60-Second Summary

Demand generation in 2026 is evolving into a revenue-focused, account-centric discipline that relies on AI, intent data, and strategic orchestration. This guide unpacks 10 essential trends, supported by practical workflows, real-world examples, and actionable frameworks to future-proof your demand engine.

AI and Human Collaboration: High-performing teams use the 'Sandwich Model'—AI handles data and segmentation; humans shape strategy and final decisions.

ABM as Revenue Architecture: Account-Based Marketing has matured into a company-wide motion with shared, dynamic Target Account Lists (TALs) informed by real-time signals.

Multi-Channel Buyer Journeys: Modern campaigns span LinkedIn, email, search, and events—designed around buyer behavior, not channel silos.

Privacy-First Compliance as Differentiator: Teams using GDPR-compliant tools like Dealfront for firmographics, consent, and intent gain lasting trust and performance benefits.

The result of these things is that demand gen is shifting from a “more leads, more forms, more MQLs” model to a revenue-focused, account-centric engine.

This article doesn’t simply list trends. It shows how to turn them into pipeline in 2026, with 10 essential demand gen trends, examples, playbooks, and next steps… plus a few extras, such as, how platforms like Dealfront help operationalise them across European markets.

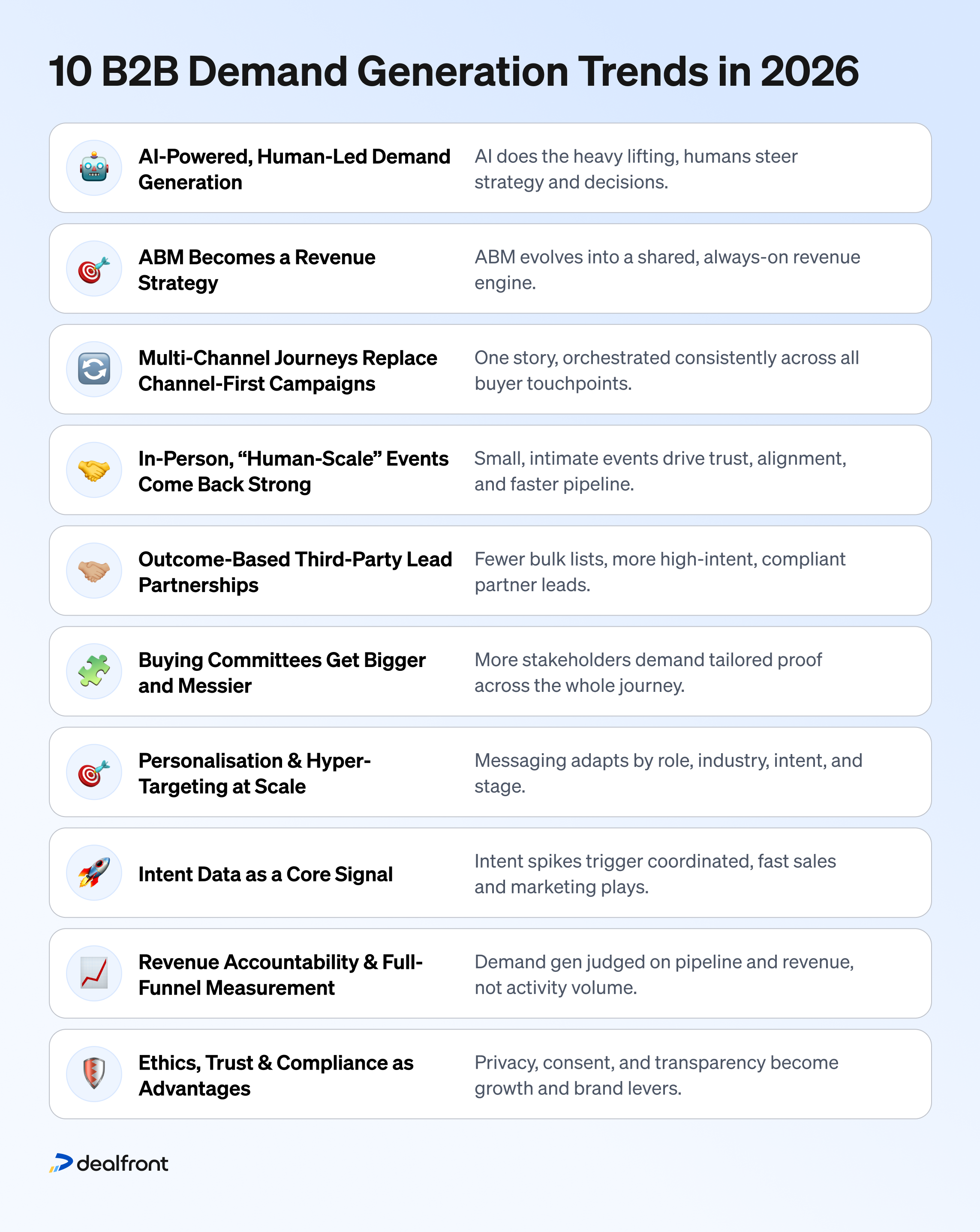

10 Key B2B Demand Generation Trends in 2026

1. AI-Powered, Human-Led Demand Generation

AI has moved far beyond simple automation and now sits at the centre of modern demand gen. But the highest-performing teams don’t try to replace people, they pair AI with human judgement. This is what Ken Roden calls the Sandwich Model: AI handles the heavy lifting in the middle (analysis, enrichment, scoring), while humans guide the strategy upfront and make the final decisions at the end.

