, particularly startups, the price tag can be hard to justify, especially if they only need limited functionality or regional data.

- 3.

Compliance questions: Cognism prides itself on GDPR compliance, which is undoubtedly a plus for many, but if your team doesn’t sell into Europe, you might not need all those bells and whistles. Some companies want a simpler, faster approach to compliance, or a platform that emphasizes CCPA or US-based privacy features instead.

- 4.

Feature limitations: Cognism focuses on data discovery and enrichment, but doesn’t offer a full suite of outreach tools. If you’re looking for multichannel engagement, automation, or native CRM workflows, other platforms can offer a more unified experience.

The right alternative often depends on your team size, data quality needs, and how well the tool connects with your existing systems.

Quick look at the 10 best Cognism competitors

Here's a simple comparison of the top Cognism alternatives for 2026:

Platform | Best For | Standout Feature | Price Range | Data Coverage |

Dealfront | Intent, engagement & prospecting | ICP insights | $$-$$$ | Europe/Global |

ZoomInfo | Enterprise sales | Deep org charts | $$$$ | Global |

Apollo.io | Sales engagement | Email sequencing | $$ | Global |

Lusha | Quick prospecting | Browser extension | $-$$ | Global |

UpLead | Data accuracy | Real-time verification | $$ | Global |

Seamless.AI | Contact discovery | Real-time verified contacts | $$-$$ | US/Global |

6sense | ABM & intent data | Predictive analytics | $$$$ | Global |

Leadfeeder | Website visitor ID | CRM integrations | $$ | Global/Regional |

LeadIQ | Prospecting workflows | Sequence automation | $$ | Global |

SalesIntel | Verified data | Industry specialization | $$$ | US/Global |

Every platform brings something different to the table when it comes to B2B lead generation and sales intelligence, with distinct strengths in data accuracy, reach, and feature depth.

Top Cognism competitors and alternatives

Whether you’re looking for more flexible pricing, better regional data coverage, or stronger outreach capabilities, here are ten of the most popular Cognism alternatives worth considering in 2026.

