How to Track BoFu Content Performance to Show Marketing Impact

Expected results

Attribute content performance by product and funnel stage

Prove revenue impact and defend content marketing budgets

Surface high-fit accounts engaging with decision-stage assets

Support sales and paid media with timely, data-backed signals

You can write the best bottom-of-funnel (BoFu) content in the world, but if you can’t prove it works, it won’t get the credit it deserves. That’s the challenge BOFU.ai set out to solve.

Founded by B2B SaaS content strategist Lashay Lewis, BOFU.ai is a consultancy that specializes in building and optimizing BoFu content that’s tightly aligned with business outcomes like revenue, not just vanity metrics. By combining strategic insight with AI-powered tools, BOFU.ai helps marketing teams create content that converts and prove that it does.

But even the best content needs the right infrastructure to connect performance to the pipeline. That’s where Dealfront comes in. Together, BOFU.ai and Dealfront have written this Play to explain how we’ve developed a scalable, high-precision attribution framework that reveals exactly which companies are engaging with specific content, how that engagement moves through the funnel, and how to act on those insights across sales and marketing channels.

This Play breaks down BOFU.ai’s step-by-step process inside Dealfront, showing how to track content engagement, attribute impact by funnel stage and product line, and ultimately demonstrate that BoFu content drives results. Whether you're part of an agency looking to prove value to clients or an in-house team justifying budget and strategy, this Play shows how to make content performance visible, credible, and actionable.

The problem with bottom-of-funnel attribution

Why BoFu gets overlooked

Bottom-of-funnel (BoFu) content is often the unsung hero of the buyer journey. It’s rarely the first thing a prospect encounters; instead, their path typically begins with top-of-funnel (ToFu) blog posts or middle-of-funnel (MoFu) resources like guides and webinars. These early-stage assets are designed to attract attention, build awareness, and educate. They’re more likely to be discovered through organic search, social media, or newsletters, channels that make them easy to track and attribute.

By contrast, BoFu content (think product comparison pages, pricing breakdowns, competitor one-pagers, or late-stage case studies) appears much later, when the prospect is actively evaluating solutions and preparing to make a purchase decision. This is where real buying intent shows up.