AI won’t replace marketers, but teams that fail to integrate AI into their workflows will be outperformed three to five times by those who do. In 2026, AI will be most effective when paired with strong data foundations and clear human oversight.

High-impact AI use cases

Predictive lead and account scoring: merge engagement, firmographic, and intent signals into a unified score. This doesn’t just guess who’s interested, it uses data to predict which accounts are most likely to convert. Dealfront’s clean, compliant European-intent and firmographic data strengthens scoring accuracy, reducing noise and improving precision.

AI-enrichment for prioritization: with Dealfront’s AI Enrichment, you can automatically qualify and score company lists using natural-language prompts. This helps marketing and sales align on which companies are top priority.

AI-Powered Company Insights: use AI Company Insights to instantly assess whether a company fits your Ideal Customer Profile (ICP). A simple question like “Does this company operate in our target market?” triggers a data-backed summary which is fast, transparent, and actionable.

High-velocity Creative Testing: Run rapid experiments on messaging, CTAs, and campaign creatives. Use AI to generate variants, then A/B test them to see which resonate best, accelerating optimisation without overloading your team.

Role-based Contact Search: rather than relying on job titles alone, Dealfront’s AI Contacts lets you describe a role (for example, “who leads partner marketing in Germany?”) and generates a list of decision-makers based on function, seniority, and real responsibilities.

AI-generated Content & Variant Testing: generate multiple versions of content such as, emails, offers, subject lines, then let human reviewers refine them. This speeds up creative testing while maintaining brand voice and quality.

Real-Time Web Visitor Summaries: use Dealfront’s AI Web Visitor Summary to get a privacy-safe, conversational breakdown of how companies are interacting with your site. The AI synthesises visit patterns, key page activity, and engagement signals so you and your team can act quickly.

AI List Alerts: automatically monitor key accounts for critical events (like exec changes, product launches, funding rounds) without manual tracking. With AI List Alerts, your team stays updated on company developments that could trigger outreach.

These use cases go beyond theoretical AI; they directly support demand gen outcomes including, better prioritisation, faster insight, tighter alignment between sales and marketing, and smarter, more relevant outreach.

Start with one high-impact AI workflow: automated lead scoring with intent + firmographics

The fastest way to see meaningful AI impact in demand generation is to start with a single, tightly defined workflow, and automated lead scoring is one of the highest-leverage places to begin. Dealfront’s clean, compliant European data provides the firmographic, technographic, and intent foundations that make AI scoring models more accurate and less noisy. By blending AI-powered enrichment with real buying signals, teams can focus their time on the accounts that are most likely to convert.

A simple way to get started is to automate your scoring workflow using Dealfront’s AI Enrichment. In just a few steps, you can feed a target list into Dealfront, apply an AI prompt that reflects your ICP criteria, and return a scored, prioritised set of companies. This lets your team identify high-value accounts faster, align sales and marketing around a shared view of priority, and eliminate the manual effort usually required to qualify lists.

To follow the workflow end-to-end, including prompts, steps, and examples, check out the full Play that’ll walk you through how to automate lead scoring with AI Enrichment.

A simple 30-day starter plan

Dealfront’s clean, compliant European data strengthens AI models and reduces noise. Here’s how you can get started with it:

Week 1: Audit data quality and identify 1–2 high-value AI use cases.

Week 2: Pilot one workflow (such as AI-assisted scoring or content variants) with defined QA steps.

Weeks 3-4: Measure early impact, refine the workflow, and introduce basic governance and guardrails.

2. ABM Becomes a Revenue Strategy

In 2026, ABM isn’t a campaign, it’s how pipeline is created. Teams that still treat ABM as a set of ads or a single-channel programme will consistently lose to those who treat ABM as revenue architecture, built jointly by sales, marketing, and customer success. ABM has fully matured from a marketing-led programme to a shared commercial motion where every team contributes to identifying, engaging, and converting high-value accounts. The winning organisations in 2026 anchor this around a dynamic, jointly owned Target Account List (TAL) that evolves continuously based on fit, behaviour, and real-time buyer signals.

How to build a dynamic Target Account List (TAL)

A truly dynamic TAL blends firmographic fit, buying signals, historical performance, and real-time intent; Dealfront provides the clean, compliant European intelligence needed to keep that list accurate and actionable. Rather than relying on static spreadsheets or annual TAL reviews, the top teams of 2026 will update their TAL continuously based on account behaviour, research patterns, and in-market movement.

If you want to operationalise ABM as a revenue motion (not a marketing campaign), the best place to start is with Dealfront’s Intent Data + ABM Playbook. It walks you step-by-step through how to identify in-market accounts, build a living TAL, and align sales and marketing into one coordinated sequence, from pre-awareness, to multi-threaded engagement, through to expansion and customer growth. It also includes recommended workflows, messaging approaches, and the metrics that matter most when ABM becomes the backbone of your revenue engine.

3. Multi-Channel Journeys Replace Channel-First Campaigns

Buyers now move fluidly across channels, devices, and content formats, and in 2026 demand teams will need to respond by orchestrating connected journeys rather than launching isolated campaigns. The goal is consistency: design a narrative that travels with the buyer, adapting based on behaviour, intent, and where the account is in its research process. Consistency, not volume, is what drives pipeline.

