60-Second Summary

Choosing between Demandbase and Dealfront comes down to priorities: enterprise-scale orchestration vs. fast, flexible pipeline generation. This guide compares their approaches, capabilities, and trade-offs to help revenue teams choose the best fit.

Platform focus: Demandbase is built for complex enterprise ABM programs, while Dealfront prioritizes speed and pipeline generation through real-time buyer intent.

Time to value: Dealfront delivers insights within days with minimal setup, while Demandbase typically requires multi-month implementations and ops resources.

Differentiating capability: Dealfront’s real-time website visitor intelligence reveals anonymous traffic and prioritizes accounts for immediate outreach, fueling a faster pipeline.

Adoption strategy: Demandbase suits teams with dedicated ops and long planning cycles, while Dealfront empowers lean GTM teams to get results—no consultants required.

This is where the conversation often narrows to two names: Demandbase, the enterprise ABM pioneer, and Dealfront, the modern pipeline generation platform.

Both aim to unite sales and marketing around high-value accounts, but the way they deliver value is very different. Demandbase is a traditional ABM platform, best suited to large enterprises with complex processes. Dealfront takes a broader, faster approach, providing visibility into buyer intent, website visitors, and actionable insights that fuel pipeline growth across the entire GTM motion.

This article breaks down how each platform supports revenue teams and where they differ when it comes to generating pipeline and delivering ROI.

What is Demandbase and why do modern GTM teams use it?

Demandbase is one of the pioneers of ABM technology. Founded back in 2006, when “account-based marketing” was still a relatively new idea, Demandbase has grown into a large, enterprise-focused platform. Its promise is straightforward: use intent data and account insights to help B2B companies identify, target, and engage the right accounts.

For GTM teams, Demandbase offers tools to analyze account engagement, run targeted advertising campaigns, and personalize outreach. It’s most often selected by large enterprises with significant sales and marketing resources, complex buying journeys, and the need for a platform that can scale across thousands of accounts and dozens of markets.

Key strengths include:

Enterprise scalability: Built for very large teams managing high volumes of accounts.

Data intelligence: Surfaces accounts showing early buying behavior through intent signals.

Integration ecosystem: Connects seamlessly with major CRMs and marketing automation systems like Salesforce, HubSpot, and Marketo.

Demandbase, once it’s up and running, can carry your team a long way, but it takes significant resources to get it moving… or to get it to pivot and change direction.

What is Dealfront and who benefits most from it?