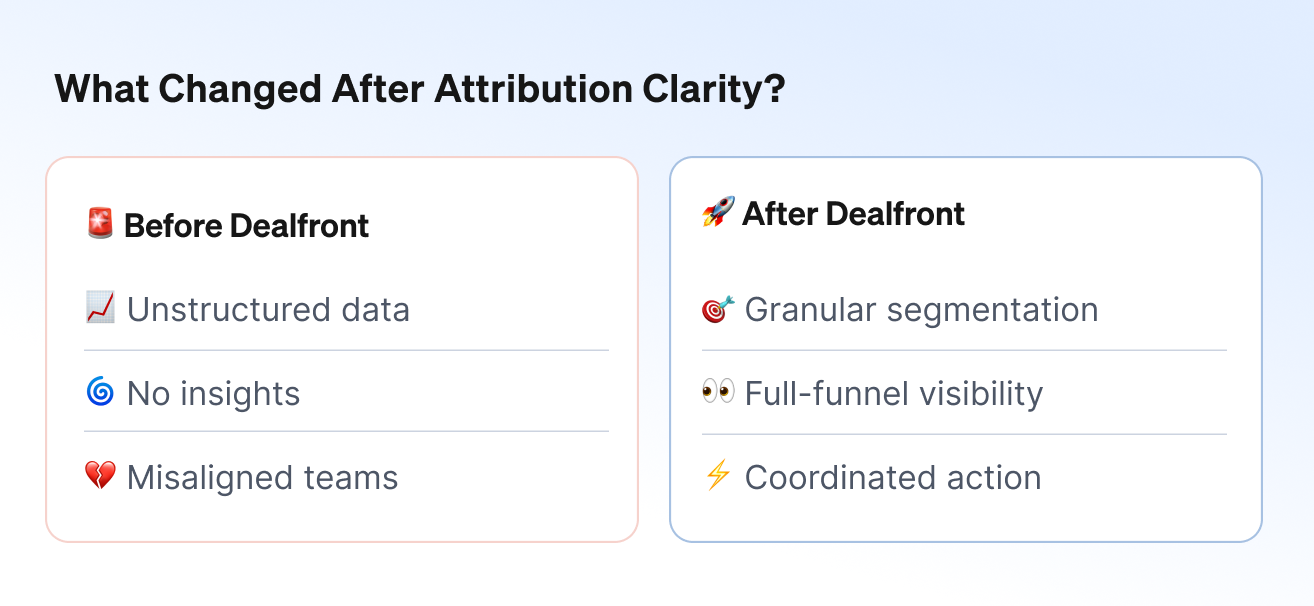

So, what’s the problem? Most attribution models are still first-touch or last-touch. That means credit is assigned to whichever piece of content brought the prospect in, or sometimes to the final conversion point, while the critical assets in between, like BoFu content, get ignored. As a result, the content doing the heavy lifting to move a deal across the line often looks like it had no impact at all.

Without multi-touch attribution or a way to see the full journey, BoFu content gets sidelined in performance reports. That makes it harder for marketing teams to justify investment in the very content that really helps to close deals.

Content gets credit, but never enough

Marketers lean heavily on bottom-of-funnel (BoFu) content to close the loop in the buyer journey. These assets (comparison pages, “vs” posts, solution-focused buying guides, and competitor alternatives) are specifically crafted to convert high-intent prospects into pipeline. They’re the digital equivalent of a well-timed sales pitch, but proving their impact is a different story.

The challenge starts with attribution. If a lead doesn’t fill out a form, marketing has limited visibility into what content influenced their decision. Pageviews only tell part of the story. UTM parameters break down when shared links are passed around internally, viewed across multiple sessions, or accessed anonymously. Most attribution tools can’t track what happens in the messy reality of modern B2B buying.

Then there’s the problem of dark social - when content is shared in private Slack groups, passed around in LinkedIn DMs, or sent via email threads between decision-makers. These influential interactions are completely invisible to standard analytics tools, yet they play a huge role in how buying teams align and make decisions.

Executives, however, want concrete answers: “Which content influenced this deal?” “What’s actually driving revenue?” Without a reliable framework for content attribution, marketers are left in the dark. They know their content is working but they can’t back it up with the kind of evidence that earns trust and secures future budget.

Without insight, Sales doesn’t act

The challenge with BoFu content goes beyond attribution though, directly affecting how sales teams prioritize and engage accounts. When sales teams lack visibility into content engagement, they miss critical buying signals.

Imagine this: a high-fit prospect spends five minutes reading a deep-dive comparison article, clicks through to your pricing page, lingers for a moment, and then leaves. No form fill. No demo request. No chatbot interaction. From the CRM’s perspective, that prospect never existed. But from a buyer behavior standpoint, that was a flashing neon sign of intent.

Without insight into who’s consuming high-value content and when, sales teams are left flying blind. They default to cold outreach, chasing stale lists or relying on arbitrary scoring models. Meanwhile, engaged prospects slip through the cracks simply because no one knew they were there.

This breakdown in visibility creates a disconnect between marketing and sales. Marketing produces strategic, high-intent content designed to enable buying conversations, but without shared data, sales can’t act on it. And what does that leave you with? Missed timing, missed opportunities, and ultimately, missed revenue.

That’s exactly the gap BOFU.ai set out to close, by creating a framework where marketing and sales can finally see and act on the same signals.

Why BOFU.ai built a content attribution framework in Dealfront

Multi-product complexity creates segmentation challenges

When your company sells multiple products to different audiences, content attribution gets exponentially harder. That was the case for one of BOFU.ai’s key SaaS clients, a public safety technology provider with a diverse portfolio of solutions, each targeting distinct buyer personas and use cases. Their product lines include:

ShotSpotter

CrimeTracer

Resource Router

SafePoint

Case Builder

And a combined solution suite called Safety Smart

To understand how content was performing, BOFU.ai needed more than just pageview data, they needed to connect the dots between who was engaging and what they were engaging with. Was a visitor reading about ShotSpotter or SafePoint? Were certain pieces of content driving interest in CrimeTracer, but not CaseBuilder? And, most importantly, which assets were influencing actual sales conversations?