As Dealfront’s Director of Brand and Content, Jamie Pagan puts it:

“It’s not just about creating great content, it’s about making sure it shows up where your buyers already are. We use the same core content across channels like LinkedIn, YouTube, and email to build consistency and stay present across the journey. Content might be king, but distribution is queen and she wears the pants.”

This shift means teams must think less about individual channels and more about the complete buyer journey: one story, delivered everywhere your audience already spends their time.

Channels that work well together

Paid social

Paid search

SEO + content

Email

Webinars + events

Partners

Sales outreach

Example 6-8 touch journey

1-2: Paid social + content download

3-4: Retargeting + email nurture

5-6: Webinar invite + SDR outreach referencing behaviour or intent

7-8: Case study + demo or consultation offer

How Dealfront supports multi-channel journey mapping

The first two stages of any modern journey, awareness and early engagement, are where most teams struggle. This is where Dealfront’s Leadfeeder and Promote products give you an edge.

With Leadfeeder, you can identify which companies are visiting your website, engaging with your content, and even viewing your ads. Instead of guessing who’s interacting with early-stage campaigns, you get verified account-level visibility into which organisations are showing interest, what they’re consuming, and where they are in their journey.

Once you know who’s engaging, Dealfront Promote allows you to run targeted retargeting campaigns directly inside Dealfront, ensuring that interested accounts stay warm and continue progressing through the journey. You can take website visitors, content downloaders, or ad engagers and immediately place them into personalised campaigns tailored to industry, behaviour, or buying stage.

Pragmatic attribution - how Leadfeeder makes it possible

Perfect attribution models are unrealistic in B2B, because buying cycles are long, buying committees are large, and many touches happen across devices, channels, or offline. That’s why a “primary source + assist channels” mindset is more useful: you aim for a model that guides decisions, rather than pretends to deliver perfect precision.

But you don’t have to guess. With Leadfeeder you can get company-level visibility into who’s engaging, when, and how. That means: you can track website visitors triggered by paid campaigns, see which companies repeatedly visit, follow their journey over weeks or months, and correlate ad-driven interest with pipeline or closed deals. This makes your attribution far more realistic, and far more useful.

4. In-Person, “Human-Scale” Events Come Back Strong

Digital channels will remain essential, but nothing accelerates trust like live interaction. The companies that see the fastest pipeline movement in 2026 will lean into smaller, intimate events that create meaningful connections between buyers and experts, the kind of moments that build conviction, not just awareness.

As Dealfront’s Director of Community and Ecosystem Marketing, Dipak Vadera, explains:

“As AI handles more of the routine interactions that shape the buying journey, the gaps that matter are the human ones. That’s why I expect F2F engagement to become even more prominent in 2026. Executive dinners, roundtables and customer councils consistently move deals faster because they build trust in a way no automated sequence can. When everything else scales, the unscaled moments become the ones that matter most.”

Small, highly curated experiences will outperform big-budget roadshows, and in a tighter economic environment, they deliver better ROI, faster learnings, and deeper multi-threading across buying committees.

High-pipeline event types

Executive roundtables

Workshops

VIP dinners

Customer advisory councils

Regional roadshows

Pre/during/post event playbook

Pre: targeted TAL invites, pre-event content, 1:1 AE scheduling.

During: facilitated discussions, demos, content capture.

Post: personalised follow-ups, recap assets, account-level outreach.

Pro tip: If budgets are tight in 2026, as expected, don’t run more events - run smaller ones. Prioritise highly intimate formats (12–20 people max). Smaller rooms drive deeper conversations, higher-quality engagement, and dramatically stronger pipeline impact per event.

Key metrics

Influenced opportunities

Velocity

Win rate vs non-attendees

ACV

5. Third-Party Lead Generation Becomes an Outcome-Based Partnership Model

The old “bulk lead list” model is disappearing fast. In 2026, smart teams won’t be buying large lists or generic “syndicated leads��”, they’ll build controlled, outcome-based partnerships with third-party providers. The focus shifts from volume to quality, intent, verified consent, and compliance, especially for teams operating in Europe. These partnerships only work when lead quality is transparent, targeting is tight, and data is clean and permission-based.

What good content syndication looks like

Tight ICP filters

Topic alignment

Verified consent

Progressive profiling

SLAs on lead quality (job role, company size, region, intent)

How Dealfront strengthens third-party lead quality (and protects you in Europe)

Most third-party lead providers still struggle with accuracy, consent verification, and clean firmographic data, all of which are critical in Europe. Dealfront helps you turn “raw” partner leads into sales-ready, compliant records by enriching and validating them against our proprietary database of European company intelligence.

With Dealfront, you can:

Verify company identity (no more mismatched or made-up companies)

Confirm job roles and seniority before passing leads to Sales

Add missing firmographics (industry, size, HQ, region)

Layer on website behaviour, showing whether those accounts also visited your site

Add intent signals so your team can prioritise the right leads quickly

This turns third-party leads from “just names” into fully enriched, compliant, actionable account records.

Workflow: clean & qualify third-party leads using Dealfront

Step 1: Upload & enrich

Import your third-party lead list (CSV, spreadsheet, etc.) into Dealfront.