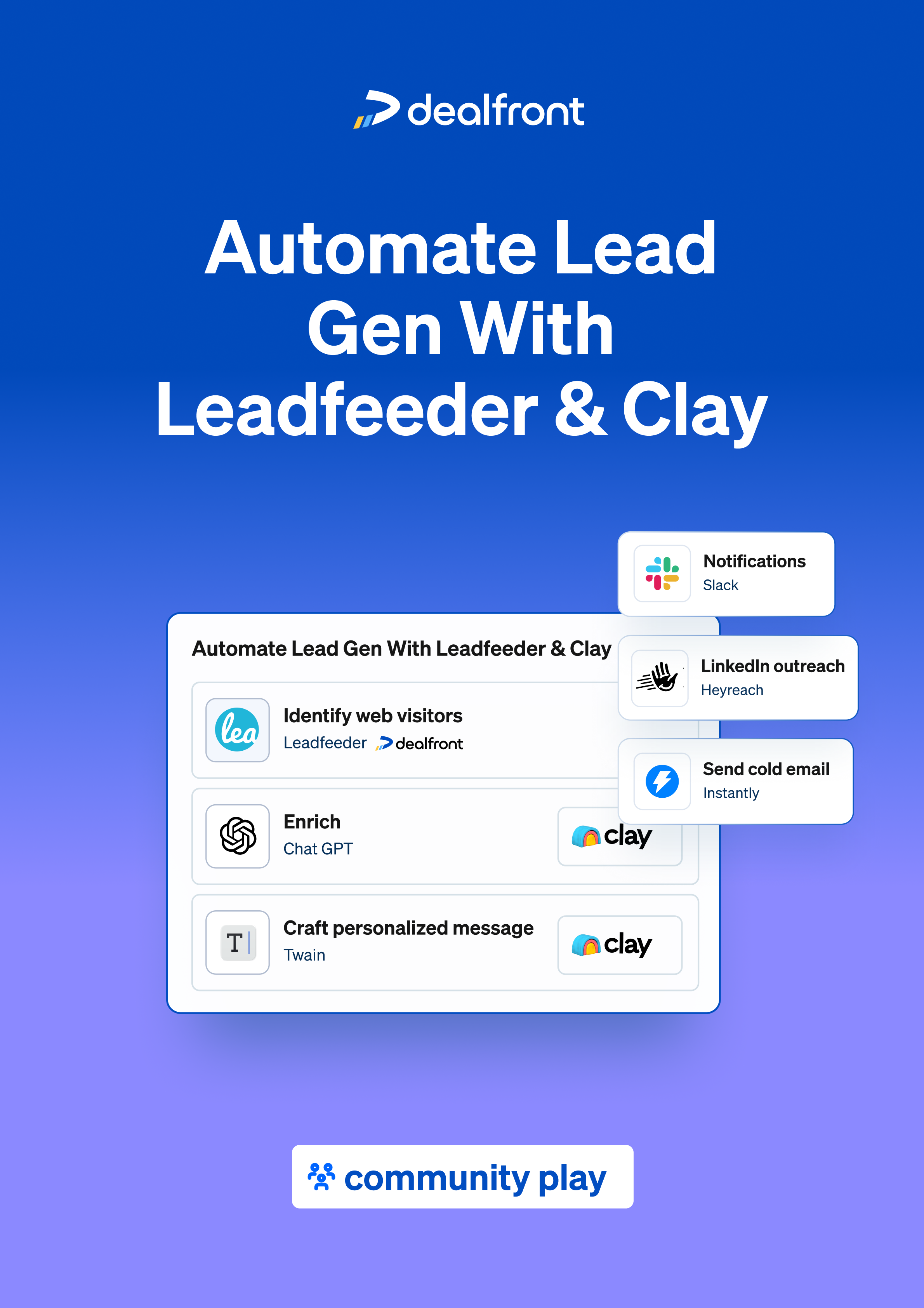

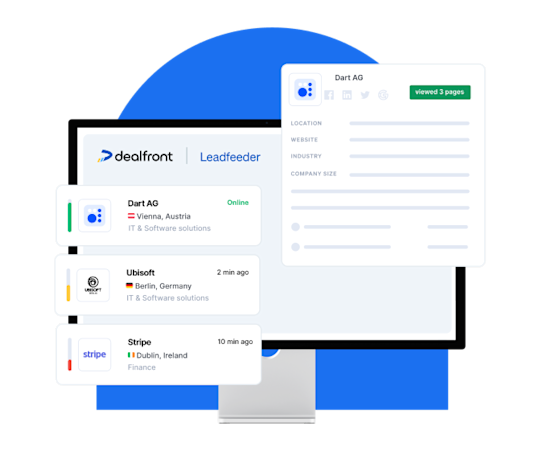

Dealfront takes a different approach. It positions itself not just as another ABM platform and more as a pipeline generation platform. It equips sales and marketing teams with real-time website visitor intelligence, firmographic data, and actionable insights, turning anonymous traffic into prioritized opportunities. Unlike traditional ABM platforms that lean heavily on campaign orchestration, Dealfront helps teams capture demand the moment it appears, route it to sales, and build pipeline faster. It covers the full GTM process (marketing, sales, RevOps), combining first-part data, intent, and sales prioritization to deliver, not just orchestration, but actionable buyer signals. Where Demandbase emphasizes enterprise-scale infrastructure, Dealfront emphasizes speed, usability, and transparency.

Dealfront’s core strength is in website visitor intelligence. It can show you which companies are browsing your site, even when they don’t fill out a form, and can connect those visits directly to your workflows. For marketers, that means campaigns aren’t just driving clicks into a void; they’re revealing the real companies behind the traffic. For sales teams, it means they know exactly when an account is showing intent, without waiting for a form fill.

