60-Second Summary

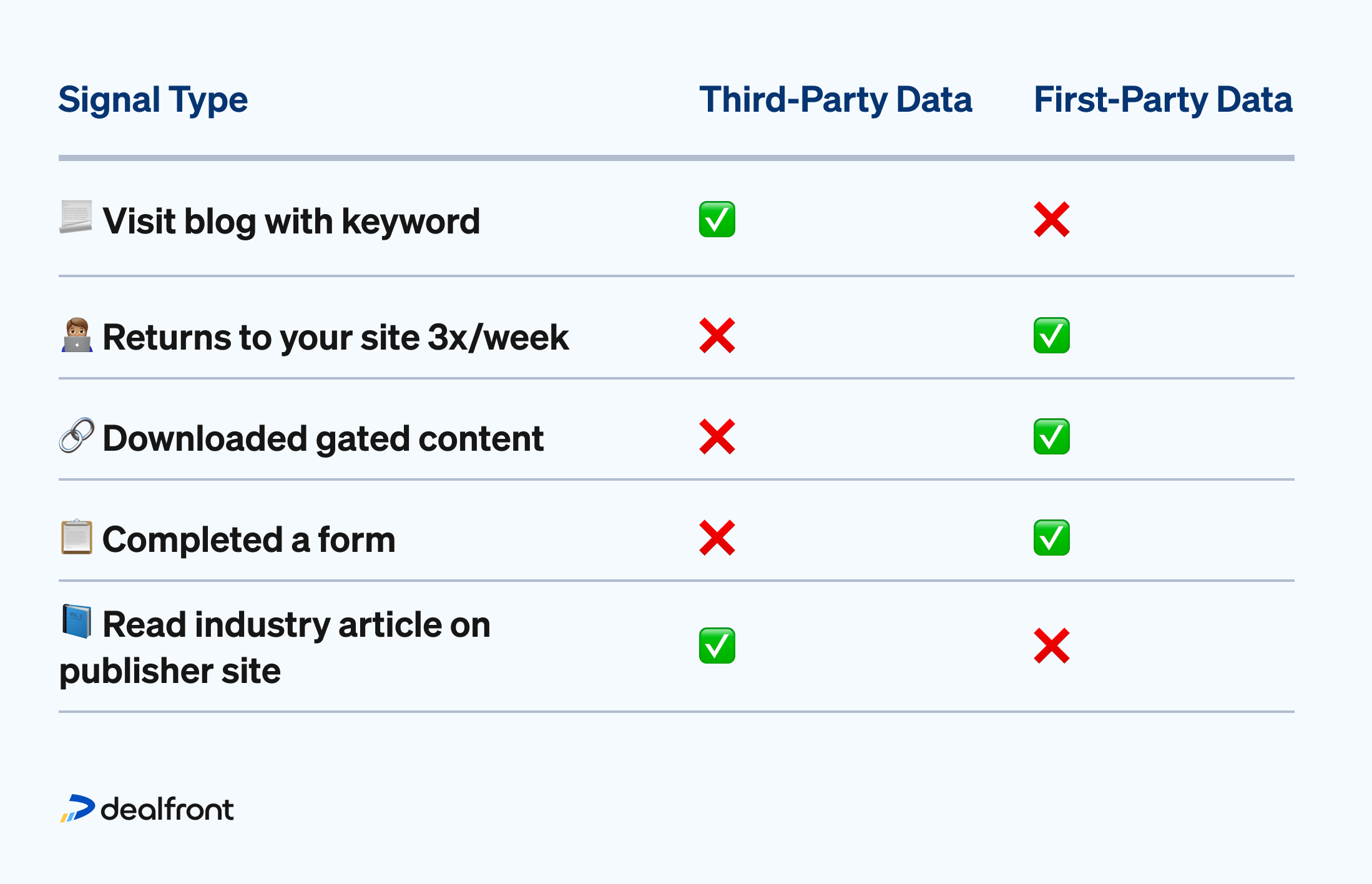

Third-party intent data often creates false positives that mislead sales teams into chasing unqualified leads. By refocusing on first-party engagement and actionable buying signals, revenue teams can improve pipeline quality and close rates.

Key takeaway: Third-party “surges” often originate from anonymous or irrelevant traffic and don’t indicate true buying intent unless verified with first-party signals.

Strategy: Prioritize intent scoring models that reward real engagement—such as return site visits, content consumption depth, and form activity—over raw keyword matching.

Framework: Combine firmographic signals like funding, hiring trends, and recent tech installs with behavioral activity to gauge true sales readiness.