Use Dealfront’s enrichment tools to validate company identity, location, industry, size, and job titles.

Confirm role accuracy (e.g. seniority, function) before passing leads on to Sales.

Step 2: Append behaviour & intent

Cross-check enriched leads against Dealfront’s database to see if those companies have visited your website, consumed content, or shown intent signals.

Tag and prioritise accounts with both good firmographics and signs of intent or engagement.

Filter out leads with missing data, no consent trace, or weak firmographic/technographic fit.

Step 3: Qualify, segment & route

Segment the cleaned and enriched leads into buckets (e.g. high-fit & high-intent; fit but low intent; poor fit).

Send high-fit & high-intent leads to SDRs for outreach; route moderate-fit to nurture; discard or archive poor-fit leads.

Maintain a compliance log for consent and data provenance, ensuring GDPR-ready operations.

6. Buying Committees Get Bigger and Messier

Buying teams continue to grow more complex, with different roles requiring different forms of proof. The average B2B buying group now includes roughly 10-11 stakeholders, and many enterprise deals involve 11 to 13 or more. If you’re only talking to one person, you’re already behind, you just might not realise it yet.

To keep pace, teams need faster, more accurate ways to identify every relevant stakeholder inside an account. This is where tools like Dealfront become critical: instead of manually hunting through LinkedIn or guessing who’s involved, you can use AI-assisted workflows to surface decision-makers, influencers, and adjacent roles automatically.

Example committee for a SaaS deal

CMO (economic buyer)

RevOps (technical validator)

IT (security)

Finance (ROI)

Marketing Manager (primary user/champion)

Each persona needs different proof: ROI for executives, benchmarks for finance, security for IT.

Example 90-day multi-persona journey map

Weeks 1-4: Building awareness & internal alignment

Champion: Light, narrative-led content that helps them articulate the problem internally (short videos, before/after stories, case studies).

Executives: High-level ROI messaging, market trends, and business risk framing (1-pagers, analyst data, competitive insights).

Use Leadfeeder signals to see who from the account is visiting key content and trigger tailored nurture paths per persona.

Weeks 5-8: Deepening validation & technical confidence

IT / Security: Technical documentation, integration guides, architecture diagrams, security compliance sheets.

Finance: Benchmarks, ROI calculators, model templates, procurement-friendly comparisons.

Wider Buying Group: Social proof assets such as vertical case studies, customer webinars, peer quotes.

Use buyer intent to detect additional stakeholders researching similar topics. Map unknown visitors to accounts so you can proactively multi-thread, even if they haven’t filled a form, and run persona-specific retargeting via Dealfront Promote.

Weeks 9-12: Consensus building & closing motions

Champion + Project Team: POC or pilot offer, implementation walk-throughs, success planning.

Executives: Short executive brief + 30/60/90-day value roadmap showing business outcomes.

Procurement: Pricing breakdowns, risk-mitigation docs, legal/compliance checklists.

Track surges in traffic from procurement, legal, or finance to anticipate next steps. Use account-level insights to personalise SDR/AE outreach to every active stakeholder. Also, trigger final-mile content (case study packs, ROI summaries, comparison sheets) to all engaged personas.

7. Personalisation & Hyper-Targeting at Scale

Personalisation in 2026 will go far beyond first names or token drops. Buyers will expect relevance by role, industry, intent, and stage, and they’ll reward the brands that deliver it consistently.

Key data types

Firmographic (industry, size, region)

Technographic

Behavioural (pages viewed, events attended)

Personalisation tiers

1:1 for strategic accounts

1:few by vertical or segment

1:many by industry or use case

Three quick-win experiments

- 1.

Website: dynamic hero/case study by industry or country (Dealfront helps ensure accurate regional segmentation for EU visitors.)

- 2.

Email: behaviour-based nurtures triggered by content consumption.

- 3.

Ads: vertical-specific creative informed by account insights.

8. Intent Data Becomes a Core Signal, Not a Nice-to-Have

As budgets tighten, teams will rely heavily on intent to focus resources on high-probability revenue. Intent will act as the “starting gun” that triggers coordinated sales and marketing actions.

Three types of intent

1st-party: your website/product.

2nd-party: partner content properties.

3rd-party: research happening across the web.

Simple intent playbook

A strong intent engine doesn’t need to be complicated, it just needs to be consistent, timely, and routed correctly. In 2026, the fastest-growing revenue teams will treat intent not as a “nice-to-have signal,” but as the backbone of how pipeline is created and prioritised.

Thresholds that matter: you’ve heard it before, but not all intent is equal. Here are some good thresholds for you to track:

Pricing page visits (strong bottom-funnel intent)

Repeated consumption of key topics (e.g., “lead scoring,” “website tracking,” “buyer intent��”)

Surge score spikes (sharp increases in research activity across the web)

Return visits to high-value content (guides, benchmark reports, comparison pages)

If you want a deeper, step-by-step framework for spotting which high-intent signals are worth acting on, the Dealfront playbook High-Intent Lead Conversion is the best companion and it will teach you how to capture, prioritise, and convert high-intent leads efficiently.

What “surge score” actually means: a surge score measures the increase in research activity around specific topics that indicate buying intent. When a company suddenly consumes more content, visits key pages, or shows repeated interest in your solution area, the score “surges.” This surge helps you spot who is heating up right now, even if they haven’t engaged with you directly yet.

