How to Research Companies Before an Outbound Campaign

Expected results

Faster and more consistent account research across the team

More relevant outreach that leads to higher reply and meeting rates

Less wasted time on poor-fit accounts and unfocused personalization

Before launching any campaign, one question matters more than any other: Do we actually understand the companies we’re about to target?

In B2B marketing, campaigns fail far more often because of weak research than weak execution. Messages miss the mark, personalization feels superficial, and teams end up targeting accounts that were never a real fit to begin with.

This Playbook is designed to fix that.

If you read this guide, you will learn exactly how to research a company before a campaign, what information to look for, where to find it, and how to do it quickly and consistently without jumping between dozens of tools.

You’ll learn a clear, repeatable research workflow that helps you:

Decide whether a company belongs in your campaign at all

Understand its business context, priorities, and growth signals

Identify the right roles and decision-makers to target

Create more relevant messaging before you launch

This isn’t about over-researching or spending hours digging through LinkedIn and Google. It’s about using a structured, complete approach to account research that gives marketing teams the confidence to launch campaigns with the right accounts, the right context, and the right assumptions.

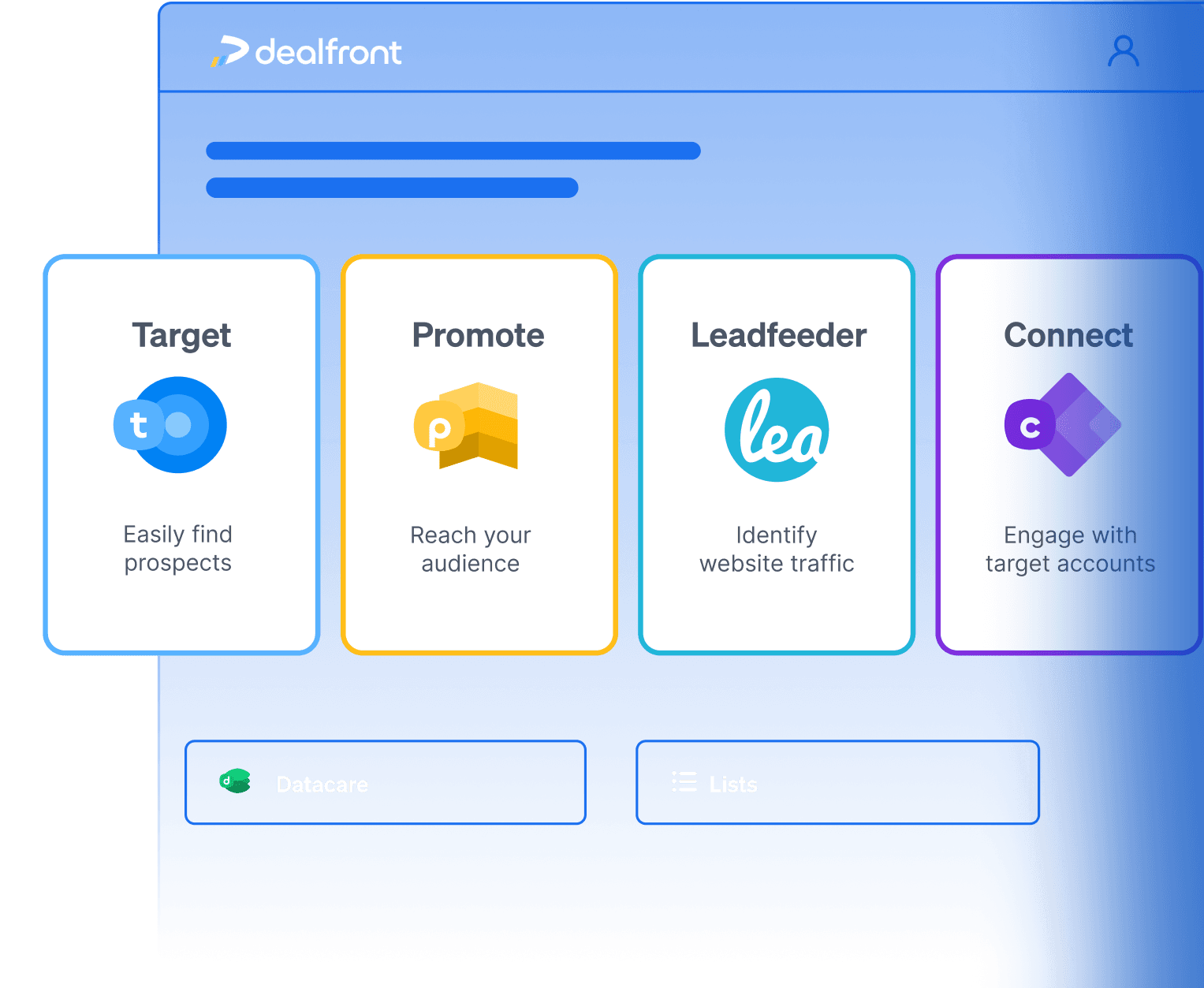

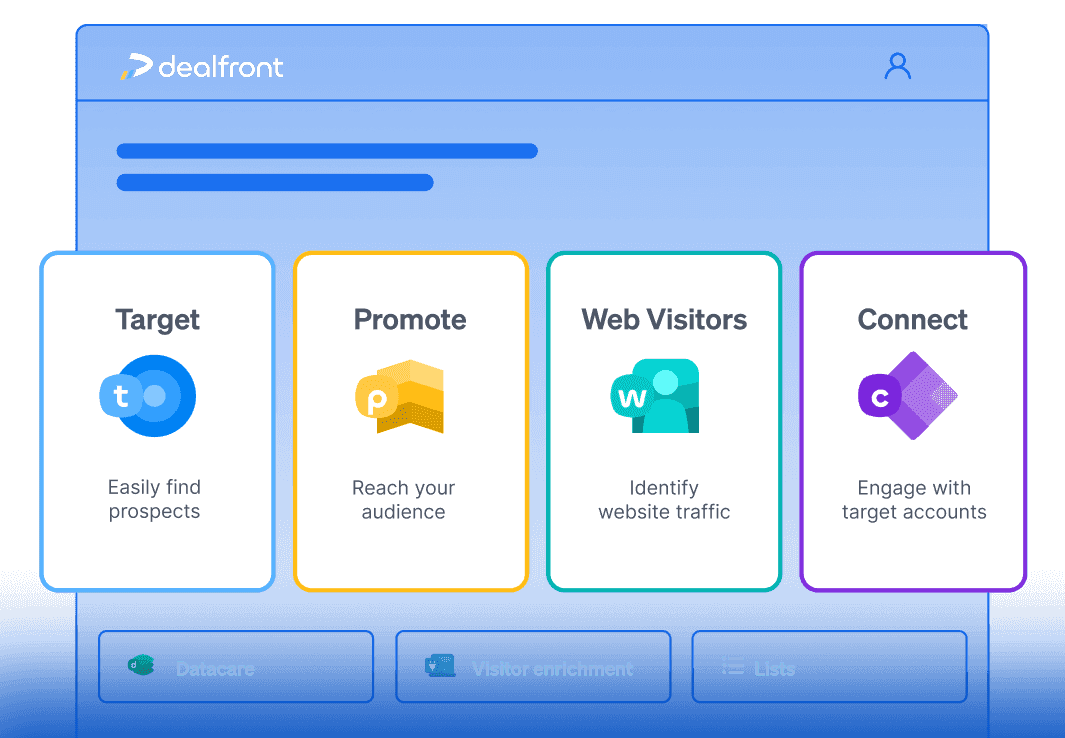

Dealfront plays a central role in this process by bringing company data, contact information, and real buying signals into one place. Instead of stitching together fragments from multiple sources, you can research each target account thoroughly and consistently — and then move straight into campaign planning.

By the end of this Playbook, you’ll have a practical framework you can use to research any company before a campaign, whether you’re building an ABM program, refining a target list, or preparing a new outbound or inbound initiative.

Prerequisites for making 10-minute research work

Before diving into the step-by-step workflow, it helps to set clear expectations.

You don’t need perfect information, and you don’t need a long checklist. You need a complete, practical snapshot that gives you confidence to include a company in a campaign and know how to approach it.

After about ten minutes of structured research, you should have clarity on the following areas.

Company fit and context

You understand what the company does, where it operates, and whether it fits your ICP well enough to target. This includes:

Industry and core business model

Company size and primary geography

Whether the company looks stable, growing, or changing

Signals and momentum

You can see whether there are signs that the company is active or potentially in a buying or evaluation phase, such as:

Hiring trends or funding activity

Recent website engagement or other relevant signals

Any changes that suggest new priorities or challenges

Technology and environment

You have a basic view of the tools, platforms, or technologies that matter for your product and messaging. You don’t need a full tech audit — just enough context to avoid irrelevant outreach.

