How to Leverage Intent Data to Generate Pipeline

Expected results

Implement a structured process for using intent data in ABM campaigns

Prioritize high-intent accounts more effectively for sales outreach

Align marketing & sales teams to maximize engagement and pipeline velocity

Intent data is transforming the way sales and marketing teams identify, engage, and convert prospects.

By analyzing signals that indicate buying intent, businesses can focus their efforts on the most promising opportunities, ensuring that outreach is both timely and relevant. However, effectively leveraging intent data requires a clear understanding of its different types, potential challenges, and best practices for integration into Account-Based Marketing (ABM) programs.

This is our first Partner-Play, built in collaboration with FullFunnel.io, one of our valued customers. Every insight, strategy, and outcome shared here is based on their real-world experience using our platform to drive revenue. Their expertise and success in leveraging intent data inform this play, providing a tested framework for optimizing ABM strategies.

In this Play, we’ll explore:

The different types of intent data: first-party vs. third-party

Common challenges in using intent data effectively

How to use intent data in ABM programs to maximize pipeline generation

By the end of this Play, you’ll be able to:

Select and prioritize target accounts based on intent insights

Execute timely, personalized outreach that resonates with buyers at the right moment

Identify & segment intent data accounts

Effectively using intent data starts with identifying the right accounts to target. By analyzing key intent signals, you can prioritize prospects who are actively researching solutions like yours. This process involves defining intent data sources, categorizing accounts based on their engagement, and aligning sales and marketing efforts to drive meaningful conversations.

Step 1: Define key sources of intent data

To identify high-intent accounts, start by tracking intent signals from multiple sources. At FullFunnel.io, they use:

Leadfeeder to pinpoint companies visiting their website.

LinkedIn engagement data to track interactions with posts, company updates, and industry discussions.

Aligned intent tracking to capture demand signals and monitor engagement with bottom-of-funnel content.

Keyword tracking to identify prospects searching for relevant terms like “ABM agency” or “ABM consultant.”

By combining these data points, you can build a clear picture of which accounts are showing buying intent and should be prioritized for outreach.

Building a strong foundation with ICP

Before using intent data for account selection, it’s really important to have a clear Ideal Customer Profile (ICP) as a foundation. Your ICP helps define the characteristics of companies that are most likely to benefit from your solution, ensuring that you focus on accounts that fit your business objectives.

If you haven’t yet defined your ICP, check out our play on creating an Ideal Customer Profile.