Dealfront surfaces these signals through EU-compliant tracking, website visits, and topic-level intent, making it easier to spot high-intent accounts early and act before competitors.

Routing rules (the system every team should use)

Here’s a simple but effective routing model:

High intent → SDR within 24-48 hours (speed matters more than perfection at this stage)

Medium intent → personalised nurture sequence (education, problem framing, proof points)

Low intent → light awareness (brand touches, thought leadership, no hard asks)

The golden rule: Reference the problem space, not creepy user-level behaviour! Instead of, “we saw you clicked X,” use “Teams often struggle with Y… here’s how others solve it.”

Example: From surge → meeting in 7 days

Here’s a clean, repeatable, high-impact workflow:

Day 0 - Surge detected An account spikes in topic consumption or pricing/product interest.

Day 1-2 - Email + retargeting Send a value-first email + launch tailored retargeting based on the problem area (e.g., “lead qualification inefficiency”).

Day 3-4 - SDR outreach SDR references the challenge, not the behaviour. For example: “Many teams are struggling to qualify inbound traffic faster, want to benchmark how you compare?”

Day 5-7 - Value-led meeting Offer something with intrinsic worth:

short audit

mini benchmark

data-backed insights

a quick “what’s working in your segment” review

This 7-day workflow aligns perfectly with our High-Intent Conversion Playbook and is one of the fastest ways to turn intent spikes into pipeline.

Compliance matters (especially in Europe)

Dealfront offers fully GDPR-compliant intent data and web visitor intelligence, which is critical for EMEA-focused demand gen.

9. Revenue Accountability & Full-Funnel Measurement

Demand gen is now judged on revenue contribution, not activity volume. The teams that will lead in 2026 will operate as one revenue engine, aligning sales and marketing around the same high-intent accounts, the same data, and the same definitions of success. When both sides share real-time buyer signals, collaborate on the same Target Account List, and measure the funnel with unified metrics, deal cycles shorten and conversion rates rise.

This is the foundation of aligning sales & marketing for shared success:

Empower both teams to focus on the same high-intent accounts and accelerate deal cycles through seamless collaboration.

Share real-time intent signals and priority account lists across sales and marketing.

Sync all lead, account, and engagement data directly into the CRM for smooth handovers and consistent follow-up.

Enable a frictionless workflow across teams so high-potential prospects move faster through the funnel.

Core 2026 KPIs

Pipeline sourced and influenced

MQL → SQL → Opp → Close rates

CAC & payback

LTV:CAC

Simple full-funnel dashboard

Top: traffic and engagement

Middle: leads, MQAs, nurtures, meetings

Bottom: pipeline, revenue, velocity, win rate

Dealfront can feed account-level intent, plus engagement data, into CRM/BI tools for a unified funnel view.

10. Ethics, Trust & Compliance as Strategic Advantages

With GDPR expansions, AI regulation, and cookie deprecation accelerating, trust is no longer optional. In 2026, teams that earn and protect trust will gain a measurable performance edge in deliverability, engagement, and brand preference.

Trust-first program components

Clear consent

Honest subject lines

Preference centres

Data residency considerations

Transparent value exchange

Why trust improves performance

Better deliverability

Higher engagement

Stronger brand equity

Dealfront’s Europe-first compliance framework ensures marketers run high-impact demand gen without privacy risks.

How To Turn 2026 Demand Gen Trends Into a Practical Strategy

Building a modern demand generation strategy in 2026 will require more than following trends, it’ll be about assessing where you are, prioritising the moves that matter, and executing with clear measurement and alignment. Here’s how to translate trends into actionable, revenue-focused steps.

Step 1 – Assess Your Current Demand Gen Maturity

Before you implement new tactics, it’s critical to understand where your team stands. Most organisations fall somewhere on a spectrum of maturity. At the earliest stage, teams are channel-focused, running basic email and ad campaigns with no unified reporting. As they progress, some automation is introduced, lead scoring begins, and small ABM tests may exist, but efforts remain largely siloed.

More advanced teams run integrated campaigns, leverage early intent and ABM signals, and track full-funnel metrics to guide decisions. The most mature organisations in 2026 are using AI-assisted orchestration, have tight alignment with sales, and are fully revenue-focused, relying on data to optimise every step of the demand generation process.

A quick self-assessment can help identify gaps and priorities. Consider asking yourself:

Do we use intent data in routing?

Do we share a TAL with sales?

Do we have agreed lead/account stages?

Are we measuring pipeline, not just leads?

Is AI present in scoring or experimentation?

Are regional compliance workflows documented?

Step 2 – Prioritise 3-4 Trends Based on Your Stage

Once you understand your current maturity, the next step is prioritisation. Not every trend needs to be implemented at once; focus on the few that will deliver the fastest, most measurable impact. For lean teams with smaller budgets, the priority should be high-value content and SEO, basic intent signals, simple ABM approaches, and lightweight personalisation.

Growth-stage companies under pipeline pressure should emphasise full-funnel measurement, AI-assisted lead scoring, and multi-channel journeys that guide buyers across touchpoints. Enterprise organisations with complex stacks should focus on ABM as a revenue strategy, advanced personalisation, high-value regional events, and robust governance and compliance frameworks.

The guiding principle is simple: choose the 3-4 trends that will move your key metrics most effectively, rather than trying to chase all 10.