Real-world lesson: Companies like Skribble and S.I.E. dramatically boosted lead quality and slashed research time by shifting from generic intent platforms to Dealfront’s first-party data intelligence.

You’re not alone. Many revenue teams using limited-intelligence, third-party intent platforms like 6sense, Demandbase, or Cognism are seeing the same pattern: a rush of promising signals that don’t seem to go anywhere. Reps follow up, only to be met with silence, or a polite “we’re not looking right now.” In fact, approximately 60% of B2B sellers feel they are wasting time on ‘interested’ accounts that don’t result in a sale.

You’d be right to wonder, what’s going on? And here’s the short answer: false positives. Signals that look like interest, but don’t actually reflect buying intent or true buying signals. These false positives are the digital equivalent of mistaking a glance for a handshake.

Most third-party intent data is built on anonymous content consumption across wide publisher networks. And while that sounds powerful in theory, it often leaves you chasing activity you can’t verify or tie back to your site.

In this article, we’ll explore how to improve pipeline quality by spotting false positives in your intent signal scoring model. We’ll walk through three signs your pipeline might be padded with false positives, and what you can do to tighten your scoring model and focus on signals that actually close.

Here are 3 false positive red flags

High-intent accounts stall after first touchpoint

Intent surges don’t correlate with web visits

Perfect-fit accounts ghost after the discovery call

Why is your pipeline full of false positives?

Intent data should be a shortcut, a way to bypass the time-consuming process of cold prospecting every single Ideal Customer Profile (ICP) match. Imagine your sales team receiving a neatly curated list of accounts that are supposedly “in the market” for exactly what you offer. It paints a picture of efficiency and effectiveness, doesn't it? Less wasted effort chasing uninterested leads, a laser focus on companies with demonstrated interest, and ultimately, a faster path to closing deals. It truly sounds like a revenue team's dream scenario.

But here’s where the dream often diverges from reality. The fundamental issue lies in the source of most third-party intent data: it doesn’t originate from your own valuable channels. Instead, it’s amassed by crawling across vast networks of publishers. Think about the sheer volume of the internet – thousands upon thousands of blogs, niche industry news sites, and even those comparison platforms we all browse before making a purchase. These sites often share their collected cookie data with large data aggregators, companies like Bombora, which then package and sell these insights as intent signals or triggers to businesses eager to fill their pipelines.

Why does third-party intent data lead to false positives?

Consider this scenario: imagine five individuals within the same company's internet protocol (IP) range happen to read an article that contains the keyword sales enablement. Immediately, your intent monitoring tool flags that entire organization as exhibiting a “research spike” in that topic. On the surface, it looks promising, but dig a little deeper. Who were these five people? Were they senior decision-makers actively evaluating solutions? Or could they have been summer interns conducting preliminary research? Perhaps they were simply looking for a basic definition of the term. Crucially, will any of this anonymous activity ever translate into those individuals landing on your website, exploring your specific content, or even considering your product as a viable solution to their needs? You’re often left with a significant number of unanswered questions, while concrete, actionable insights remain elusive.

This is where false positives begin to infiltrate your pipeline. They thrive in the ambiguous space between casual, anonymous curiosity and genuine, demonstrated buying behavior. When that initial flicker of potential interest isn't substantiated by solid first-party evidence (data directly generated from interactions with your own website, content, or marketing channels), it becomes incredibly easy for sales teams to get sidetracked, chasing after fleeting signals that ultimately lead nowhere.

3 signs your pipeline is full of false positives (and what to do about it)

There are always red flags when something’s going wrong in your pipeline, but recognising them isn’t always as easy as we’d hope. To help you troubleshoot your own pipeline, here are the telltale signs that seemingly promising accounts in your pipeline are not as close to buying as you think. For each red flag, we will analyze the cause and provide actionable solutions.

1. “High-intent” accounts never progress beyond awareness

So, you've got these accounts that look like they're really interested and are showing “high intent”. Your next step is to reach out with a tailored deck, and if you’re lucky, you might even get a polite response. But then… nothing. They don't ask for a demo, they don't come back to your website to check out pricing again, and your follow-up emails just disappear into the void. The opportunity slowly withers.

This is one of the most common symptoms of false positives: accounts that appear hot because of off-site intent activity, but never show up again on your radar once contacted.

Why it happens

Now, let's talk about why this happens. Often, these "high-intent" signals you're seeing from third-party data providers are really just picking up on what we can call passive research; someone at the company read a few articles with a relevant keyword, but it wasn’t connected to a real project or buying decision. Maybe they were just doing some general learning, or perhaps someone in a completely unrelated department was looking into something briefly. It wasn't tied to any actual project they're working on or a real decision to buy anything. So, when you reach out based on these signals, you're essentially responding to someone's general curiosity, not a genuine commitment to finding a solution like yours.