Likely priorities and angles

Based on what you’ve seen, you can form a few reasonable assumptions about:

Two or three likely pains, goals, or opportunities

Where your campaign message might be relevant

What not to lead with

The right people to target

You’ve identified a small set of relevant contacts, typically:

Three to seven people

Across the most relevant departments and seniority levels

This is enough to plan targeting and messaging without overcomplicating things.

The key is consistency. A clear, repeatable account snapshot that every marketer or rep can create is far more valuable than occasional deep dives that slow campaigns down.

Think of the output as a one-page mental brief, not a document, not a report, but a shared understanding you can act on immediately.

With that foundation in place, the next sections walk you through exactly how to gather this information quickly and reliably using Dealfront.

4 Steps for Successfully Researching Companies Before a Campaign

Step 1: Confirm ICP fit and tier the account (2–3 minutes)

The first step of account research is not research at all. It is a decision. Is this account worth investing time in?

Open the account in Dealfront or discover it through saved searches and lists.

Check core ICP signals

In under two minutes, confirm:

Industry alignment.

Company size.

Geography.

Any obvious mismatches such as unsupported markets or segments.

This alone will eliminate a surprising number of accounts.

Add signal-based context

Look for simple signals such as:

Recent website activity.

Hiring trends.

Growth indicators.

Engagement patterns.

You are not analyzing deeply yet. You are scanning for relevance.

Assign a simple tier

Use a lightweight tiering model in Dealfront:

Tier 1: strong fit and strong signals.

Tier 2: strong fit but neutral or unclear signals.

Tier 3: moderate fit with strong signals.

This tier determines how much effort you put in next. Tier 1 accounts deserve the full ten minutes. Tier 2 may get a slightly lighter version. Tier 3 may be monitored rather than actively pursued.

This quick triage prevents wasted effort and keeps research focused.

Step 2: Build a 360 degree company snapshot (4–5 minutes)

Once an account passes the fit check, use the bulk of your time to understand the company itself.

Basic profile (about 2 minutes)

In Dealfront, confirm:

Industry and sub-industry.

Company size and employee range.

Headquarters and operating regions.

Ownership type if relevant.

Look for growth markers such as:

Headcount growth.

Expansion into new regions.

Funding events.

You are building context, not writing notes.

Bonus: Use Dealfront AI insights to quickly summarize what’s happening at the account and highlight relevant signals. From there, form two or three hypotheses and tailor outreach by tier: deeper personalization for Tier 1, lighter for Tier 2, and mostly segment-based for Tier 3.

Strategic direction (about 2 minutes)

Visit the company website directly from Dealfront:

Homepage to understand positioning.

Product or solutions pages to see focus areas.

Careers page to spot hiring themes.

Capture two or three strategic themes such as:

Focus on expansion.

Push toward automation.

Emphasis on enterprise customers.

Investment in a new product line.

These themes will later become outreach angles.

Competitive and tech context (about 1 minute)

Use Dealfront AI company insights to:

Identify similar or related companies.

Spot competitors if visible.

Note key technologies that are relevant to your offering.

You do not need a full tech audit. One or two meaningful data points are enough.

At the end of this step, you should be able to describe the company in two sentences without sounding vague.

Step 3: Map buyers and influencers (2–3 minutes)

Account research is incomplete until you know who matters inside the company.

Using Dealfront’s contact data, filter by:

Department.

Seniority.

Location or language where relevant.

Select priority contacts

Aim for three to seven people depending on account size:

One or two potential decision makers.

One or two likely champions.

One or two users or influencers.

Even if you are not sure, an educated guess is enough.

Assign simple roles

Label contacts mentally or in the CRM as:

Economic buyer

Champion

User

Technical evaluator

Influencer

This role-based thinking helps structure outreach and multi-threading later.

Sync or save these contacts into your CRM so the work is reusable. The goal is to research once and benefit multiple times.

Step 4: Turn insights into outreach angles and talk tracks (2–3 minutes)

This is where research becomes useful.

Take what you have learned and form two or three reasonable hypotheses about the account.

For example:

Rapid hiring in sales combined with pricing page visits may suggest scaling challenges.

Expansion into new regions may indicate operational complexity.

A specific tech stack may hint at integration needs.

You are not claiming certainty. You are forming informed starting points.

Tier-based personalization

Use different levels of personalization based on the tier:

Tier 1: multiple account-specific references such as signals, tech, and region.

Tier 2: one specific insight plus one industry-level point.

Tier 3: mostly segment-based messaging with light personalization.