Step 3 – Build a 90-Day Full-Funnel Experiment Plan

With priorities set, design a short, focused experiment plan to put them into action. Start by selecting one ICP and one core offer, then map a set of TOFU, MOFU, and BOFU tactics aligned with the chosen trends. For TOFU, consider testing a vertical-specific landing page, running paid search experiments, or offering ungated guides to capture early engagement.

MOFU activities can include webinars, retargeting campaigns, and nurture sequences that guide interested leads further down the funnel. BOFU initiatives should focus on conversion: POC offers, SDR outreach referencing intent signals, or ROI calculators tailored to account insights.

Set clear baseline metrics and define uplift targets, for example, aiming for a 15% increase in MQL→SQL conversion, to measure the success of your experiment and guide iterations.

Step 4 – Align With Sales & Customer Success

Pipeline ownership is now a shared responsibility, and alignment across marketing, sales, and customer success is critical. Define clear stages from MQL through MQA, SAL, SQL, Opportunity, and Closed Won, and set SLAs to ensure timely follow-up; for instance, SDRs should contact high-intent prospects within 24 hours.

Establish regular TAL reviews, ideally quarterly, to ensure both teams are aligned on target accounts, and create feedback loops where sales provides qualitative insights on lead quality and marketing adjusts campaigns accordingly. Using a shared account view, such as combining Dealfront’s intent and account intelligence with your CRM, allows both teams to see the same signals, making multi-threaded engagement seamless and measurable.

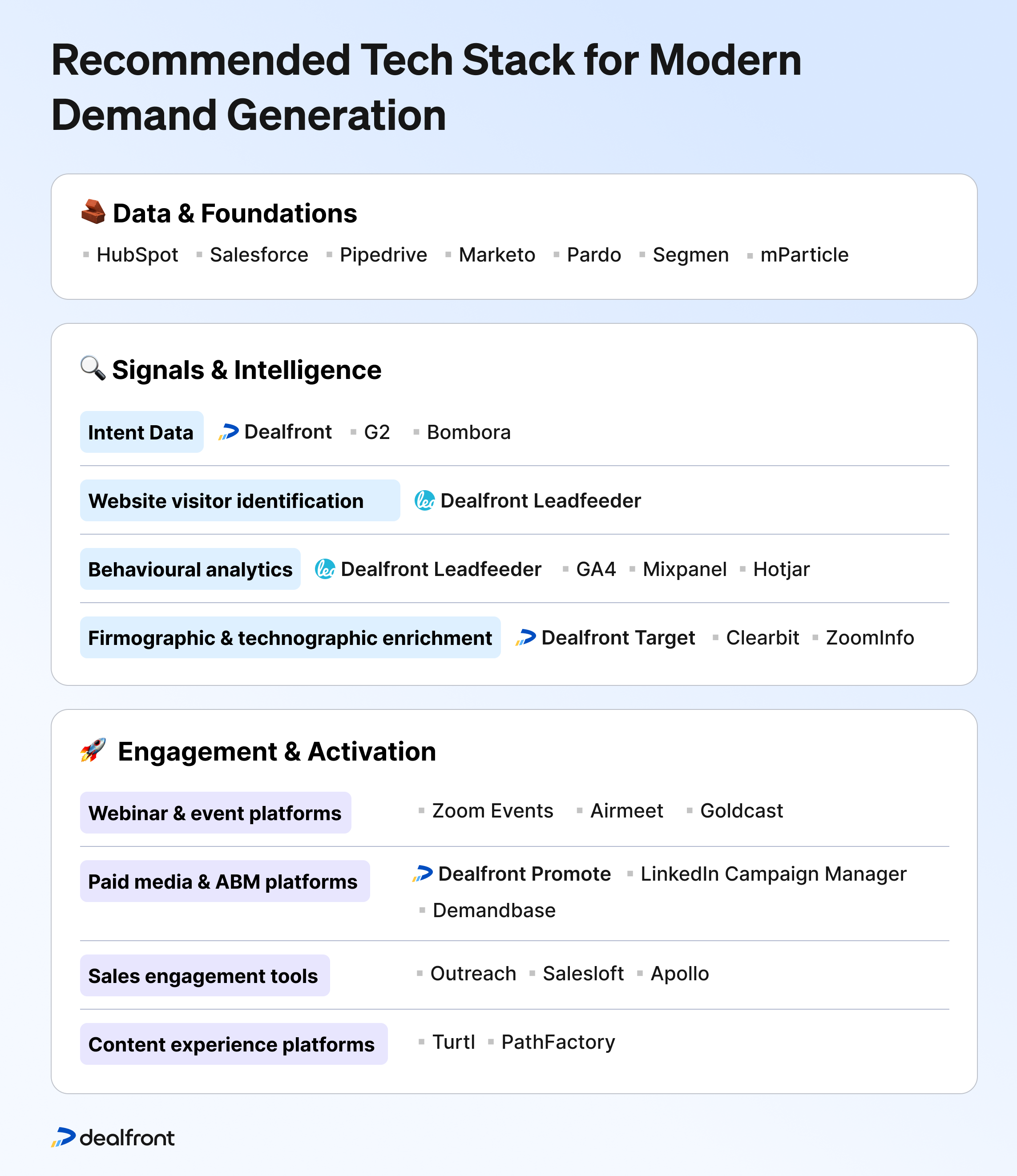

Recommended Tech Stack for Modern Demand Generation

Data & Foundations

A modern demand generation engine starts with clean, reliable data. At the core sits your CRM (think: HubSpot, Salesforce, Pipedrive, etc), acting as the system of record for accounts, contacts, and pipeline. This is supported by a marketing automation platform (e.g. HubSpot, Marketo, Pardot) to run journeys, scoring, and nurture flows.