Without that level of product-specific segmentation, every insight was diluted. All the content engagement blended together, making it impossible to tie marketing performance to specific revenue streams.That’s why BOFU.ai partnered with Dealfront to build a more granular, multi-touch content attribution framework. With Dealfront’s data, they could isolate content interactions by product, track high-intent engagement across the funnel, and surface clear signals to sales.

Precision was what they were after, and precision is what they got. And a much clearer story about what content actually drives the pipeline, for which product, and with which accounts.

Funnel-specific segmentation matters

To fully measure content performance, BOFU.ai knew they needed more than just pageviews, they needed context. Specifically, they wanted to understand where in the funnel each visit was coming from.

Were visitors landing on top-of-funnel blog posts designed to drive awareness? Were they engaging with middle-of-funnel resources like how-to guides and industry explainers? Or were they heading straight to bottom-of-funnel content such as comparison pages, competitor alternatives, or decision-stage case studies?

Segmenting traffic by funnel-stage gave BOFU.ai the clarity to act strategically. It enabled them to:

Understand contribution to pipeline at every stage; not just who showed up, but also who moved forward

Optimize internal linking paths to guide readers from awareness to action

Focus content investment on formats and topics that consistently drive qualified opportunities

Without segmentation by funnel stage, and by product line, content performance data becomes a blur. Valuable patterns get lost in the noise. And without that clarity, it’s nearly impossible to tell what’s working, what’s not, and where to double down. Funnel-specific insight doesn’t just help you understand what’s happening, it helps you shape what happens next.

How it works – BOFU.ai’s step-by-step process in Dealfront

To prove the impact of bottom-of-funnel (BoFu) content, BOFU.ai built a robust, scalable attribution framework inside Dealfront. It’s designed to offer complete visibility into how specific articles influence the pipeline, without relying on form fills or guesswork.

Here’s the exact step-by-step process they use.

Step 1 – Organize content by product + funnel stage

The first step was to bring structure to the content inventory. BOFU.ai started by auditing every article, guide, and landing page on the site, tagging each one by:

Product line (e.g. ShotSpotter, SafePoint, Resource Router)

Funnel stage (BoFu, MoFu)

From there, they created a consistent naming convention that made it easy to segment content inside Dealfront:

“ShotSpotter BoFu”

“ShotSpotter MoFu”

“SafePoint BoFu”

Each group or “feed” would only contain URLs tied to one product and one stage of the funnel, nothing more, nothing less.

“We separate by product first. Then by funnel. It helps us get extremely granular with how companies are finding us.”

This level of organization laid the foundation for tracking performance with precision.