Dealfront is particularly well-suited to small and mid-sized GTM teams, but it’s increasingly used by larger organizations who want faster, more direct insights into which accounts are leaning in.

Key differentiators include:

Website visitor intelligence: Reveals anonymous companies visiting your site, plus which pages they explored.

Sales acceleration: Sends real-time alerts when high-interest accounts engage.

Quick setup: Delivers usable data within days, with minimal technical lift.

Dealfront is agile, easy to get to grips with, and will help you get from a flooded, but unstructured pipeline to a focused stream of high-quality opportunities that your whole revenue team can act on.

Key pipeline generation capabilities: Demandbase vs Dealfront

With the basics covered, the real question is how these two platforms perform where it matters most: generating pipeline in the day-to-day work of sales, marketing, and revenue teams. Here’s how Demandbase and Dealfront stack up across the core capabilities that fuel predictable growth.

Account targeting and segmentation

Both platforms give revenue teams tools to define and organize high-value accounts, using filters such as industry, company size, and technology usage. Demandbase is particularly strong for enterprises that need to manage very large account lists across multiple regions, where ABM orchestration at scale is the priority. Dealfront, however, makes segmentation faster and more actionable by combining firmographic filters with real-time website behavior. For pipeline generation, this means teams can not only define their ICP accounts but also see which of them are actively showing interest, turning static lists into dynamic, prioritized opportunities.

Capability | Demandbase | Dealfront |

Account identification | Uses AI to match anonymous traffic to known companies | Uses IP-based website visitor tracking and company data |

Segmentation options | Offers AI-driven segments and rule-based filters | Offers filters for geography, size, industry, and web behavior |

Custom audience creation | Builds audiences based on intent and engagement signals | Builds audiences using real-time company behavior & helps find ICP fit companies |

List management | Supports dynamic lists and journey stage assignment | Supports dynamic lists & account grouping with AI enrichment & AI list alerts |

Engagement and reporting

Demandbase tracks engagement through its proprietary “Engagement Minutes”,assigning value to account activities across ads, email, and web. This is useful for campaign-level reporting but can feel abstract for teams looking to connect activity directly to pipeline outcomes..

Dealfront, on the other hand, takes a more grounded approach, focusing on how accounts actually behave on your website. By scoring visits based on depth and relevance, teams can see not only that an account is engaging but also what they care about, whether that’s a pricing page, product details, or case studies. Insights flow directly into CRMs and sales workflows, making it easier to act on signals while they’re fresh.

Marketing and sales alignment

Both platforms aim to bring marketing and sales closer together, but they go about it differently. Demandbase automates account qualification and synchronizes with CRM lead stages, ensuring that enterprise teams can keep large, complex funnels organized. Dealfront prioritizes immediacy: it sends real-time alerts to revenue teams the moment a high-fit account lands on the website, arming both sales and marketing with a clear signal to engage. For pipeline generation, this speed often makes the difference between winning the conversation early and missing the window of opportunity.

In short, Demandbase centralizes a wide range of multi-channel engagement data, while Dealfront focuses on clarity and speed by enriching first-party website data with firmographic insights.

Data intent and integrations which platform delivers more value

At the heart of any ABM or pipeline generation strategy is data. But it’s not about how much of it you can gather, but how accurate, timely, and actionable it is. Both Demandbase and Dealfront collect buying intent signals, but the way they use that data makes a big difference for revenue teams.

Data depth and accuracy

Demandbase aggregates intent data from a broad mix of sources: its ad network, third-party providers, and machine learning models that roll these signals into engagement scores.. This approach gives enterprise teams a wide-angle view of account activity across large markets, but it often raises questions about freshness and reliability, especially when decisions hinge on third-party data.

Dealfront builds its insights on first-party website data; the activity happening on your own digital front door and the most direct indicator of buying intent. By using IP-to-company matching and layering in verified firmographic information, Dealfront reveals which companies are visiting your site, which pages they’re looking at, and how engaged they are. For pipeline generation, that’s a critical advantage: instead of relying on forecasts and trends, you get a live feed of real companies showing real interest in your offerings.