Some organisations layer on a Customer Data Platform (CDP) like Segment or mParticle if they need deeper unification across web, product, and offline touchpoints, but this is optional, not mandatory. What is essential is data hygiene: standardised fields, correct regional workflows, and enrichment processes that ensure downstream AI, scoring models, and personalisation actually work.

Signals & Intelligence

Once the foundation is stable, the next layer is intelligence, the fuel for prioritisation and personalisation. This includes:

Intent data (Dealfront Intent, G2, Bombora)

Website visitor identification (Dealfront Leadfeeder)

Behavioural analytics (Dealfront Leadfeeder, GA4, Mixpanel, Hotjar)

Firmographic & technographic enrichment (Dealfront Target, Clearbit, ZoomInfo)

Dealfront is especially strong for companies selling into Europe, providing GDPR-compliant intent data, website visitor intelligence, account insights, and high-quality European firmographics, all in a single platform. These signals help teams identify who is researching their category, which accounts are warming up, and where to focus next.

Engagement & Activation

With insights in place, the next step is activating them through modern go-to-market tools. This layer typically includes:

Webinar & event platforms (Zoom Events, Airmeet, Goldcast)

Paid media & ABM platforms (Dealfront Promote, LinkedIn Campaign Manager, Demandbase)

Sales engagement tools (Outreach, Salesloft, Apollo)

Content experience platforms (Turtl, PathFactory)

This is where data comes to life, powering personalised outreach, orchestrated multi-channel journeys, dynamic website content, and account-specific ad campaigns.

Governance, Privacy & Compliance

A modern demand engine must meet increasing privacy and regulatory expectations, especially in Europe. This includes consent management systems (OneTrust, Usercentrics), access controls, regional data workflows, and documented retention policies. Dealfront’s infrastructure is built around European compliance from the ground up, making it easier for teams to manage data responsibly while staying aligned with GDPR and regional privacy laws.

Best B2B Demand Generation Platforms in 2026 (At a Glance)

Strategy sets the direction; platforms power the execution. Below is a high-level view of the major categories shaping modern demand engines, and where each type of platform fits.

Dealfront – Best for Europe-Centric, Sales-Aligned B2B Demand Gen

Strengths: deep European data, web visitor identification, GDPR-compliant intent, sales-ready insights

Ideal for: companies targeting European markets or expanding into Northern America

Value: shared account visibility for ABM, intent playbooks, and outbound activation

Platform 2 – ABM & Intent Orchestration at Enterprise Scale

Designed for global enterprises with complex buying groups. These platforms excel in coordinating multi-channel ABM, buyer journey analytics, and precision targeting. They are powerful but require mature RevOps to realise full value.

Platform 3 – Webinar & Digital Event-Led Demand Gen

Well-suited for content-driven pipelines built through webinars, summits, and digital experiences. Strong event analytics and attendee insights, though often reliant on external ABM/intent tools for full funnel visibility.

Platform 4 – SMB-Friendly All-in-One Demand Gen Suite

A good fit for smaller teams needing email, landing pages, automation, and lightweight CRM capabilities in one place. Great for simplicity, but lacks the depth of specialist data and intent platforms like Dealfront.

Common Mistakes in 2026 Demand Generation (And How to Avoid Them)

1. Chasing Trends Without a Strategy

Many teams jump on the latest channel, tool, or tactic simply because it’s popular, only to find it drains the budget without moving the pipeline. Trend-chasing creates scattered activity rather than meaningful momentum. The antidote is discipline: start with a clear maturity assessment, define what “good” looks like for your organisation, and build a focused 90-day plan that prioritises a small number of high-impact initiatives.

2. Over-Gating and Killing Awareness

Heavy gating used to work; in 2026, it often does the opposite. When every asset sits behind a form, awareness suffers, discovery drops, and potential buyers disengage. The stronger approach is to offer a thoughtful mix of ungated educational content to build reach and trust, paired with gated, high-intent assets that capture demand when prospects are ready.

3. Misusing AI and Damaging Trust

AI is now embedded in nearly every workflow, but misusing it still creates real risks. Low-quality AI copy, hallucinated claims, and “personalisation” that clearly isn’t personal can quickly erode brand credibility. Instead of delegating everything to automation, use AI as an accelerant (augmenting research, ideation, and execution), while ensuring human oversight shapes the quality, accuracy, and tone of everything that goes out the door.

4. Treating ABM as Just an Ad Campaign

Too many “ABM programmes” are really just display ads with a target account list pasted on top. True ABM requires deeper alignment: shared target account lists, cross-functional planning with sales, coordinated plays across channels, and a commitment to account-level metrics rather than vanity numbers.

Real-World Examples & Benchmarks

Real-world examples help translate theory into practical insight. Below are two scenarios that represent the kinds of results B2B teams are seeing as they modernise their demand engines in 2026. While every organisation is different, these cases illustrate how the right combination of data, execution, and alignment can create measurable improvements in pipeline performance.