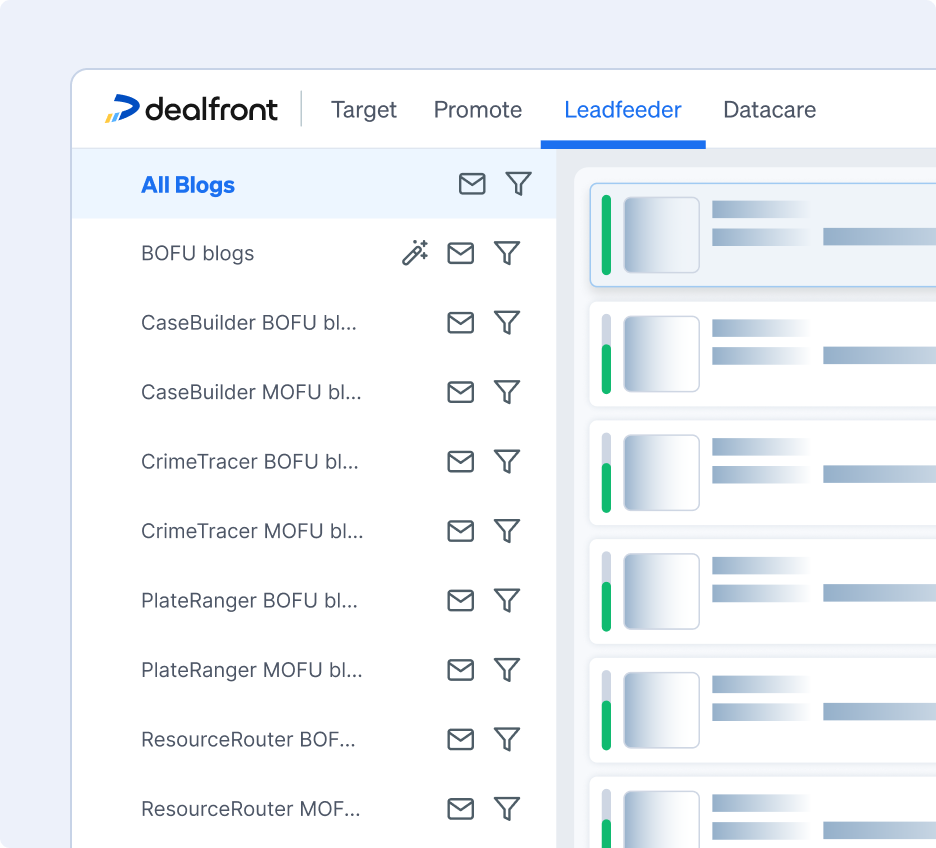

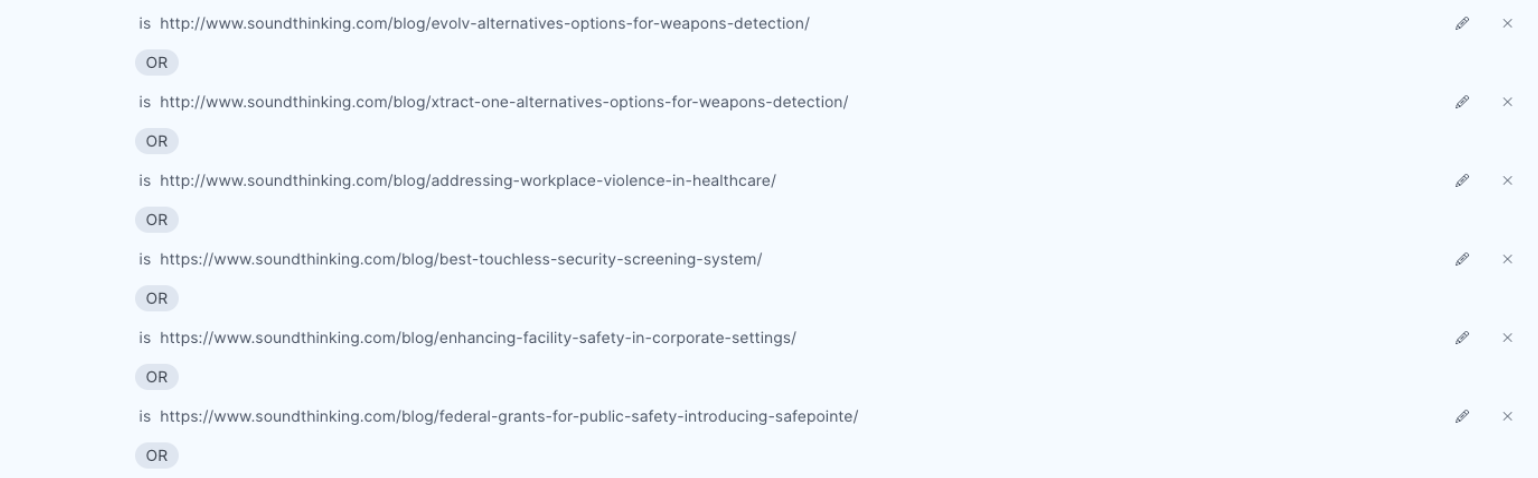

Step 2 – Create Custom Feeds in Leadfeeder

With content organized, the team turned to Dealfront’s Leadfeeder module to build custom feeds. Each feed corresponded to a unique product-funnel combination and was built using Page URL-based filters.

For BoFu content, filters might include content links to:

/alternatives-to

/best

/vs

/product-name

/integration

For MoFu content, filters might target content links to:

/how-to

/blog

/resources

These filters were curated manually, not automated. BOFU.ai chose quality over convenience, handpicking the exact URLs for each feed to ensure they were tracking only the most relevant content.

“It’s not automated—we just pull all the URLs for BoFu content by product and add them to the feed.”