Apply insights to outreach

For email:

Open with a relevant observation.

Tie it to a likely challenge or goal.

Offer a clear reason to talk.

For calls or meetings:

Prepare five to ten discovery questions grounded in what you saw.

Reference company context naturally rather than listing facts.

This step ensures research directly improves messaging rather than living in notes.

Making the 10-Minute Workflow Stick in Your Team

A good workflow only matters if it becomes a habit.

Define who does what and when

Typical patterns:

SDRs run the ten-minute workflow before enrolling Tier 1 and Tier 2 accounts into sequences.

AEs refresh the snapshot before first meetings and major deal milestones.

Account managers review signals before renewals or QBRs.

Create lightweight variants

You may end up with:

A quick SDR version.

A deeper AE version.

A monitoring version for account management.

The structure stays the same, only the depth changes.

Embed Dealfront into daily tools

Practical ways to do this:

Add Dealfront in CRM account records.

Include “Open Dealfront” as a step in sales engagement tasks.

Keep templates or checklists in a shared workspace.

Light documentation such as a one-page SOP helps new reps ramp faster without overcomplicating things.

Marketing and RevOps often play a supporting role by managing segments, saved searches, and field mappings.

Keep Account Research Always On with Signals

The ten-minute snapshot is not a one-time event. Accounts change. Dealfront helps keep research current by surfacing signals such as:

Funding announcements.

Leadership changes.

Hiring surges.

Technology changes.

Website engagement spikes.

Turn signals into actions

Examples:

Funding event triggers a strategic outreach focused on growth.

New senior hire triggers a re-introduction email.

Website spike triggers rapid SDR follow-up referencing viewed pages.

Set up alerts by segment or territory so reps do not need to constantly check manually. Log important signal-driven touches in the CRM so impact can be measured later. This turns account research into an ongoing advantage rather than a static task.

Measuring the impact of your account research process

To justify the time investment, measure outcomes.

Metrics to track

At the top of the funnel:

Reply rates.

Meeting booking rates.

Account engagement.

In the pipeline:

Stage conversion rates.

Win rates.

Sales cycle length.

Deal size.

Compare Tier 1 accounts to Tier 2 and Tier 3.

Simple instrumentation

Tag accounts where the account brief was completed. Compare performance against accounts without structured research. Over time, remove fields that reps never use and double down on signals that correlate with better outcomes. This keeps the workflow lean and effective.

Steal our free template: The 10-minute account research brief

To make this workflow easy to adopt, we’ve created a simple 10-Minute Account Research Brief you can copy and use with your team. The goal of this template is not deep research. It’s consistency, speed, and focus. If a rep can complete this brief, they’re ready to reach out or walk into a meeting with confidence.

1. Account Fit & Priority

ICP Tier (Tier 1 / Tier 2 / Tier 3)

Industry

Company size

Geography

Why this account is worth pursuing now

2. Company Snapshot

What the company does (one sentence)

Growth indicators (hiring, funding, expansion)

Key strategic themes observed on the website

3. Signals & Activity

Recent website activity or engagement

Notable changes (funding, leadership, hiring)

Why these signals matter for outreach

4. Key Contacts

3–7 priority contacts

Role in buying process (decision-maker, champion, user)

Department and seniority

5. Hypotheses & Angles

2–3 educated guesses about current priorities or challenges

How your product or message could be relevant

6. Outreach Prep

Suggested email opener or call angle

One question to validate assumptions on the first touch

How to use it

SDRs complete it before enrolling Tier 1–2 accounts into sequences

AEs refresh it before first meetings or key deal stages

Marketing uses it as a shared standard for “qualified research”

Most teams find this brief takes 5–10 minutes once Dealfront is part of the workflow.

Value: This template eliminates guesswork, reduces prep time, and ensures every account is researched to the same standard using real data, not assumptions.

What’s next

Effective account research does not require hours of work. It requires structure, focus, and the right data in one place.

A ten-minute workflow built around Dealfront helps marketing and sales teams:

Personalize at scale.

Focus effort where it matters.

Build confidence going into outreach and meetings.

Reduce noise and wasted time.

Your next step is practical. Define what “good enough” research looks like for your team. Configure Dealfront and your CRM so data is easy to access. Pilot the workflow with a small group of reps for 60 to 90 days and refine from there. Consistency beats perfection. And ten focused minutes can make a meaningful difference.

Turn insights into action

Ready to grow your pipeline?

GDPR Compliant

Built & Hosted in EU

Deep B2B Data