How to fix it

To address this false positive you need to shift your scoring model to reward first-party engagement; the signals that show real, observable interest in your brand, not just curiosity floating out on the open web.

Instead of reacting to third-party spikes alone, raise the intent score only when:

You see repeat sessions from the same company domain, especially if they occur over several days. One visit can be a fluke; consistent return traffic suggests real exploration.

Users scroll deeply, watch videos to the end, download gated content, or begin filling out forms, even if they don’t submit. These are signs they’re doing active, considered research.

Validate the behavioural signals with firmographic triggers like new funding, territory expansion, recent hiring, or complementary tech installs. Together they provide a far better predictor of readiness than an off-site keyword match.

2. Anonymous surges never reconnect to your site

Picture this: it’s Monday morning and your intent dashboard lights up with the “Top 5 Accounts Researching Your Category!” Sounds exciting, right? You pass them to SDRs, draft some outreach, maybe even prep a deck. But when you dig into your web analytics there’s nothing. No sessions, no form fills, no sign that anyone from those companies even visited your site.

So, what’s going on?

Why it happens

Most third-party spikes come from long-tail publisher traffic; a patchwork of anonymous ad clicks, syndicated content, and cookie-based keyword matches across media networks. The moment someone lands on an article tagged with a keyword you’re tracking, that activity is counted, even if the person has never heard of your brand (and maybe never will).

It’s intent in the loosest possible sense: a vague interest in a topic, certainly not a sign of sales readiness. These surges can feel exciting on paper, but they’re often just digital noise meaning no real buyer, no real research, no real signal.

How to fix it

Start by running a 14-day lookback in your web analytics for each “surging” account. If the company domain doesn’t appear in any of your reports, not even once, treat it as a false positive. Either subtract points from the intent score, or suppress the alert altogether.

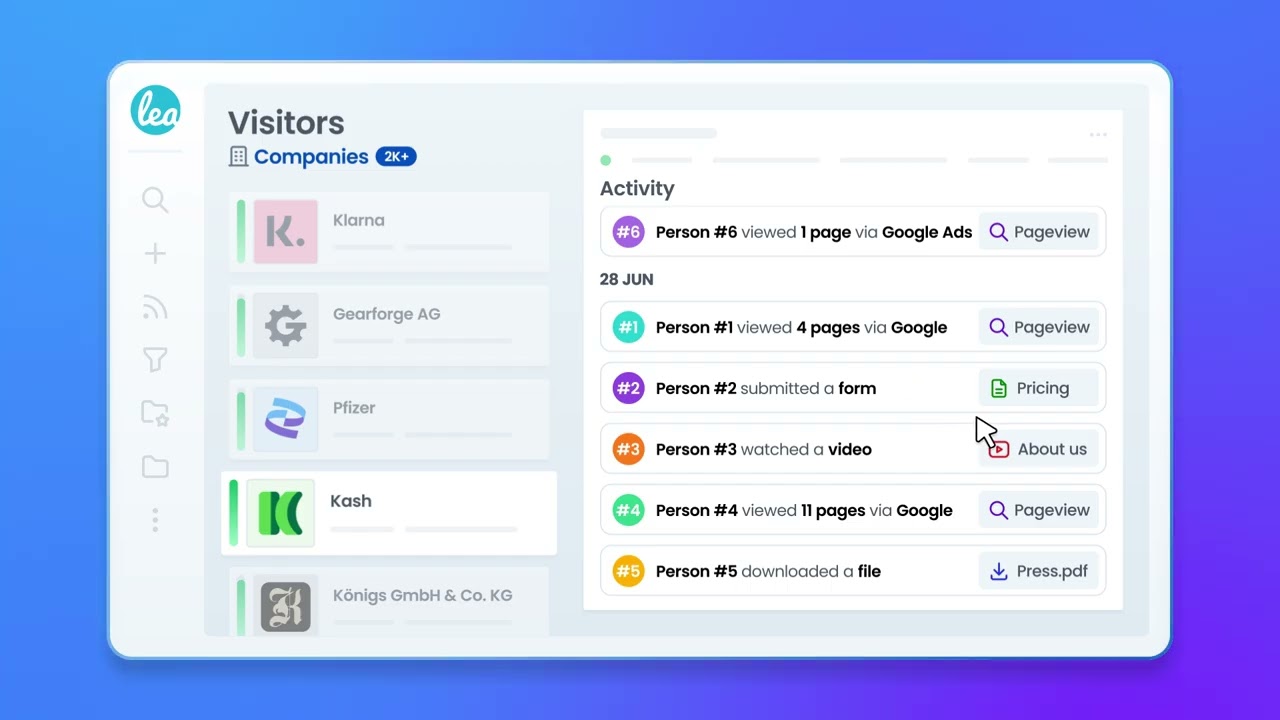

Layer in a visitor identification tool. These connect incoming IP addresses with real company names, so you can see in real-time which accounts are actively engaging with your site.