Step 2: Identifying & segmenting intent data accounts

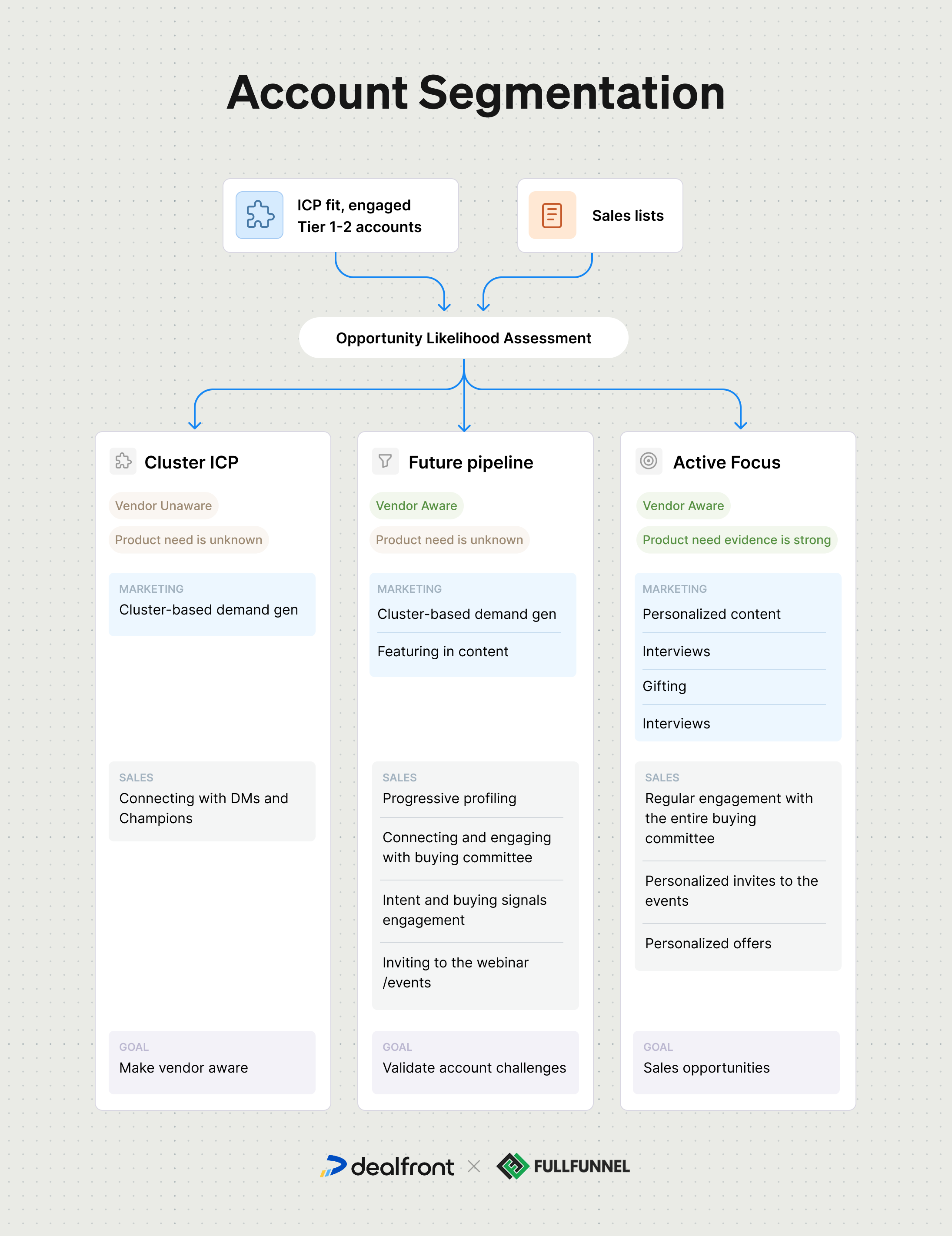

Once intent signals are identified, the next step is to qualify accounts based on predefined criteria. At FullFunnel.io, their marketing team filters all new accounts through an account qualification framework and assigns them to one of three tiers based on their engagement levels and awareness of your brand. Traditional account-based marketing (ABM) models categorize accounts into Tier 1, Tier 2, and Tier 3, but you can also take a more nuanced approach by dividing accounts into three distinct lists:

Cluster ICP: These are companies that match your ICP but have little to no awareness of your brand, and their specific needs or challenges are unknown. The key goal at this stage is to create vendor awareness first. Since they aren’t actively looking for a solution, outreach should be broad - think high-level brand awareness campaigns rather than direct sales engagement.

Future pipeline: These accounts hit your engagement threshold (e.g., spent 10 minutes on your high-intent pages three times). They are aware of your brand and have engaged in some way, but their exact pain points remain unclear. Because they are more likely to respond, they are strong candidates for nurturing campaigns designed to uncover specific challenges and tailor future outreach. These are the accounts that the sales team should invest time for in-depth account research, buying committee mapping and engagement.

Active focus: These accounts not only fit the ICP but also demonstrate clear buying signals. They have engaged significantly with content, product pages, or sales materials, indicating both a need for your solution and strong revenue potential. Additionally, you have a relationship with the buying committee, making these high-priority accounts where sales teams should focus their efforts to drive opportunities. Learn more about how to select and prioritize accounts here.

To effectively identify and segment accounts, use both first-party and third-party intent data. First-party data includes website visits, form fills, and webinar engagement, direct signals that a prospect is exploring your offering. Dealfront allows you to track these behaviors in real-time, helping you gauge intent and interest levels. Meanwhile, third-party data sources such as G2 signals, job postings, and funding events provide external indicators that a company is actively researching solutions in your category.

With the right intent data strategy, segmentation becomes more than just a static list, it evolves dynamically based on real-time engagement. By continuously monitoring these signals and mapping them to the appropriate list (cluster ICP, future pipeline, or active focus), you can ensure that your sales and marketing teams are targeting the right accounts with the right approach.

Finally, for ‘active focus’ accounts, the goal is to generate sales opportunities. These accounts have demonstrated a strong interest in your solution and have been actively engaging with your brand. By integrating intent data with your CRM, you can track ongoing engagement, uncover warm leads, and prioritize your outreach.

By segmenting accounts in this way and using both first-party and third-party intent data, your team can move beyond generic outreach and create more precise, effective account-based marketing strategies.

How to build a segmented account list

To build a segmented account list effectively, use Leadfeeder by Dealfront to track and analyze website visitor behavior, identify which companies engage with your content and how deeply they interact. By integrating Leadfeeder with your CRM, you can automatically categorize accounts into the ‘cluster ICP’, ‘future pipeline’, and ‘active focus’ lists based on real-time intent signals.

Companies that visit key pages, such as pricing or product details, will be flagged as ‘active focus’ accounts, indicating strong buying intent and warranting immediate sales outreach. Those engaging with blog content or early-stage resources will be classified as ‘future pipeline’, signaling potential interest but requiring further nurturing.

Leadfeeder can also help identify completely new accounts that fit your ICP but have minimal interaction so far, allowing you to add these prospects to your ‘cluster ICP’ list, ready for brand awareness campaigns. By continuously monitoring these behaviors and refining segmentation, you can ensure that your outreach efforts are always aligned with real-time interest levels, maximizing efficiency and conversion rates.