Example 1 – AI + Intent Improves MQL→SQL by 20%

A mid-market SaaS company implemented a combined approach: AI-based lead scoring layered on top of Dealfront’s GDPR-compliant intent signals. By enriching inbound leads with behavioural and firmographic context, they were able to route prospects more intelligently and surface genuine buying signals earlier in the cycle. SDRs shifted their efforts toward accounts already demonstrating active interest, reducing time wasted on low-fit leads. As a result, MQL-to-SQL conversion rose by 20% within the first 90 days, purely by improving prioritisation and operational efficiency.

Example 2 – In-Person Events Shorten Sales Cycles

A cybersecurity vendor found that digital-only engagement wasn’t accelerating deals fast enough. They introduced a quarterly calendar of small, curated VIP roundtables designed to bring senior decision-makers into direct conversation with sales and product experts. These intimate, high-value events helped prospects validate concerns faster and build trust earlier in the process. Within two quarters, the company saw its average sales cycle fall from 148 to 112 days, and win rates rise by 9%. The shift demonstrated that in-person experiences, when targeted and purposeful, can materially speed up enterprise buying decisions.

2026 Benchmark Ranges

Industry benchmarks vary, but the following ranges capture what most high-performing B2B teams are achieving across the funnel in 2025. These can be used as a health check or as directional targets when setting quarterly goals.

Webinar registration → attendee: 35-50%

MQL → SQL (inbound): 20-40%

MQL → SQL (outbound): 10-25%

SQL → Opportunity: 25-50%

These benchmarks aren’t strict KPIs, but they offer a helpful baseline for diagnosing bottlenecks and understanding where to focus optimization efforts, whether in content, scoring, handoffs, or sales enablement.

Conclusion: Build a Demand Engine That Outlives Any Single Trend

The trends shaping 2026 are important, but they’re not the end goal. They are signals, early indicators of where the market is heading and where competitive advantage will be found. The real objective is to build a durable, adaptable demand engine that performs consistently regardless of shifting channels, algorithms, or market noise.

Instead of trying to adopt every new tactic, choose a small number of trends that directly support your go-to-market model and invest in them with clarity and focus.

Your next steps should be practical and deliberate:

- 1.

Assess your maturity across data, content, channels, insights, and alignment.

- 2.

Select the 3-4 trends that best support your growth model and audience.

- 3.

Build a 90-day plan that spans awareness, capture, nurture, and activation.

- 4.

Deepen alignment with sales so both teams operate from shared account lists, shared metrics, and shared expectations.

- 5.

Support everything with the right tools, particularly high-quality, privacy-safe data sources like Dealfront that fuel precise targeting and prioritisation.

A strong demand engine isn’t defined by how many tools or tactics you use, but by how coherently everything works together. Start with an honest audit of your current programme, identify the two or three gaps that matter most, and invest in the platforms and processes that will close them for good.

FAQs About 20026 B2B Demand Generation Trends

What are the top B2B demand generation trends in 2026?

What are the top B2B demand generation trends in 2026?

The top trends are AI-powered, human-led workflows, ABM as a revenue strategy, multi-channel buyer journeys, hyper-targeted personalisation, intent-driven campaigns, intimate in-person events, and trust-first compliance. Tools like Dealfront help operationalise these trends with GDPR-compliant data and account-level intelligence.

How can AI improve demand generation in 2026?

How can AI improve demand generation in 2026?

AI improves demand gen by automating lead and account scoring, generating content variants, testing messaging at scale, and identifying high-value accounts using intent and firmographic signals. Teams that integrate AI into workflows can outperform peers 3–5x. Check Dealfront’s AI enrichment playbook to start automating lead scoring with compliant data.

What is a Target Account List (TAL) and why is it important for ABM?

What is a Target Account List (TAL) and why is it important for ABM?

A TAL is a curated set of high-value accounts aligned across marketing, sales, and customer success. Dynamic TALs update continuously with firmographic, engagement, and intent signals. Treating ABM as a revenue motion, not just campaigns, ensures better pipeline creation and engagement. Dealfront can refine TALs with verified European account intelligence.

How do multi-channel journeys work in modern B2B demand generation?

How do multi-channel journeys work in modern B2B demand generation?

Multi-channel journeys combine paid social, search, SEO/content, email, webinars/events, partner channels, and SDR outreach into connected sequences. These orchestrated touchpoints ensure consistency across the buyer journey. Tools like Leadfeeder and Dealfront Promote track engagement, enable retargeting, and measure attribution. See our Google Ads attribution playbook for guidance.

How can intent data improve B2B pipeline generation?

How can intent data improve B2B pipeline generation?

Intent data identifies which accounts are actively researching solutions, helping teams prioritise high-interest targets and tailor messaging. Surge scores highlight spikes in engagement, guiding timely SDR outreach. Dealfront provides GDPR-compliant European intent data to power ABM and high-intent conversion campaigns.

Why is compliance and trust crucial in B2B demand generation?

Why is compliance and trust crucial in B2B demand generation?

Compliance and trust improve engagement, deliverability, and brand reputation. Transparent consent, preference centres, honest messaging, and regional data governance protect marketers from legal risk. Platforms like Dealfront offer Europe-first compliance, enabling sophisticated demand gen without privacy issues.