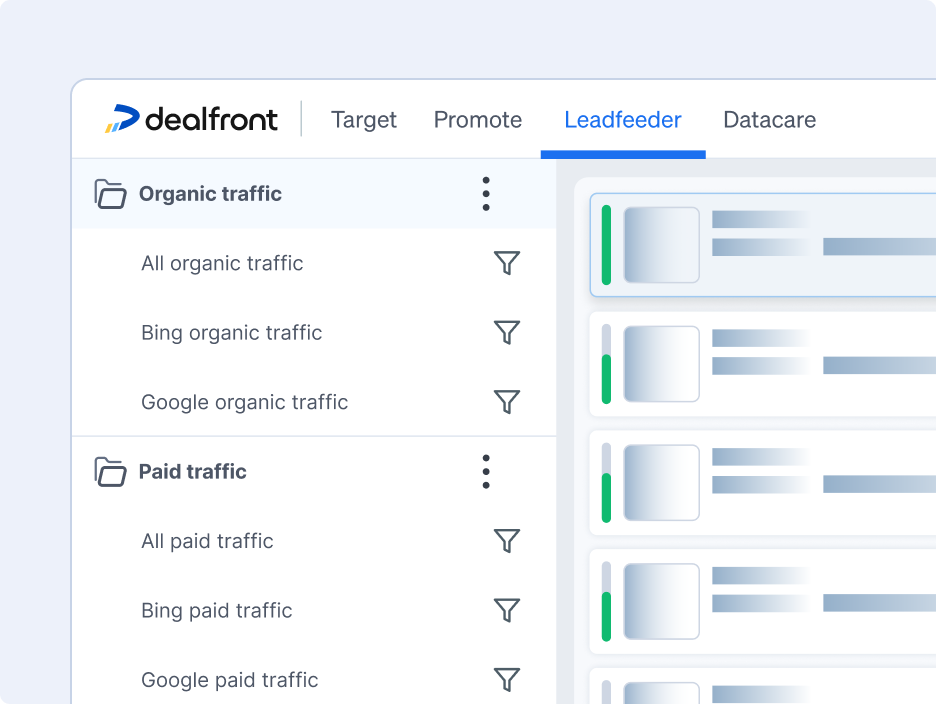

Step 3 – Segment by traffic source

Once the content feeds were in place, BOFU.ai added another layer of insight: traffic source segmentation.

Using Dealfront’s filtering options, they created separate views for key traffic types, such as:

Organic traffic (Google vs. Bing)

Paid campaign traffic (from Google Ads, Bing Ads, Facebook)

Form submission traffic (if tracked)

This allowed them to answer questions like:

Are paid ads driving BoFu traffic?

Are organic search terms bringing in high-fit companies?

Which channels lead to form fills vs. anonymous engagement?

This segmentation helped tie BoFu content not just to traffic, but to channel-specific performance.