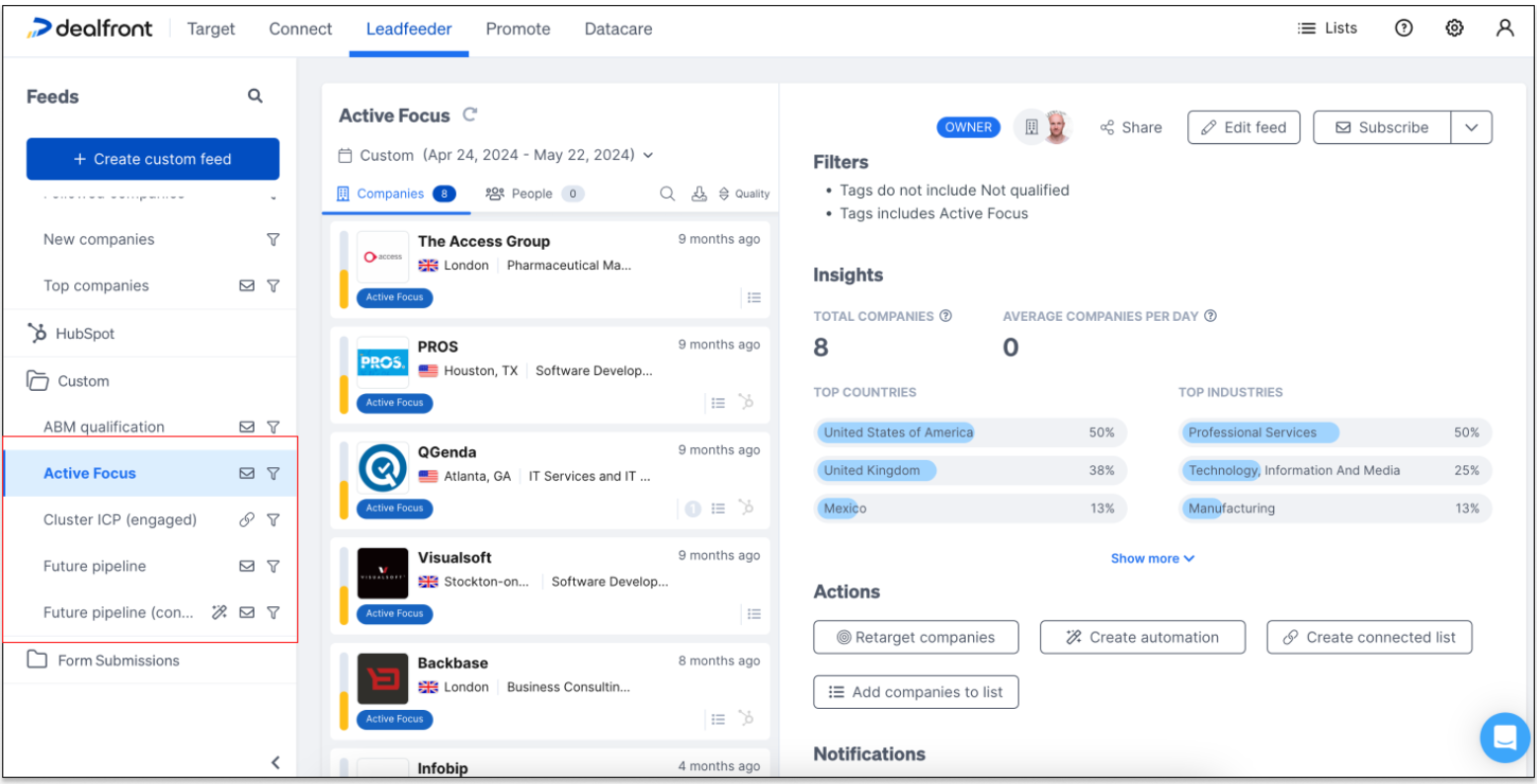

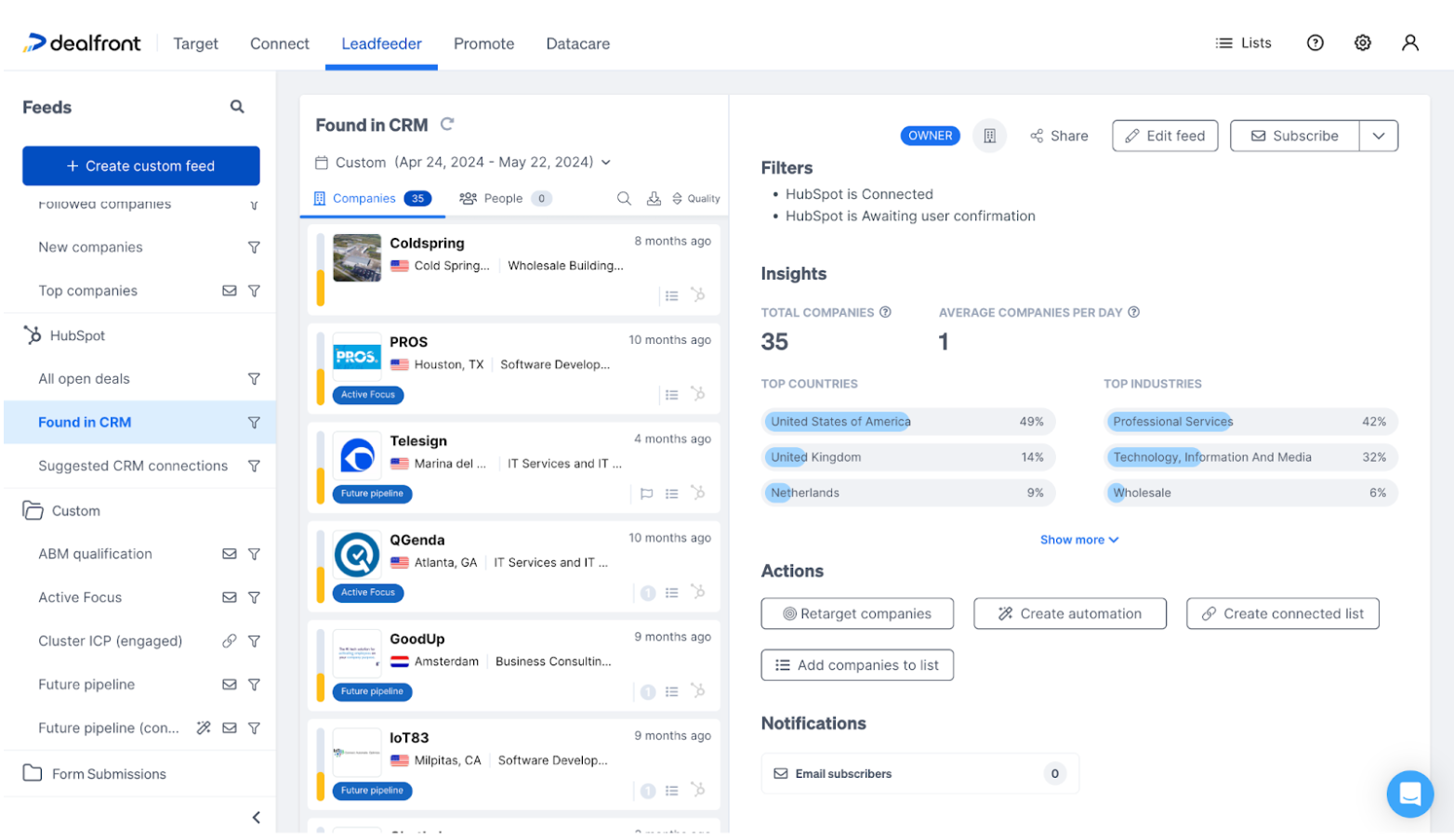

Creating custom feeds

You can create a custom feed in Leadfeeder for each of the above segments by setting filters for factors like website visits, engagement quality, and firmographics. Doing this enables you to build tailored feeds for ‘cluster ICP’, ‘future pipeline’, and ‘active focus’ categories, allowing you to track and prioritize accounts in real time. You can also filter for your ICP with our custom feed filters, as shown below:

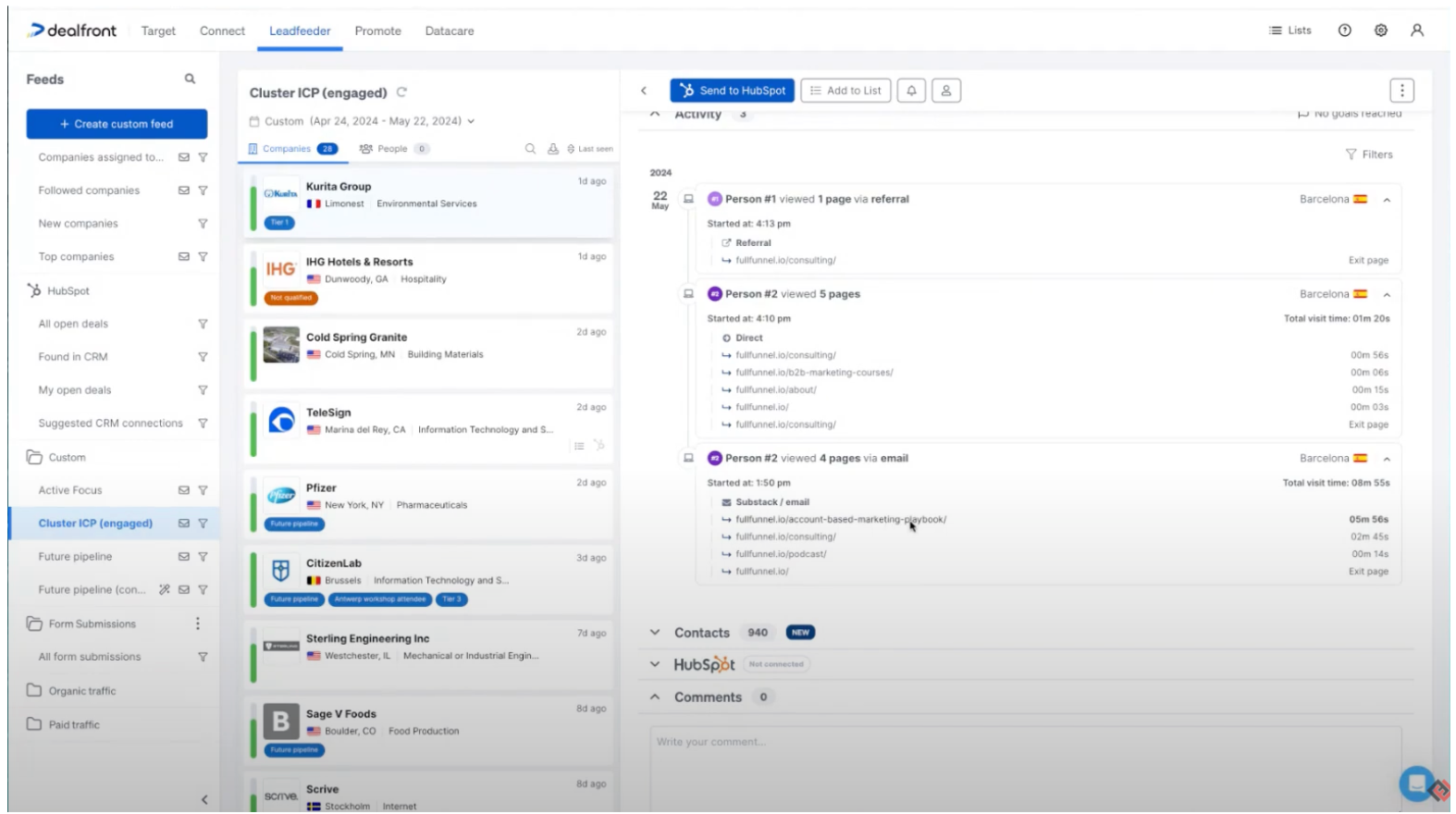

You can quickly verify if the companies in your custom feed match your account segmentation criteria to ensure you're focusing on the right accounts. By opening a company profile, you can check if its details align with your segmentation criteria (as seen above). If it qualifies as a Tier 1 company, you can also create a tag for it in Leadfeeder for easier tracking and prioritization.

Step 3: Run account research and fill in the tracking spreadsheet

With qualified accounts segmented, the next step is to gather deeper insights. At FullFunnel.io, the team conducts thorough research on each high-priority account, collecting publicly available information about their strategic initiatives, recent activities, and key decision-makers.

This includes:

Identifying key stakeholders and mapping the buying committee.

Researching company announcements, hiring trends, and market movements.

Tracking engagement history and previous interactions with content or sales.

All insights are logged in a tracking spreadsheet, ensuring sales teams have a complete view of each account before outreach begins. This research-driven approach allows for highly personalized engagement that aligns with the prospect’s priorities.