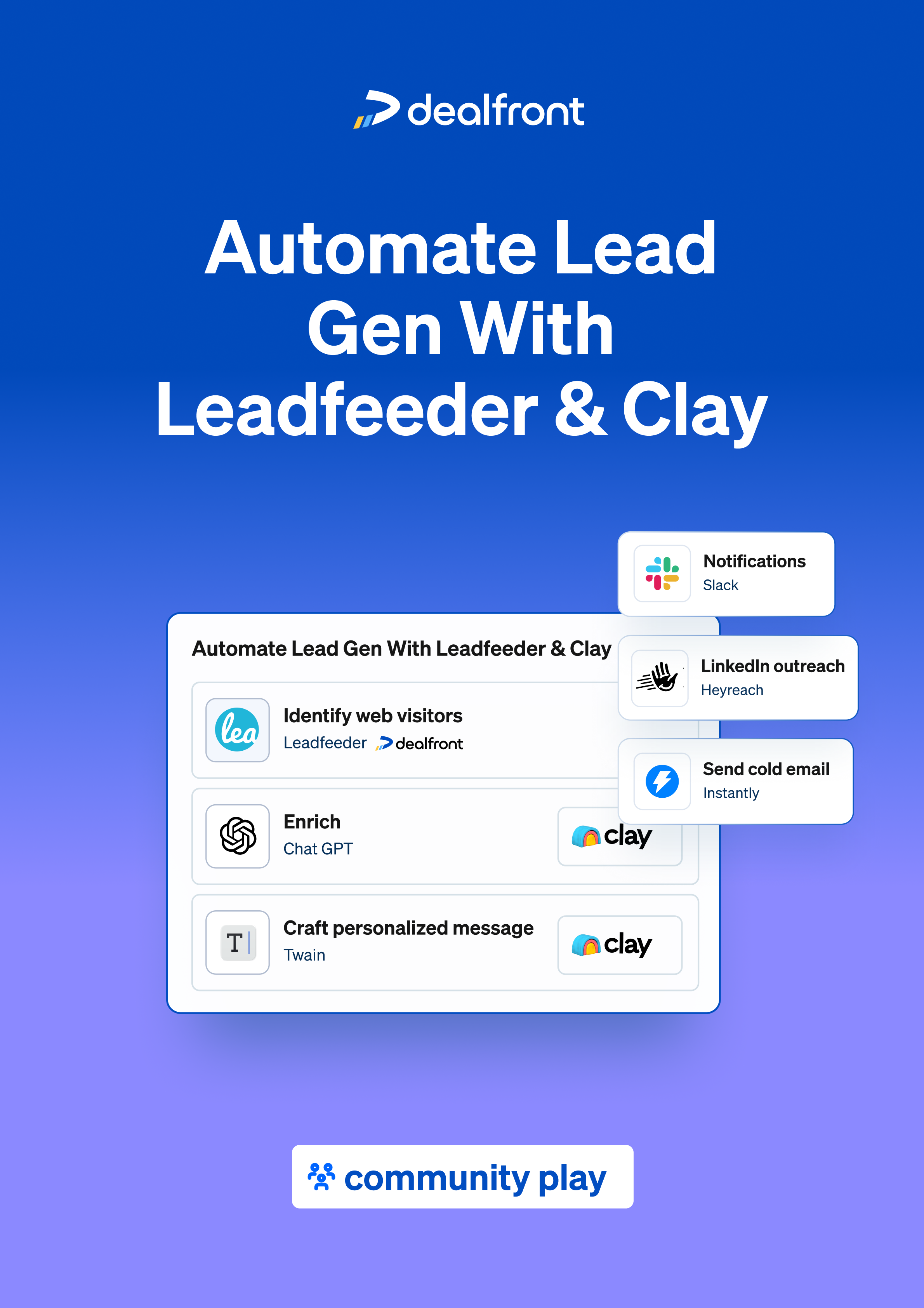

1. Dealfront

Dealfront helps B2B revenue teams work more effectively by showing them who’s actually interested, and why. Instead of just giving you a static list of names and titles, Dealfront delivers real-time insights into buyer intent and account engagement, helping you focus your outreach where it's most likely to convert.

Key features:

Real-time intent signal tracking

AI company insights, contacts & activity summary

Ideal customer profile (ICP) insights

Account engagement monitoring

Integration with CRM and marketing tools

Dealfront is built for go-to-market teams that want more than just raw contact data, it helps you understand timing, interest, and fit. Its GDPR-first data practices make it a trusted choice for businesses operating in Europe, and its account intelligence tools go beyond contact scraping to support true sales and marketing alignment.

While Dealfront offers robust intent and outreach features, teams seeking a massive global contact database might pair it with a secondary tool for deeper phone or email coverage. That said, what Dealfront lacks in bulk data, it more than makes up for in actionable insight, data transparency, and sales and marketing team collaboration.

Of all the Cognism alternatives on this list, Dealfront strikes the best balance between buyer insights, accuracy, and compliance. It’s particularly valuable for teams focused on account-based marketing, European territories, or intent-driven sales workflows. If you're looking for a platform that not only tells you who to reach out to but also why now is the right time, Dealfront is the smartest move.

2. ZoomInfo

ZoomInfo is a comprehensive data platform for enterprise sales and marketing teams. It's known for its extensive database of company and contact information as well as its sales intelligence tools.

Key features:

Deep organizational charts showing company structures and reporting lines

Intent data that signals when companies are researching solutions

Technology tracking to see what tools companies already use

Advanced filters for creating targeted prospect lists

ZoomInfo offers global data with particularly strong coverage in the US and Europe. Its enterprise focus means it’s built for scale, with robust integrations and analytics.

However, their pricing is one of its biggest barriers, typically requiring annual contracts and it can be cost-prohibitive for smaller businesses. Some users also report a steep learning curve and occasional inaccuracies in contact data, especially outside North America.

3. Apollo.io

Apollo.io combines a strong B2B contact database with outreach automation tools, making it a go-to for teams that want everything in one place. It’s especially popular with startups and fast-growing companies.

Key features:

Built-in email sequencing for automated follow-ups

Chrome extension for LinkedIn prospecting

Contact and company data enrichment

Engagement tracking for emails and calls

Apollo.io stands out for its affordability and generous free tier, which includes basic prospecting and outreach features which can be a big plus for budget-conscious teams.

But while it’s a more affordable option, it also lacks the data depth and accuracy of higher-end platforms, particularly outside the US. Its intent data is less sophisticated than competitors like ZoomInfo and Dealfront, and some users find its UI occasionally glitchy or inconsistent.