Data Aspect | Demandbase | Dealfront |

Intent sources | Third-party providers, ad network, AI models | Website visits, public company data, business registries |

Signals tracked | Ad engagement, content consumption, website activity | Page views, visit frequency, company behavior, last visit |

Update frequency | Daily to weekly, depending on source | Near real-time with daily data refreshes |

Accuracy approach | Uses AI-based validation techniques | Validates using official business listings |

Tech stack integrations

Demandbase integrates deeply with enterprise systems like Salesforce, HubSpot, and Marketo, enabling large-scale campaign orchestration. These integrations are powerful but often require careful setup by IT or certified partners. For large companies with complex workflows, that makes sense. For smaller or more agile revenue teams, it can mean long implementation timelines and added cost.

Dealfront keeps integrations simple and fast. It integrates natively with popular CRMs such as Salesforce,HubSpot, and Pipedrive as well as analytics tools like Google Analytics. Its setup is designed to be straightforward: most teams can connect their systems in hours, not weeks, without calling in IT support. While Demandbase provides two-way CRM synchronization, Dealfront focuses on speed and simplicity, pushing website intent data directly into the tools revenue teams already live in.

Lead routing and alerts

Demandbase routes accounts to sales once they hit certain engagement thresholds, moving them through rules-based qualification stages. It’s a rules-based approach that fits enterprise processes but can sometimes feel slow to react and can lag behind fast-moving buyer interest.

Dealfront, meanwhile, sends real-time alerts;. the moment a high-fit account visits your site or meets custom criteria, alerts flow directly into email, Slack, or CRM, meaning your team hears about interest the moment it happens. This immediacy can be the difference between engaging an account while intent is fresh versus missing the moment altogether.

Pricing and ROI: evaluating cost effectiveness for 2026

Pricing is often where the tough decision gets made. With budgets under scrutiny, revenue leaders want platforms that prove value fast, not just in theory, but in real pipeline creation.

Pricing models and hidden costs

Demandbase uses a custom pricing model tied to company size, number of accounts, and features. Contracts typically start in the mid–five figures annually and can climb into six figures for enterprise-scale deployments. Beyond subscriptions, many teams face added costs for technical onboarding, professional services, or certified implementation partners. The true price tag often ends up far higher than the contract alone.

Dealfront takes a different approach with transparent tiered pricing for the Leadfeeder by Dealfront product. Plans start at a base monthly rate and scale based on users, website traffic, and advanced features. Teams can choose between monthly or annual contracts, reducing financial lock-in. Because onboarding is quick and intuitive, customers don’t need to budget for costly services or consultants, which can be a big factor when calculating ROI. Pricing for Dealfront’s Target product or platform is tailored to individual customer requirements; a call to outline your specific needs is needed to establish the most cost-effective package for your team.

Time to value and team requirements

The difference in time to value is stark: Demandbase implementations often stretch over 3-6 months before revenue teams can fully leverage insights. Dealfront typically delivers usable data in just 1-2 days, meaning GTM teams can start filling the pipeline this quarter, not half a year later.

Operational demands also differ. Demandbase generally requires dedicated marketing ops or CRM admins to manage integrations and workflows, making it better suited for companies with large support teams. Dealfront, on the other hand, can often be managed by just one or two sales or marketing professionals. That means leaner teams can still unlock enterprise-grade insights without tying up resources.

ROI and pipeline impact

Both platforms can support ABM, but the ROI equation depends on speed, complexity, and resourcing. Demandbase fits enterprises with long planning horizons and extensive ops infrastructure. Dealfront positions itself differently: as a full GTM solution designed to drive pipeline through real-time intent data, rapid adoption, and flexibility. For revenue teams that need to prove value quickly and consistently, Dealfront often emerges as the more cost-effective and growth-focused choice.

It boils down to this: Demandbase is built for scale and orchestration, while Dealfront is built for speed, flexibility, and measurable pipeline generation.

Common implementation challenges and how each platform addresses them

For many revenue teams, the decision to adopt a new platform isn’t just about the features on a checklist. It’s about how quickly the tool can be implemented, how intuitive it feels for everyday users, and how seamlessly it fits into existing GTM workflows. This is often where the gap between Demandbase and Dealfront becomes most apparent.