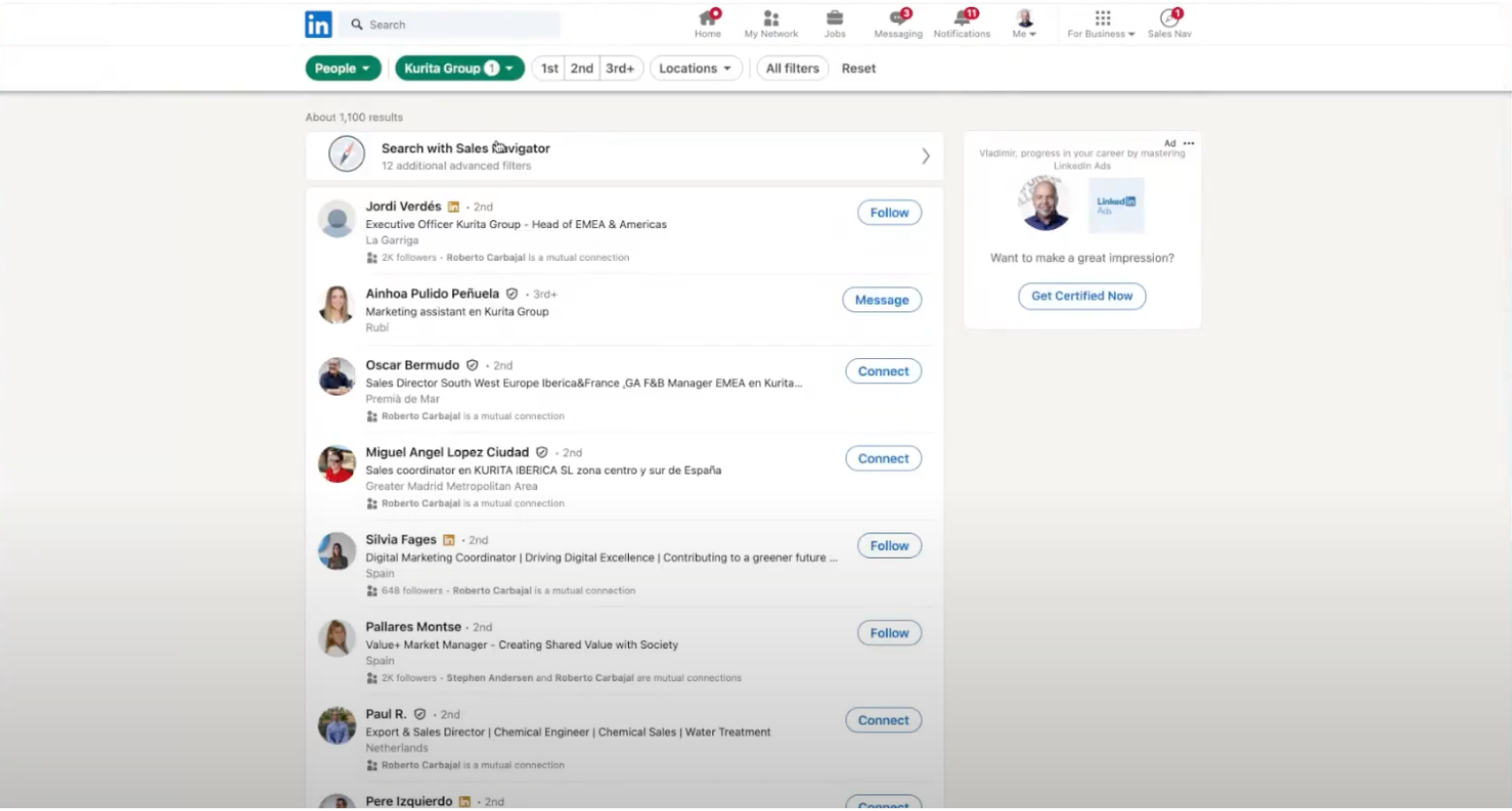

You can navigate to the company’s LinkedIn profile directly from Leadfeeder to check if any employees are already connected with you. By identifying any 1st-degree connections, you can quickly reach out and start a conversation.

Step 4: Define engagement accounts and add them to CRM.

Once research is complete, the next step is to understand which accounts are really engaged. At FullFunnel.io, marketers apply a clear engagement criteria: only accounts that meet a predefined threshold of activity are moved forward.

This includes evaluating:

Website visits and content interactions.

Responses to outreach or ad engagement.

Any signals that indicate active buying intent.

If an account meets the criteria, it is added to the CRM, ensuring that sales teams focus only on the most engaged, high-potential opportunities. This streamlined process prevents wasted effort and ensures that outreach is both strategic and timely.

Align sales & marketing on intent signals

To drive more account velocity (the movement of accounts from one stage to another) sales and marketing need to work together efficiently. Accounts in the "cluster ICP" bucket must be qualified quickly so they can transition to the "active focus" bucket, where sales teams concentrate their efforts on conversion. Since the "active focus" bucket is where the strongest buying signals exist, speeding up this transition is essential for maximizing sales opportunities.

One key approach is to schedule weekly pipeline review meetings, ensuring both sales and marketing teams align on intent data findings. This allows for a collaborative review of accounts, ensuring each one is correctly categorized and prioritized. Marketing should also provide account-specific insights to help sales teams tailor their outreach.

FullFunnel.io have found that a simple but powerful way to make these meetings more effective is to turn every week into a small sprint. Instead of treating ABM as a long-term, linear process, companies can break it down into weekly cycles with clear priorities and immediate action items. For example, a structured 60-minute Monday meeting can follow this agenda:

SDRs share insights from target account conversations and research, highlighting what’s needed to move accounts forward.

AEs provide updates on pipeline deals, new buying committee members, and specific needs for deal progression.

RevOps presents engagement insights from the past week—high-intent page visits, event sign-ups, and newly engaged accounts.

The ABM lead consolidates all insights, prioritizes actions, and structures a sprint for the next week.

Each sprint includes:

Specific content requests to support pipeline creation, nurture accounts, or accelerate deals.

Targeted ads for key accounts.

Precise SDR engagement actions beyond generic follow-ups.

AE-specific next steps to progress deals.

This agile approach ensures teams take the right actions at the right time, rather than following a rigid waterfall plan where sales and marketing operate in silos. By staying aligned in execution—not just strategy—companies can accelerate account velocity, focus on the most engaged opportunities, and drive more revenue.

Another critical point is the importance of dynamic ABM lists over static target lists. Many companies make the mistake of targeting a broad Fortune 500 list without considering real-time intent signals. Instead, ABM lists should be continuously updated based on ICP criteria and buyer engagement. This aligns closely with Dealfront’s new Connected Lists feature, which enables teams to create and maintain dynamic lists that automatically adjust based on real-time data.

By maintaining alignment between sales and marketing, capitalizing on weekly reviews, and using dynamic intent-driven lists, companies can accelerate account velocity, focus on the right opportunities, and drive more revenue.

Personalize outreach and messaging

Most companies make the mistake of treating intent data as just another list of website visitors, passing it straight to sales without any context or personalization. But raw data alone doesn’t create conversations. To turn intent insights into meaningful engagement, outreach needs to be tailored based on what the data is actually telling you.