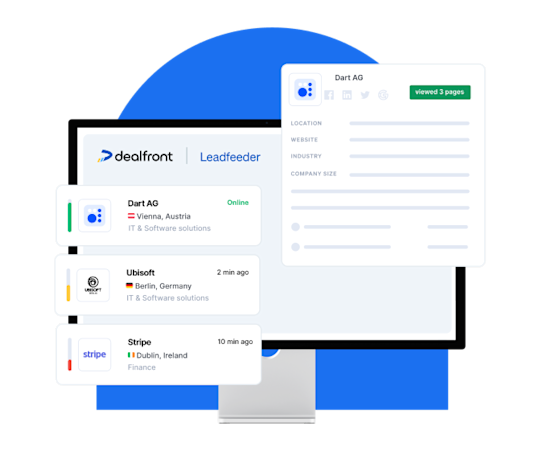

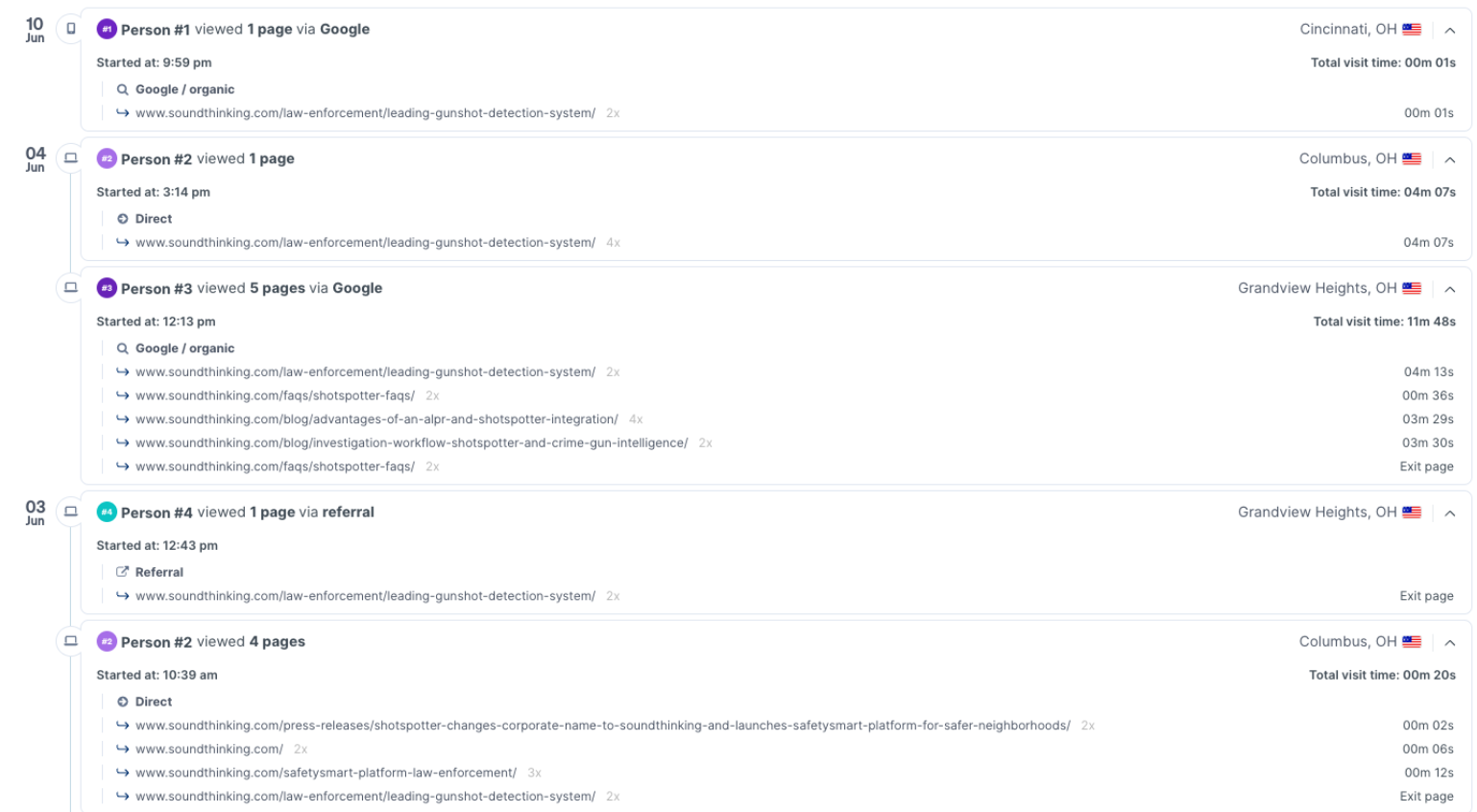

Step 4 – Identify which companies are engaging

With content and traffic filters in place, the next step was to see who was actually engaging.

Each custom feed revealed the company names visiting specific articles. From there, BOFU.ai analyzed behavioral signals like:

Time on page: did they stick around or bounce?

Depth of engagement: did they view multiple articles?

Return visits: were they coming back for more?

Page journey: did they move from BoFu to pricing?

All of this gave the team a high-resolution view of account-level engagement without requiring a single form fill.

“We’re able to see down to the article how these leads are coming in—and what their journey looks like.”