Onboarding time

Demandbase implementations typically stretch across weeks or even months. The process usually involves multiple stakeholders, from marketing operations to sales operations and IT, all working together to connect data sources, configure account journeys, and customize workflows. For enterprises with large teams, that investment can still pay off. But for smaller or mid-sized GTM teams, it can mean long delays before the platform is truly usable.

Dealfront takes the opposite approach. Its implementation timeline is measured in days, not weeks or months. Setting up website tracking and creating target audiences requires minimal technical involvement, and most sales or marketing teams can handle the setup themselves. The difference is a bit like moving into a fully furnished apartment compared to building a house: with Dealfront, you’re operational almost immediately, seeing pipeline-driving insights from the start, while Demandbase takes far more time, planning, and resources to get off the ground.

Training and adoption

Demandbase offers a comprehensive training ecosystem, including its own academy, certifications, and webinars. This structured approach reflects the depth and breadth of the platform’s features, but also signals a steeper learning curve. New users need time to become comfortable with the interface, workflows, and campaign tools.

Dealfront, meanwhile, focuses on accelerating time-to-value. Its guided onboarding, in-app tooltips, and clear documentation make it simple for new users to adopt and start seeing value right away. The interface is designed for the real daily rhythms of GTM teams (think: prospecting, pipeline prioritization, and account engagement), which means most users are fully productive in their first week, not their first quarter.

Support and accessibility

Demandbase offers technical support, professional services, and certified implementation partners; while helpful for complex rollouts, this adds cost and slows down responsiveness. Dealfront leans into accessibility with in-app support, live chat, and quick-start tutorials that meet teams where they are, without requiring a consulting budget. This gives sales and marketing teams confidence they can troubleshoot quickly and keep momentum without waiting on external partners.

In short, Demandbase delivers power and scale for enterprises with long sales cycles and the resources to manage complex onboarding. Dealfront delivers speed, clarity, and pipeline impact. It isn’t just an ABM tool, it’s a full GTM solution designed to help leaner teams get live faster, adopt with ease, and start generating measurable pipeline without the drag of technical hurdles.

Choosing the right pipeline generation platform for your revenue team

Choosing between platforms like Demandbase and Dealfront is more than just a software decision, it also must be a strategic one. The right choice depends on your current go-to-market (GTM) approach, your team’s resources, and how you expect your strategy to evolve over the next few years.

Evaluate feature fit

Start by evaluating feature fit. Make two lists: your “must-have” features and your “nice-to-haves.” Then, map those lists against the platforms. Do you need enterprise-level campaign orchestration with dozens of moving parts, or are you looking for a tool that helps you identify in-market accounts and build pipeline today? For example, if your goal is to run global, multi-channel ad campaigns with detailed segmentation across multiple business units, Demandbase may check those boxes. But if your immediate priority is fueling the pipeline with verified, in-market accounts in real time, Dealfront provides those insights out of the gate.

It’s also worth asking: where are the gaps in your current process? Maybe you’re generating plenty of leads, but they’re not qualified. Maybe marketing is driving awareness, but sales can’t see which accounts are actually interested. The right platform should actively close those holes, not just layer on more data or dashboards.

Assess organizational needs

Next, consider your team structure and resources. How many people will actually use the platform, and in what roles? Do you have dedicated marketing operations or CRM admins to manage setup and maintenance, or does your sales and marketing team need to own it directly?

Budget goes beyond the subscription price. With enterprise tools like Demandbase, costs often include professional services, partner support, and longer onboarding timelines. Dealfront, by contrast, keeps overhead low: most teams can get live without IT involvement, and without hidden costs.

Finally, think about integrations. The best platform doesn’t force you to rebuild your stack, it plugs neatly into the systems you already rely on, like Salesforce, HubSpot, or Google Analytics. That’s where Dealfront’s streamlined integrations give GTM teams the flexibility to hit the ground running.

Plan for future growth

Your GTM strategy today will look different in 12-18 months. Account lists grow, new markets open, and strategies shift. A platform should scale with you, not slow you down. Look at the vendor’s product roadmap: are they innovating frequently, adding new features, and keeping pace with changing buyer behaviors?