Connect Leadfeeder with your CRM for contextual outreach

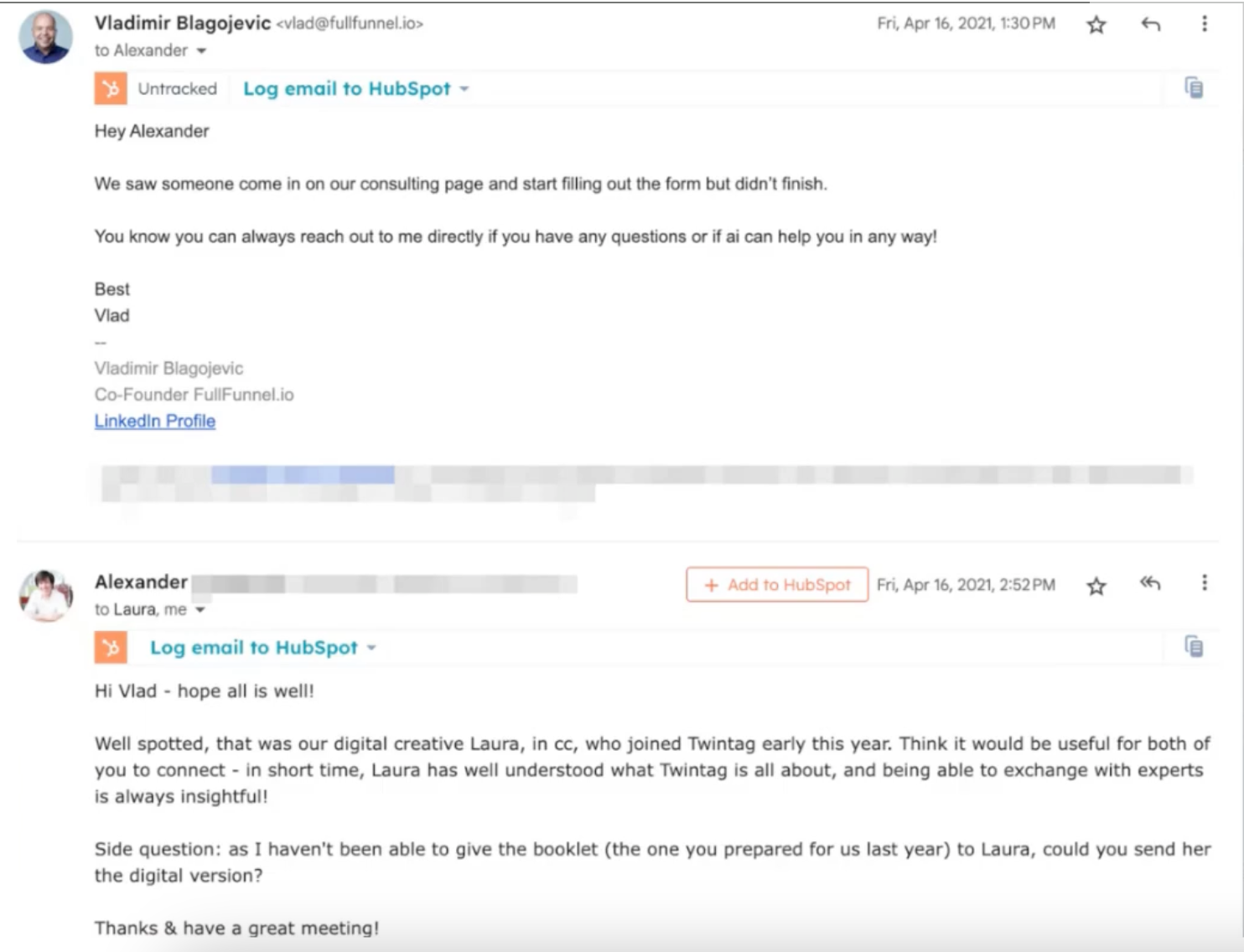

By integrating Leadfeeder with your CRM (as shown with HubSpot), sales teams can immediately see if an engaged account is already in the pipeline. This allows for timely, relevant follow-ups instead of generic cold outreach. If a company with an open deal suddenly revisits key pages, that’s a strong buying signal and is perfect for a well-timed, value-driven message.

Use intent data to craft relevant messaging

Instead of boring and easy-to-ignore generic outreach, match your message to the intent signals you're seeing. Here’s how:

First touchpoint: If you notice a company engaging with specific content (e.g., "Saw your team attended our webinar on ABM strategies"), reference it in your outreach.

Follow-ups: If someone from an account views your case studies, follow up with a question like, “I noticed [Company] was checking out our success stories, are you exploring solutions in this space?”

Signal-based outreach: If website activity comes from a new department or region (e.g., US colleagues from an EMEA company), reach out to your existing contact: “Hey, I noticed some engagement from your US team—did you share our site with them? Would love to understand how we can support the team.”

Make every interaction count

Leadfeeder insights also help validate challenges before pitching. If an account is browsing resources related to ABM, but there's no clear buying signal yet, start by asking: “Is ABM something you’re currently exploring with your marketing team?” This opens up a conversation rather than forcing an irrelevant pitch.

By continuously refining outreach based on real-time engagement and CRM insights, sales teams can have smarter, more meaningful interactions, which drive conversions while avoiding the all-too-common trap of spray-and-pray prospecting.

First touch outreach templates

Your first touch sets the tone for the relationship. These outreach templates help you turn initial engagement (whether from a webinar, case study download, or website visit) into meaningful conversations. Personalize them to match your prospect’s interest and make every interaction count.

Templates

Webinar engagement

Webinar engagement

Subject: Enjoyed the webinar? Here’s something extra for you

Hi [First Name], I saw that your team recently attended our webinar on [Webinar Topic]. Great to see your interest! In case you missed it, here’s a [related guide, case study, or resource] that goes deeper into [key webinar topic]. I’m just curious, are you exploring [topic, e.g., ABM strategies] for your team? Let’s chat if you'd like to see how we help teams like yours.