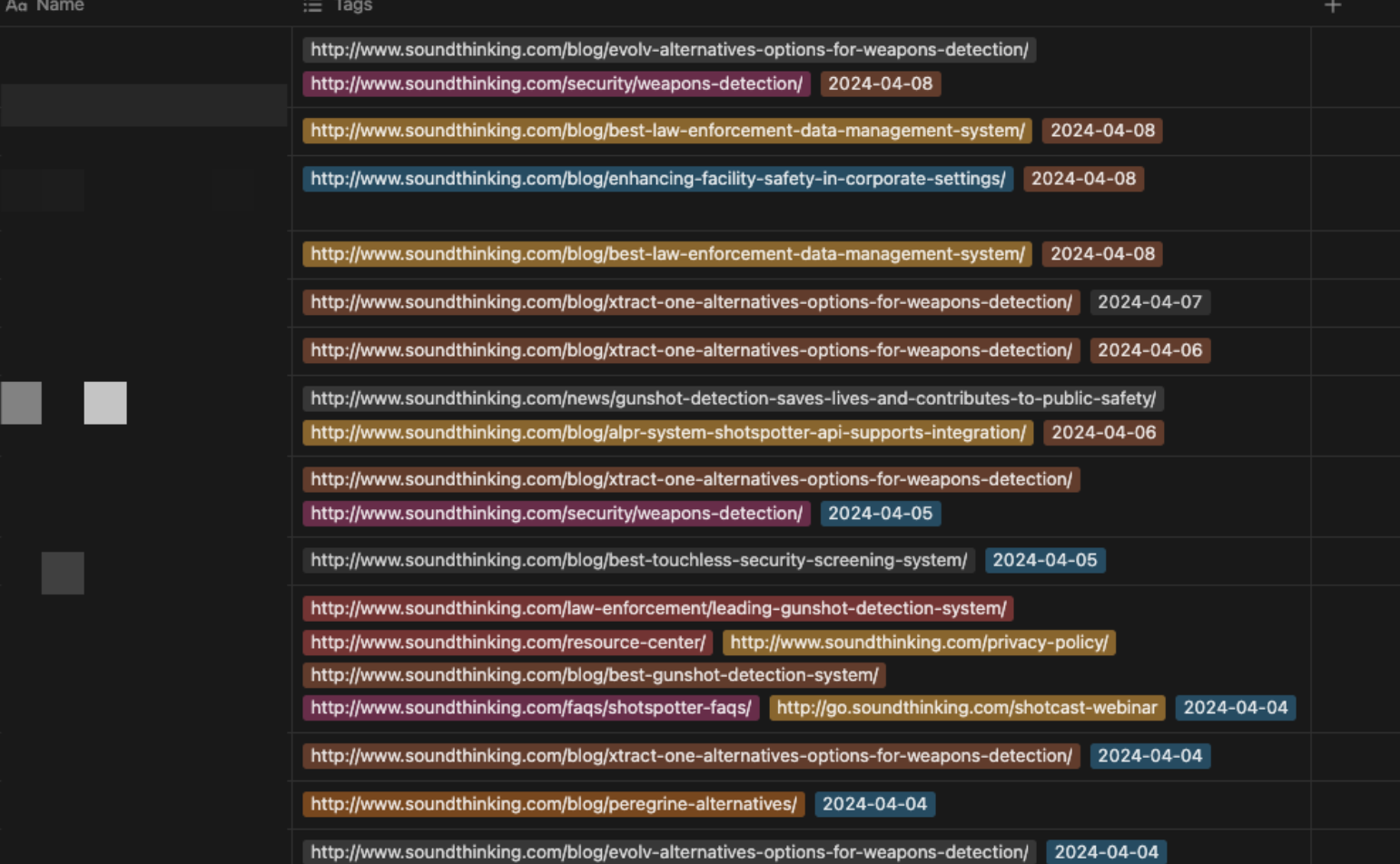

Step 5 – Track engagement in Notion + CRM

To make insights accessible across the company, BOFU.ai built a lightweight reporting dashboard in Notion.

The dashboard includes:

Company name

Article viewed

Date of visit

This gives marketing, content, and sales teams a shared, real-time view of what’s resonating, and with whom.

“They can quickly see the lead name, which article they came in on, and the date. It just pulls back the curtain.”

In some cases, high-fit accounts with repeated BoFu activity are pushed into the CRM or flagged for follow-up. This alignment closes the loop between marketing content and sales outreach.