4. Lusha

Lusha is designed for speed and simplicity, offering sales reps instant access to contact details via a browser extension. It's a decent tool for quick prospecting, particularly on LinkedIn.

Key features:

One-click contact information via browser extension

Credit-based system for accessing data

GDPR-compliant data collection

Team sharing and collaboration tools

Lusha's credit-based pricing makes it flexible for teams of different sizes. It's particularly useful for salespeople who need immediate contact information while browsing potential leads online.

However, Lusha’s data can be hit-or-miss depending on region or industry. It also lacks advanced filtering, intent data, and in-depth account insights, making it less suitable for teams running complex outbound strategies or ABM campaigns.

5. UpLead

UpLead emphasizes data accuracy with real-time email verification. Unlike many platforms that sell you a list and wish you luck, UpLead verifies each email address in real time before you download it, cutting down on bounces and wasted sends.

Key features:

Real-time email verification before download

Technology filters to find companies using specific tools

International data covering over 200 countries

CRM integrations for direct data transfer

UpLead is a good choice for teams who value precision and want to avoid cluttering their CRM with bad data. Its clean interface and transparent pricing appeal to both nimble startups and mid-market teams.

It’s worth noting that UpLead’s database isn’t as deep as tools like ZoomInfo, Dealfront, or Cognism, especially when it comes to mobile numbers or firmographic detail. While excellent for contact accuracy, it lacks advanced intent signals or outreach automation features, so it often works best as a complement to other tools.

6. Seamless.AI

Seamless.AI is an AI-powered sales prospecting tool focused on helping sales teams find verified contact information and build targeted lead lists quickly. It combines AI data enrichment with real-time web crawling to uncover fresh contacts and company details.

Key features:

AI-driven lead generation and contact discovery

Real-time verified email and phone numbers

Chrome extension for prospecting on LinkedIn and company websites

Integration with popular CRMs like Salesforce and HubSpot

Seamless.AI’s strength is in accelerating contact discovery with a strong focus on accuracy and volume. It’s popular among outbound sales teams looking for quick access to up-to-date leads without manual research.

However, Seamless.AI can generate a high volume of leads that sometimes require additional qualification, and some users find the user interface less intuitive compared to competitors. Pricing can also get costly as usage scales, which might limit its appeal for smaller sales teams or those with limited budgets.

7. 6sense

6sense uses AI and intent signals to identify companies in-market and helps align sales and marketing efforts around them.

Key features:

AI-powered account identification and prioritization

Buying stage insights to time your outreach

Anonymous intent data capture

Campaign orchestration across channels

Designed for enterprise teams running sophisticated ABM strategies, 6sense helps focus outreach on the accounts that actually matter, and helps users to reach them at the right time.

But 6sense also comes with a steep learning curve and a hefty price tag. It’s generally considered overkill for smaller teams or those without mature ABM infrastructure. Some users report that setup can take a fair amount of time, and meaningful results often require tight alignment across sales, marketing, and RevOps.

8. Saleshandy

If Apollo feels like too much platform and not enough simplicity, Saleshandy offers a lighter, email-first alternative focused on speed and ease of use. It’s a cold email automation tool that also includes a modest B2B contact database, making it ideal for teams that just want to hit “send” on well-crafted outreach.

Key features:

Anonymous visitor identification

Integration with Google Analytics

Lead scoring based on website behavior

CRM synchronization for sales follow-up

Saleshandy is fine for small teams or solopreneurs who want to run efficient outbound campaigns without the complexity (or cost) of an all-in-one platform. Its intuitive UI and affordable plans make it an attractive entry point into the world of automated sales outreach.

Saleshandy's contact data is limited compared to other platforms, both in depth and accuracy. It’s also heavily email-focused, meaning you’ll miss out on features like phone numbers, intent signals, technographic insights, or CRM integrations. Larger teams or those scaling up their outbound engine may outgrow it quickly.

9. LeadIQ

LeadIQ focuses on making the lives of prospecting reps easier, especially those who spend a lot of time sourcing leads on LinkedIn. With its Chrome extension and automation tools, it helps sales teams capture contact details quickly and get them into sequences without the usual copy-paste hassle.