Best, [Your Name]

Case study download

Case study download

Subject: [Company Name]’s success with [Your Product]—Could this work for you? Hi [First Name], I noticed you checked out our [case study name] on how we helped [Company Name] improve their [pain point]. Most teams looking into this are exploring [related challenge]. Is this something your team is currently working on? Happy to share more insights if you're interested?

Best, [Your Name]

Website visit (multiple pages/high engagement)

Website visit (multiple pages/high engagement)

Subject: Exploring [Your Company]? Let’s connect Hi [First Name], I noticed that your team has been exploring our [specific product or feature] pages over the past few days. Many companies looking at these are typically focused on [specific pain point, e.g., improving outbound efficiency]. Would it make sense to grab some time together and see how we might be able to help you?

Best, [Your Name]

Follow-up outreach (website engagement – case studies viewed)

Follow-up outreach (website engagement – case studies viewed)

Subject: Interest in [Company Name]’s success with ABM?

Hi [First Name],

I noticed someone from [Company Name] recently checked out our case studies on [specific topic]—glad to see the interest!

If you're exploring how companies like [Case Study Example] use intent data to personalize outreach and accelerate pipeline, I'd be happy to share some insights tailored to your industry.

Would a quick chat next week be useful?

Best, [Your Name]

Follow-up outreach (multiple page views – buying signals identified)

Follow-up outreach (multiple page views – buying signals identified)

Subject: ABM & Intent Data—A perfect fit for [Company Name]?

Hi [First Name],

I saw that your team has been actively exploring our content on [ABM, intent data, sales prospecting]. Many of our customers use intent-driven account segmentation to prioritize high-fit opportunities - something we discuss a lot at Dealfront.

Would you be open to a quick call to see if this approach aligns with your current goals? I’d be happy to walk through a few successful strategies.

Let me know what works for you!

Best, [Your Name]

Follow-up outreach (Leadfeeder + CRM insights – open deals engagement)

Follow-up outreach (Leadfeeder + CRM insights – open deals engagement)

Subject: [Company Name] team checking us out? Let’s connect!

Hi [First Name],

I noticed activity from your team on our site, particularly around [product/service page]. Since we’re already in discussions, I wanted to check if this was related to your internal evaluation.

Would it make sense to loop in key stakeholders and address any open questions? Let me know what works for you!

Best, [Your Name]

Follow-up outreach (engagement from a different region – internal interest)

Follow-up outreach (engagement from a different region – internal interest)

Subject: Expansion interest from your [Region] team?

Hi [First Name],

I noticed that your colleagues in [Region – e.g., US, EMEA, APAC] have been exploring our content recently. Has your team been discussing expanding ABM efforts into new markets?

If so, I’d love to share how we help teams align across multiple regions while keeping outreach highly personalized. Let me know if a quick 15-minute chat makes sense.

Best, [Your Name]

Execute multi-touch engagement

Reaching your prospects once isn’t enough, especially when multiple competitors are working with similar intent data. To break through the noise, you need a multi-touch, multi-channel approach that engages prospects at different stages of their buying journey.

Effective engagement means following up across email, LinkedIn, phone, and targeted ads, ensuring your outreach is persistent but valuable. It also means leveraging social signals such as engagement on LinkedIn, job changes, or company news, to time your outreach effectively. And instead of generic follow-ups, align your messaging with intent, offering case studies, webinars, or ABM playbooks that address their specific needs.

Finally, don’t limit yourself to one champion within the account. Engage multiple buying committee members to build consensus and increase your chances of success. In this section, we’ll break down how to implement a multi-touch strategy that keeps your brand top of mind and moves deals forward.

Measure & optimize performance

A great ABM strategy is about more than just execution, it’s also about continuous improvement. To maximize results, you need to track, analyze, and refine your approach based on real data.

Start by tracking conversion rates from your intent-based outreach.

Ask yourself:

Which touchpoints and channels are driving responses?

Are your high-intent accounts converting into real opportunities?

By identifying patterns in your data, you can double down on what’s working and cut what isn’t. You’ll also need to analyze which intent signals correlate with closed deals. Not all signals are created equal, some may indicate early-stage curiosity, while others point to real buying intent. Understanding these differences helps prioritize efforts on the accounts most likely to convert.

Your messaging and outreach cadence should also evolve based on response data. If engagement is low, test different subject lines, call-to-actions, or follow-up sequences. If certain channels are outperforming others, shift resources accordingly.

Finally, continuously refine your ABM playbooks by gathering feedback from sales and marketing teams. They’re on the front lines, seeing firsthand how prospects respond. Regularly reviewing what’s effective (and what’s not) ensures your strategy stays sharp and competitive.

Expected results

By implementing a structured process for using intent data in ABM campaigns, businesses can ensure a more strategic and data-driven approach to targeting the right accounts. Prioritizing high-intent accounts allows sales teams to focus their outreach on prospects who are most likely to convert, increasing efficiency and improving win rates.

Aligning marketing and sales efforts also ensures a seamless handoff between teams, maximizing engagement and accelerating pipeline velocity. When executed effectively, this approach leads to more meaningful interactions, stronger relationships, and ultimately, higher revenue growth.

Subscribe to updates

Turn insights into action

Generate quality leads from website traffic