Refine your rules and only treat a surge as meaningful when there’s a corresponding action on your domain, whether it’s a visit, a scroll, a click, or a content download.

This small but crucial tweak keeps your team focused on genuine buying interest, not speculative data from all over the internet. No more chasing shadows, by fixing this false positive you’ll be working leads you can actually see.

3. Ideal-ICP logos stall after the first discovery call

Good news, you’ve finally landed a big fish. The company matches your ICP perfectly: right size, right tech stack, even the right job titles on the call. The champion seems engaged, asks smart questions, even praises your product. You walk out of the discovery call feeling good—this one feels like a win. And then you’re back to… crickets. Procurement drags their feet, budgets mysteriously disappear and priorities shift. A few weeks later, the deal quietly fizzles out and dies. But what actually went wrong?

Why it happens

Just because a company could be a great customer doesn’t mean they’re in a position to act today. Internally, they might be under-resourced, navigating a reorg, freezing headcount, or focused on other strategic priorities.

Sometimes your champion really does love the product, but they’re trying to push a boulder uphill in a business that isn’t equipped to move. And without the right momentum behind them, the deal stalls out.

How to fix it

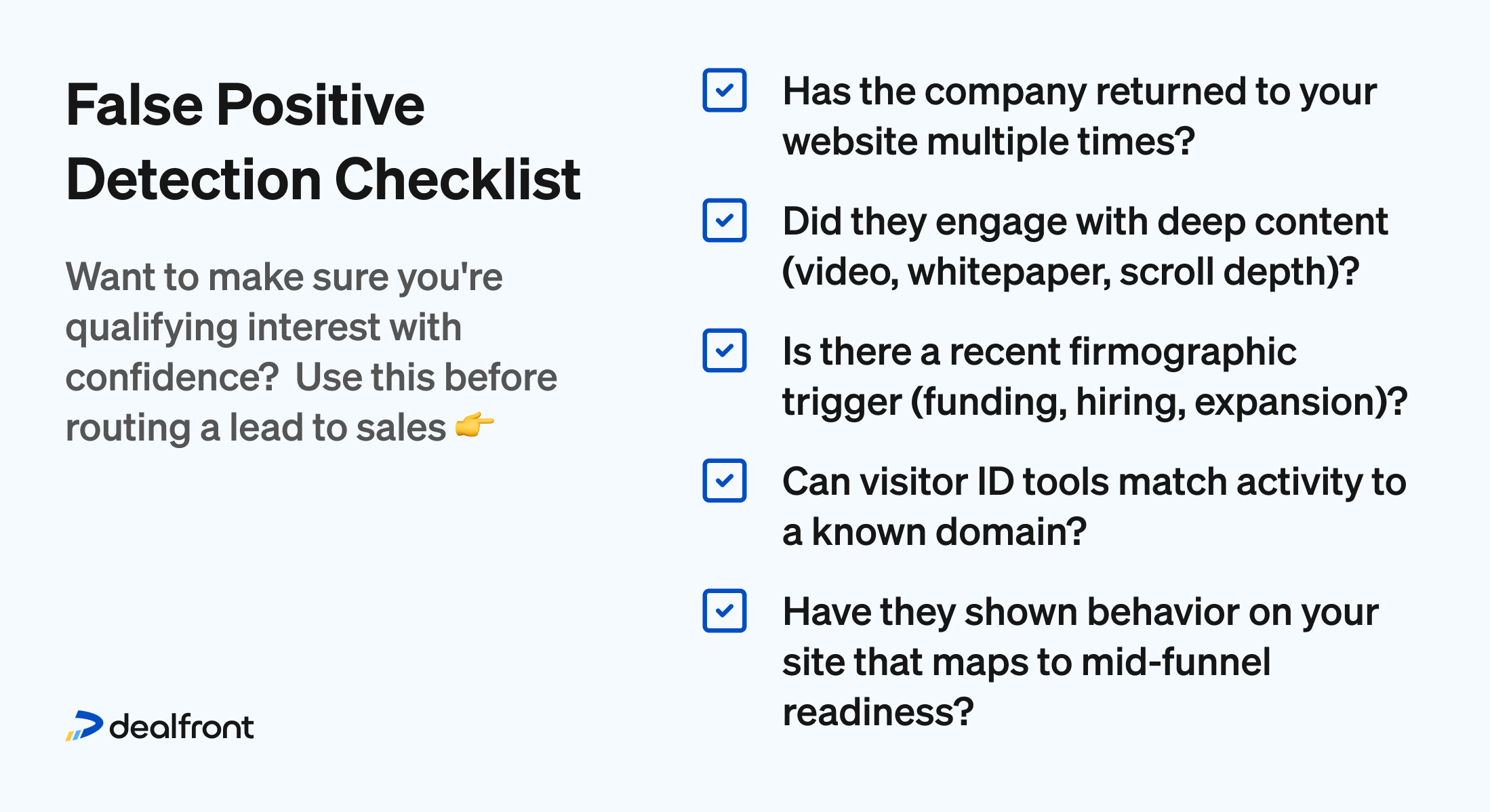

Before routing an account to sales, go beyond basic ICP filters and validate readiness using firmographic and behavioural data. You’re not just looking for the right type of company, you want to know if it’s the right time to sell.

Look for signals like:

Hiring velocity - especially in supporting functions like ops, enablement, or IT. If they're hiring in these areas, they’re likely preparing for a tooling change.

Recent funding, M&A activity, or territory expansion - these moves signal strategic change, which often brings budget and urgency.

Complementary tech installs - if they’ve recently onboarded a system that integrates with yours, it’s a strong sign of a broader initiative.

If an account meets your ICP but lacks these readiness signals, don’t discard them, re-segment them. Route them into a “future-fit” nurture track that keeps your brand visible until the timing’s better. That might mean sharing educational content, checking in around relevant business milestones, or simply watching for their next surge in activity.

Don’t think about it as giving up, instead recognise it as focusing your energy where it’s most likely to convert now, without losing sight of the deals that will be ready later. You don’t have to settle for noisy dashboards and dead-end leads. By focusing on real engagement and actionable first-party signals, your team can build a pipeline that closes, not just one that looks full.

Real companies, real results