Key features:

Chrome extension for contact capture

Automated sequence building

CRM integration and enrichment

Team collaboration features

LeadIQ is built for high-volume outbound teams that value speed and simplicity in their prospecting workflow. With flexible pricing (monthly or annual), it appeals to fast-moving teams that don’t want to get bogged down in setup or clunky interfaces.

But it’s not all sunshine and daisies here either. LeadIQ’s contact database is often called out for being shallower than the data-heavy platforms like Cognism, Dealfront, or ZoomInfo. While it excels at helping reps work faster, it lacks the broader company insights, global coverage, and intent data that larger revenue teams require. LeadIQ can help you deliver on speed, but not strategic targeting.

10. SalesIntel

SalesIntel sets itself apart by leaning into human verification. While most platforms rely on algorithms alone, SalesIntel employs researchers to double-check contact details, aiming to reduce the bounce rates and inaccuracies that often plague B2B data tools.

Key features:

Human-verified contact details

Industry-specific data sets

Intent signals for timely outreach

Data reverification every 90 days

SalesIntel works well for teams that have been burned by bad data before, or those targeting regulated or specialized industries where precision matters. It also offers strong US coverage and a growing global footprint.

While SalesIntel’s international data is still maturing, global teams may find gaps in non-US regions. The human verification process, while helpful, also means updates can lag slightly behind fully automated platforms. And where there’s a human process, there’s still space for human-error too. Pricing may also be less competitive for small teams compared to some of the leaner tools.

How to choose the right Cognism alternative

Finding the best alternative to Cognism depends on your sales strategy, team size, and data needs. Rather than chasing the biggest database or the flashiest interface, it’s smarter to evaluate tools based on how well they align with your actual goals and workflows. Here are the key criteria to consider:

Data quality and coverage

The effectiveness of any B2B data platform hinges on the accuracy, freshness, and relevance of its data. Low-quality data leads to wasted outreach and lost opportunities, so it pays to really dig into how each provider handles the following:

Verification methods: Does the platform use real-time checks, human verification, or AI validation to ensure accuracy?

Update frequency: How often is the database refreshed, and are stale records removed proactively?

Geographic coverage: Does the tool have strong data in the regions you’re targeting, especially if you’re selling in Europe, North America, or APAC?

Industry depth: Are niche sectors or specific verticals well-represented in the dataset?

Tip: Many platforms offer a free trial or a limited data sample - use it to test how well the data aligns with your ICP before committing.

Compliance and data privacy

B2B sales outreach is increasingly shaped by privacy laws like GDPR, CCPA, and others. Using non-compliant data doesn’t just create legal risk, it can erode trust with your audience. Look for:

Regulatory compliance: Does the provider meet GDPR, CCPA, and other relevant data standards?

Transparent sourcing: Can they clearly explain where and how they collect contact data?

Consent management: Do they offer tools for managing opt-outs, data removal, or privacy preferences?

Using non-compliant data can lead to legal issues and damage your company's reputation. If compliance is a priority for your organization, favor platforms with a “privacy-first” design and visible certifications.

Integration capabilities

Your data provider should plug in smoothly to the tools your sales and marketing teams already use. Good integrations reduce friction, eliminate manual tasks, and help your team move faster. Evaluate:

CRM integration: Does it connect with platforms like Salesforce, HubSpot, or Pipedrive?

Marketing automation: Can it sync with tools like Marketo, Pardot, or Mailchimp?

API availability: Is there a developer-friendly API for building custom workflows or analytics pipelines?

The better the integration, the easier it is to activate your data across the full go-to-market motion.

Pricing structure

B2B data tools can vary widely in cost and pricing models. It’s important to understand not just what a tool costs, but how you’re billed and what that includes.

Per user / seat: Pricing based on the number of active users

Credit-based: You pay for each contact, record, or data export

Usage-based: Fees scale with the features used or volume processed

Contract flexibility: Monthly billing may offer agility; annual contracts often come with better rates

When comparing options, consider both immediate budget and the total cost of ownership over time. Also factor in what’s included: are data updates, integrations, or customer support part of the base plan, or add-ons?

Which alternative is right for your team?