Demandbase offers stability for large enterprises with established structures. Dealfront offers agility: the ability to adapt quickly, expand into new markets, and keep teams focused on pipeline without adding complexity. For many revenue leaders, that adaptability is what makes the difference.

Making the choice build a predictable pipeline with the right pipeline generation platform

When it comes to Demandbase vs. Dealfront, the decision ultimately depends on your priorities, resources, and timelines. Both platforms help align sales and marketing around high-value accounts, but the way they deliver value couldn’t be more different.

Demandbase is a strong choice for large enterprises with complex operations and long sales cycles. Its breadth of features, integrations, and reporting capabilities make sense if you’re building an enterprise-scale ABM engine and have the budget and patience to match. For companies that want a long-term, enterprise-scale system of record, it delivers.

Dealfront, on the other hand, is purpose-built for teams that want results quickly and need tools that are both powerful and accessible. With real-time website visitor identification, actionable insights, and an intuitive interface, it helps revenue teams move from unstructured demand to a focused, predictable pipeline in days, not months.It isn’t just an ABM platform, it’s a full GTM solution that helps marketing, sales, and revenue operations teams identify, prioritize, and act on the accounts most likely to buy. For small to mid-sized companies, and even larger organizations looking for faster wins, Dealfront offers speed, clarity, and flexibility without the heavy lift.

To succeed with either platform, technology alone isn’t enough. Make sure you:

Define clear goals for your ABM or pipeline generation program

Align your sales and marketing teams around shared account priorities

Prioritize clean data and smooth integration with existing systems

Commit to ongoing reviews and continuous strategy adjustments

As budgets tighten and buying journeys become more complex in 2026, the ability to act on fresh intent signals quickly can make the difference between winning a deal and missing the moment. For revenue teams looking for a partner built around pipeline generation, not just ABM, Dealfront stands out as the agile choice for today’s GTM strategies.

Ready to see it in action? Take a product tour or request a demo to discover how Dealfront can help your team build a healthier, more predictable pipeline.

FAQs about Demandbase and Dealfront

Is there a difference in GDPR compliance between Demandbase and Dealfront?

Is there a difference in GDPR compliance between Demandbase and Dealfront?

Yes. Both platforms offer GDPR compliance features, but Dealfront’s European roots give it an advantage. It includes built-in compliance tools and standard data processing agreements designed specifically for EU data protection requirements. Demandbase provides GDPR support as well, but it was originally built with a US focus.

Does either platform support global data coverage in multiple languages?

Does either platform support global data coverage in multiple languages?

Demandbase provides broader global data coverage, particularly strong in North America, Europe, and parts of Asia-Pacific. Dealfront does provide US data, but is especially strong in European markets, where its data depth is hard to beat, and the company continues to expand its coverage into other regions. Both platforms support multiple languages, but Dealfront is often favored by companies with a significant European presence.

How do Demandbase and Dealfront compare on pricing?

How do Demandbase and Dealfront compare on pricing?

Demandbase typically uses a custom pricing model based on company size, account volume, and features. Most contracts start in the mid–five figures annually, scaling to six figures for enterprise use. Dealfront uses a transparent, tiered pricing model with entry-level monthly plans and flexible contracts. This makes Dealfront more accessible to small and mid-sized GTM teams, while Demandbase is generally suited to larger enterprises with much bigger budgets.

Which platform is easier to set up and adopt for revenue teams?

Which platform is easier to set up and adopt for revenue teams?

Dealfront is known for its fast setup and most teams see usable insights within a matter of days, without needing IT support. The interface is streamlined for everyday sales and marketing workflows. Demandbase, by contrast, typically requires a longer onboarding process (often 3–6 months), as well as dedicated operations or IT support. It offers more training resources but comes with a steeper learning curve.

Which platform delivers faster ROI for GTM and pipeline generation?

Which platform delivers faster ROI for GTM and pipeline generation?

For large enterprises running complex, long-term ABM programs, Demandbase provides a wide set of features that may pay off over time. Dealfront, however, is built for speed and agility across the full go-to-market process. By surfacing real-time website visitor intelligence and intent data within days, it enables revenue teams to identify opportunities, prioritize accounts, and build a predictable pipeline quickly and efficiently.