It’s one thing to read how to check for false positives, but seeing how other companies have been able to cut through noise to find real buying intent can help highlight the changes you can expect. These two Dealfront customers show what happens when you align your sales process with actual intent signals—not guesswork.

Skribble got better lead quality and smarter LinkedIn outreach: Skribble, an electronic signature provider, wanted to improve the effectiveness of its LinkedIn outreach. By using Dealfront’s targeting and firmographic filters, the team built tighter ICP segments and connected with companies that had already shown signs of interest. The result? A higher-quality lead pool, more relevant outreach, and improved conversion rates—all without increasing ad spend.

We’d previously been manually doing research for effective outreach which was of course, inefficient. This has now completely changed with Dealfront." -Tim Reinermann, Senior Digital Marketing Manager @ Skribble

S.I.E. reduced time wasted on unqualified leads by 90%: S.I.E., a German IT provider, sales research was draining valuable time. The team needed a way to qualify leads faster and avoid chasing companies that would never buy. By combining website visitor intel with intent signals from Dealfront, they cut research time by 90% and focused only on warm leads. That shift didn’t just save time—it boosted pipeline velocity and morale.

"We talked about how the sales teams at S.I.E were bogged down by time-consuming research. Thanks to Dealfront, the team has reduced the time spent on sales planning and new customer acquisition by 90%!"

Remember: More signals doesn’t always mean better signals

Intent data can be a powerful tool when it’s grounded in reality. But for many revenue teams, the promise of third-party surges has turned into a cycle of false hope: ghosting “hot” accounts, inflated pipelines, and sales teams stuck chasing shadows.

As we’ve seen, there are clear signs your funnel might be full of false positives:

High-intent accounts that never move past the first touchpoint

Weekly research spikes that never visit your site

Ideal-fit logos that stall after the first call

So, what’s the common thread? Most likely, you’re prioritising volume over verifiability. Real buying intent isn’t just about someone, somewhere reading a blog post. It’s about observable behaviour on your own channels, and firmographic signals that suggest a company is actually ready for change, not just curious.

Fortunately, there’s a fix. By shifting your scoring model toward first-party engagement and layering in real-world business context, you can cut through the noise and build a pipeline that’s actually primed to convert. So, how do I validate true buying signals in my pipeline? It starts with asking better questions; of the buyer and of yourself. Are they moving forward or just being polite? Are you seeing momentum, or managing hope?

The future of intent isn’t about collecting more data, it’s about using better data, signals you can trust, and timing you can validate to get to the prospects who are ready to take action.