The best Cognism alternative will depend on your team’s size, budget, and sales strategy. Here’s how to narrow it down based on where you are and what you need:

For larger or enterprise teams with larger budgets and complex needs, ZoomInfo, 6sense, or Dealfront offer robust features and extensive data coverage. If your team needs deep integrations, advanced intent data, and large-scale coverage, these platforms are built for scale:

ZoomInfo – Feature-rich and widely adopted across large sales orgs

6sense – Designed for account-based marketing and predictive insights

Dealfront – Enterprise-ready capabilities with European data depth and real-time engagement signals

For SMBs and growing companies, Dealfront, Apollo.io, UpLead, or Lusha provide affordable options with flexible terms and core functionality. Growing businesses often need strong data without the overhead. These options strike the right balance of power, usability, and affordability:

Dealfront – A standout for SMBs selling into Europe. It combines intent data, website visitor tracking, and firmographics into one GDPR-compliant platform

Apollo.io – Affordable with built-in outreach tools and flexible plans

UpLead – Prioritizes data accuracy with real-time verification and transparent sourcing

Lusha – Simple to use and effective for sales teams working primarily via LinkedIn

For startups with limited resources, Apollo.io's free tier or LeadIQ's streamlined approach may be the most practical starting point. Early-stage teams need speed, simplicity, and low-cost entry points. These tools help you start moving without big investments:

Apollo.io (Free tier) – A somewhat generous entry-level offering that includes basic data and sequencing

LeadIQ – Focuses on fast contact capture while prospecting on LinkedIn

Saleshandy – Email-first with basic contact data and affordable cold outreach features

For specific use cases:

Teams focused on account-based marketing might prefer Dealfront or 6sense

Those prioritizing data accuracy could lean toward UpLead or SalesIntel

Companies targeting European markets will find Dealfront’sregionally focused, GDPR-aligned data most appropriate

Before making a final decision, request demos from your top choices and test their data quality with samples relevant to your target market.

Finding Your Ideal B2B Data Solution

Selecting the ideal alternative to Cognism boils down to understanding your team’s unique needs, whether that’s data accuracy, comprehensive coverage, advanced features, or budget flexibility. The best strategy is to assess your priorities, experiment with a few options, and choose the platform that offers the greatest value for your specific use case.

We recommend starting with free trials or demos of 2-3 platforms that align with your requirements. This hands-on experience will give you insight into which tool integrates best with your workflow and meets your data quality standards.

For teams focused on real-time buyer intent and account engagement, particularly those targeting European markets, Dealfront offers a strong, GDPR-compliant approach that could be an excellent fit for your sales and marketing goals.

FAQs about Cognism competitors

Which platform offers the best value for small businesses?

Which platform offers the best value for small businesses?

Dealfront is a strong choice for SMEs looking to balance functionality, data quality, and compliance. It offers real-time intent data, CRM integrations, and strong European coverage, without the enterprise-level pricing of tools like ZoomInfo or 6sense. Apollo.io also provides good value for SMEs, especially those that need built-in outreach tools alongside data access.

Which platform offers the best value for startups?

Which platform offers the best value for startups?

Apollo.io and Lusha typically offer the best value for very small businesses because of their flexible pricing models, free or low-cost entry points, and core features that cover essential prospecting needs without requiring large investments.

How do these platforms handle compliance with data protection laws?

How do these platforms handle compliance with data protection laws?

Most platforms now include GDPR and CCPA compliance features, with Dealfront and Lusha emphasizing their "GDPR-first" approaches. Each platform handles compliance differently, from data collection methods to providing tools for managing consent and preferences.

What’s the difference between contact data and intent data in these tools?

What’s the difference between contact data and intent data in these tools?

Contact data refers to information like email addresses, phone numbers, and job titles. Intent data tracks online behavior to signal purchase readiness, such as visiting competitor websites or searching for specific solutions. Tools like Dealfront offer both, helping sales teams prioritize leads showing real buying interest.

Can these alternatives integrate with my existing CRM system?

Can these alternatives integrate with my existing CRM system?

Yes, all the alternatives mentioned offer integrations with popular CRM systems like Salesforce and HubSpot, though the depth and quality of these integrations vary. Dealfront offers a particularly strong API option for custom integrations.

Which Cognism competitor is best for targeting European markets?

Which Cognism competitor is best for targeting European markets?

Dealfront stands out as the top alternative for European B2B sales teams. It offers GDPR-compliant data, localized company information, and intent signals tailored to European buying behaviors, something many US-centric platforms don’t provide natively.