Turning insight into action

Attribution and analytics are only valuable if they drive real-world outcomes. BOFU.ai uses the engagement data they collect to fuel smarter marketing, sharper targeting, and more effective sales outreach. Here’s how they turn insight into action.

Use high-performing content for paid campaigns

When certain bottom-of-funnel articles consistently attract and convert the right kind of traffic (like a high-intent “Alternatives to [Competitor]” post) BOFU.ai doesn’t just celebrate. They double down.

Those proven performers become landing pages for paid media, including:

Facebook Ads

Google Ads

Bing Ads

The strategy is simple: invest in a budget where there’s already momentum. If a page converts organically, it’s likely to work even better when you send more qualified traffic its way.

“If something’s working organically, we’ll run Paid to it. It drives more inbound leads.”

This approach minimizes waste and ensures every ad dollar supports content with a track record of results.

Alert sales about BoFu visitors

When a target account—especially a high-fit one—views bottom-of-funnel content, that’s a buying signal Sales can’t afford to miss.

BOFU.ai closes the loop between marketing and sales by sending timely alerts, either:

As Notes in the CRM

Or as Slack notifications to the relevant account owner

For example:

“Florida Dept. of Management visited /alternatives-to-shotspotter”

That’s paired with a suggested follow-up, like:

Send a relevant case study

Craft a 1:1 outreach email referencing the article

The result? Sales teams stop wasting time chasing cold leads and start focusing on companies that are actively showing intent.

Build lookalike lists for outbound

Patterns in engagement also inform the outbound motion.

When BOFU.ai notices repeated high-value activity from a certain type of company—say, regional public safety agencies or mid-size logistics firms—they don’t stop at that insight.

Instead, they:

- 1.

Use Dealfront to identify lookalike companies

- 2.

Build targeted outbound lists based on those patterns

- 3.

Tailor messaging based on the content those companies engaged with

This creates a self-reinforcing cycle: proven BoFu content attracts the right kind of traffic, and that traffic generates insights that power smarter outbound campaigns.

What next: measuring what matters

Once content engagement is segmented and tracked, the real value emerges: connecting specific articles to business outcomes. BOFU.ai’s process goes beyond vanity metrics and surface-level analytics. They’re focused on what really matters: pipeline and revenue.

Tie pipeline to specific articles

Each custom feed in BOFU.ai’s setup is built around a distinct URL or group of URLs. That means they can pinpoint exactly which pieces of content are contributing to the pipeline.

They’re able to answer questions like:

Which articles generate the most qualified leads?

Which pages are consistently visited by high-fit accounts?

Which pieces correlate with follow-up from Sales—and eventual conversions?

“Now I can say: this article drove X leads from these types of companies. That’s a business case in itself.”

No more generic traffic reports. Every content asset gets evaluated based on real impact, not just clicks.

Prove the value of content

With visibility into the full journey—from anonymous engagement to outbound touch to closed-won deal—BOFU.ai finally gets to quantify the ROI of content.

They’re not just saying “this blog got traffic.”

They’re proving:

BoFu content = pipeline

BoFu content = revenue

That changes the conversation.

Marketing gets a stronger case for investment. Sales gets the context they need to close faster. Leadership gets clarity on what’s working, and why.

Expected results

By implementing this framework, BOFU.ai didn’t just improve content reporting—they transformed how content supports the business. Here’s what they now achieve consistently:

Track which content drives pipeline, segmented by both product and funnel stage

Uncover warm, high-fit accounts that would’ve otherwise stayed anonymous

Shape paid strategy based on what’s already working organically

Equip sales teams with real-time, context-rich buying signals

Build repeatable outbound motions, rooted in actual engagement patterns

This isn’t just content tracking, it’s content intelligence.

Most marketing teams struggle to connect content with pipeline. They can’t prove ROI. They chase pageviews, not business outcomes. BOFU.ai flipped that script.

With Dealfront, they’ve made attribution visible, actionable, and, most importantly,scalable.

Instead of guessing what works, they know. Instead of hoping content drives leads, they show it. And instead of stopping at MQLs, they now track revenue.

Turn insights into action

Ready to grow your pipeline?

GDPR Compliant

Built & Hosted in EU

Deep B2B Data